Finance

Is Bank of America Stock a Buy?

Since the end of October last year bank of America (NYSE: BAC) has been on a tear, rising 58% as the Federal Reserve announced a pause in its rate hike campaign. The stock has risen significantly as investors priced in the pause and possible rate cuts at the end of this year and next year, which could help ease pressure on the bank, whose loan book has significant unrealized losses.

However, it remains unclear where interest rates will be at the end of this year or next year. At the start of the year, markets priced in no fewer than six interest rate cuts. Those expectations are now reduced to two cuts. Given the recent share price rise, does it make sense for investors to buy now? Here are some things you’ll want to think about first.

Bank of America’s mounting unrealized losses have captured investors’ attention

Bank of America has more than $2.5 trillion in total assets, making it the second largest bank in the US, behind only JPMorgan Chase. Its size alone makes it a behemoth, and it has held its own over time as one of the largest banks in the US.

Banks are simple businesses that take deposits and make loans to customers. They make money on the difference between the interest charged on loans and the interest paid to customers on their deposits.

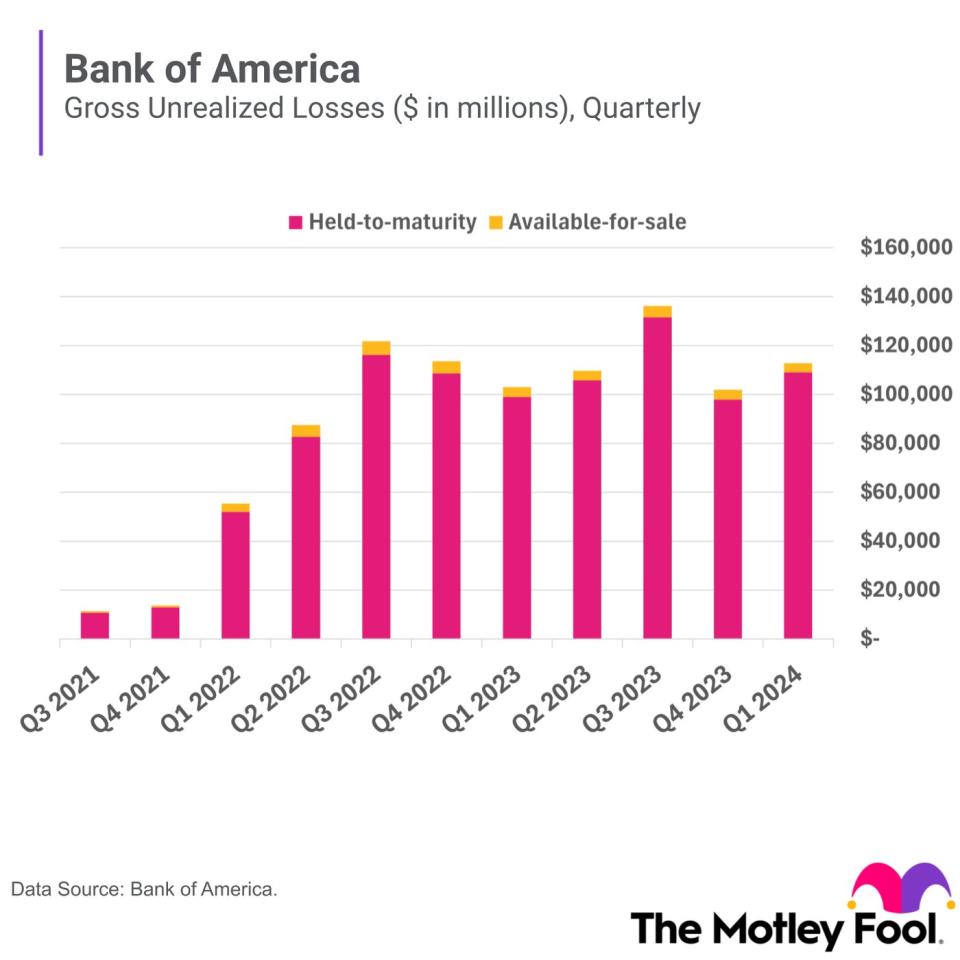

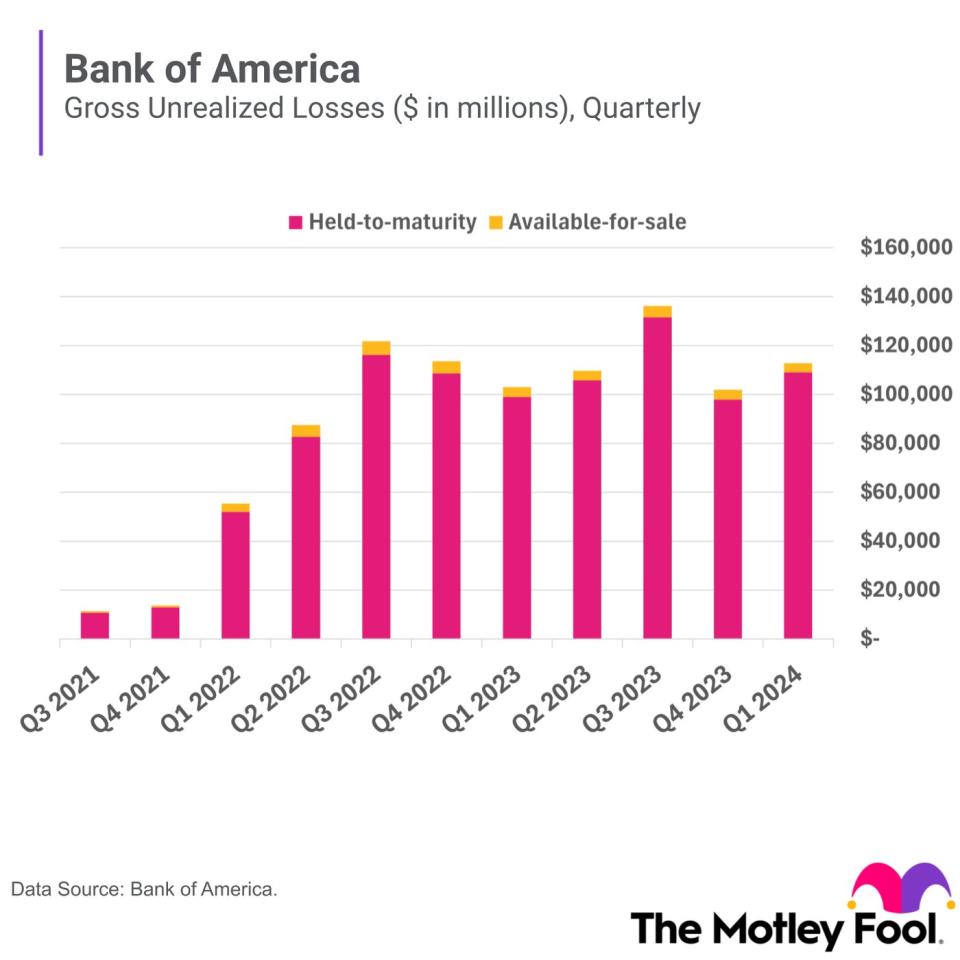

This business model makes the industry sensitive to interest rate fluctuations, and Bank of America’s sensitivity is evident in its loan portfolio. These mounting unrealized losses are worrying some investors as the Federal Reserve has raised interest rates at the fastest pace in decades. Since the Fed started raising rates in 2022, the bank’s unrealized losses have grown from $14 billion to $113 billion.

Unrealized losses represent the losses that Bank of America would incur if it had to sell its securities in the market today. This doesn’t necessarily mean the bank is in trouble, as long as it can hold these securities until maturity. However, a run on deposits at Silicon Valley Bank (a subsidiary of SVB Financial) last year forced the bank to raise capital and realize huge losses on its government bonds, which could have been even worse if the Fed had not intervened.

As one of the largest and most recognizable banks in the U.S., Bank of America has a well-diversified deposit base, with 37 million consumer checking accounts and nearly $2 trillion in retail and corporate deposits. This gives the company a solid foundation for its operations, making it less vulnerable to bank runs like those suffered by Silicon Valley Bank and other regional banks last year.

BofA’s net interest income could rise further

The higher interest rate environment is a double-edged sword for banks. While Bank of America’s unrealized losses have ballooned, it has also benefited from growing net interest income. Net interest income is the difference between the interest a bank receives on its loans and the interest it pays to savers.

When interest rates are low, as they have been throughout 2021, a bank’s net interest income is low. However, during periods of rising interest rates, banks have the wind at their backs because loan rates adjust more quickly than deposit rates. As one of the most rate-sensitive banks in the industry, Bank of America grew its net interest income from $43 billion in 2021 to $57 billion last year.

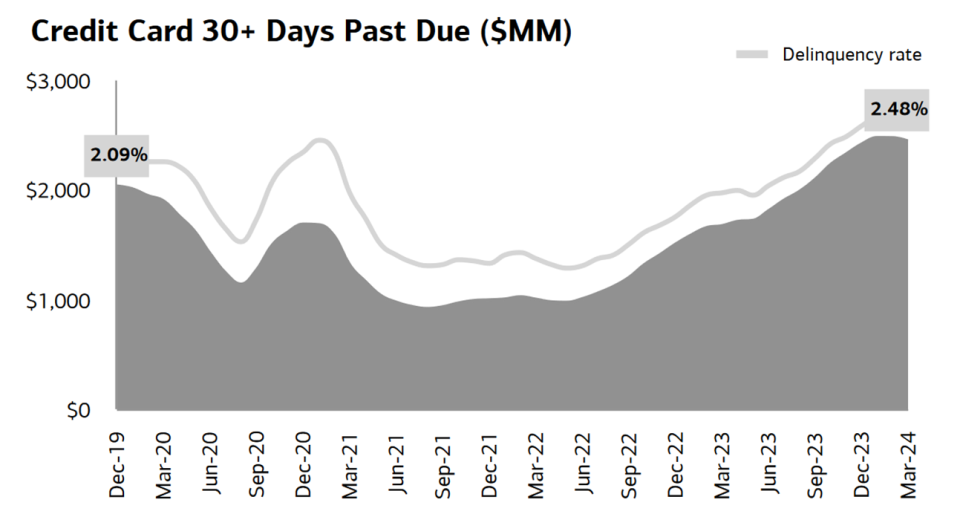

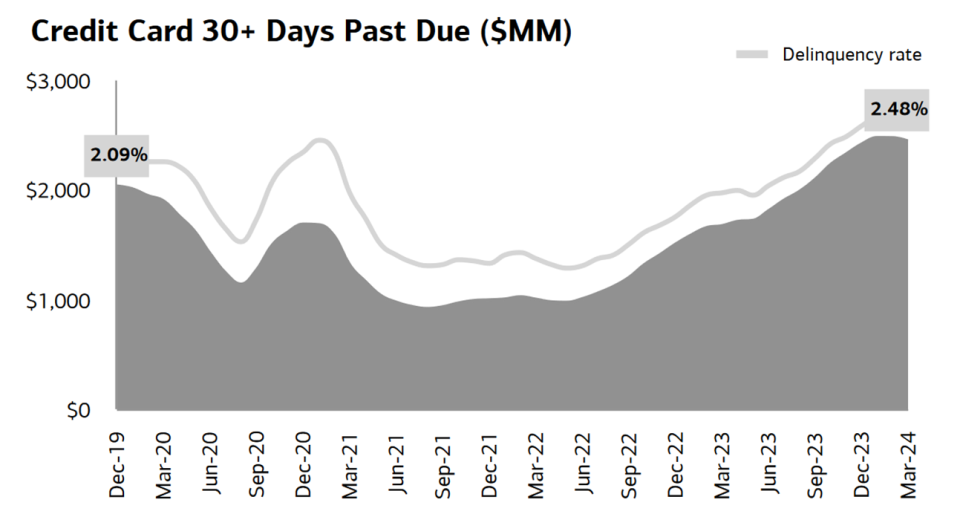

Today, banks are in limbo. In the first quarter, Bank of America’s net interest income fell compared to the same quarter last year. The bank struggled with rising interest costs on deposits and slower lending growth as banks tightened lending standards amid increasing charge cuts, putting pressure on net interest rate spread.

Delinquencies and net charge-offs on consumer loans could be a near-term headwind for the bank, but Bank of America management sees light at the end of the tunnel. During the first quarter earnings call, CFO Alastair Borthwick said delinquency trends were starting to improve and this would likely lead to charge-offs leveling off over the next quarter or two.

During this period, Bank of America has taken advantage of the longer-lasting interest rate environment by replacing lower-yielding assets with higher-yielding assets, which should help it grow net interest income late this year into early next year.

An analyst at KBW recently expressed optimism about Bank of America, predicting that fourth-quarter net interest income would be 5% above the previous estimate. Analyst David Konrad said net interest income and growth in other key parts of Bank of America’s business will help close the gap toward its target of a 15% return on tangible common equity (ROTCE ) to realise.

Is it a purchase?

Bank of America shares have risen significantly since the Federal Reserve halted interest rate hikes. Despite this rally, the stock is still reasonably priced: 1.6 times its tangible value book value and 13.6 times earnings.

While its operations are dependent on the US economy and prevailing market conditions, Bank of America has done an excellent job navigating market cycles. As one of the largest banks in the US, with a strong brand and a robust balance sheet, the bank is poised to do well as it takes full advantage of the current interest rate environment and is an excellent stock to buy today.

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, you would have $21,765!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $39,798!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $363,957!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

*Stock Advisor returns June 24, 2024

Bank of America is an advertising partner of The Ascent, a Motley Fool company. SVB Financial provides lending and banking services to The Motley Fool. JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Courtney Carlsen has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Bank of America and JPMorgan Chase. The Motley Fool has one disclosure policy.

Is Bank of America Stock a Buy? was originally published by The Motley Fool