Finance

Is the stock market going to crash? Who knows? That’s why I would own these high-yield dividend stocks.

If you’re like most investors, you like the long-term upside of the market. You just don’t want to experience occasional (and sometimes painful) setbacks. Problem? You don’t know when crashes are coming. The best you can hope for is to minimize their misery once they arrive. And the best way to do that is to be well positioned before major pullbacks take shape.

With that as background, there’s one name in particular I’d like to own right now, just in case a market crash looms. That is Annaly Capital Management (NYSE:NLY).

Never heard of it? Don’t worry. You’re not alone. It’s not exactly a household name, and with a market cap of just $10 billion, it’s not likely to attract much attention from the financial media.

However, it does its job incredibly well for investors.

What is Annaly Capital Management?

Annaly Capital Management is one real estate investment trust (REIT). As the name suggests, REITs are real estate-focused organizations. REITs own properties ranging from hotels and office buildings to shopping centers, apartment buildings and more. However, their main goal is the same in all cases: to generate reliable, recurring income for shareholders.

However, Annaly is unique, even by REIT standards. Rather than holding rental or income-bearing real estate, this company’s activities are a combination of managing mortgage loan rights, buying and selling mortgage-backed securities issued by government agencies, such as Fannie Mae or Freddie Macand which essentially means there is interest rate arbitrage between its own borrowing costs and the yields on the mortgage-based securities it holds.

It sounds crazy, and in some ways it is. The business model is 100% tied to the US mortgage market, which ebbs and flows due to ever-changing interest rates. Sometimes this business is predictable. Other times that is not the case. And sometimes, even if it’s predictable, that doesn’t necessarily mean there’s an easy way for a mortgage REIT to defend itself against looming setbacks.

But ultimately, Annaly Capital Management makes it work. Since its founding in 1996, this REIT’s total returns have kept pace with the S&P500‘s earnings for the same time frame, with most of Annaly’s net profit coming in the form of what is usually an oversized dividend that continues to be paid even when the broader market is in trouble.

A beneficial decoupling

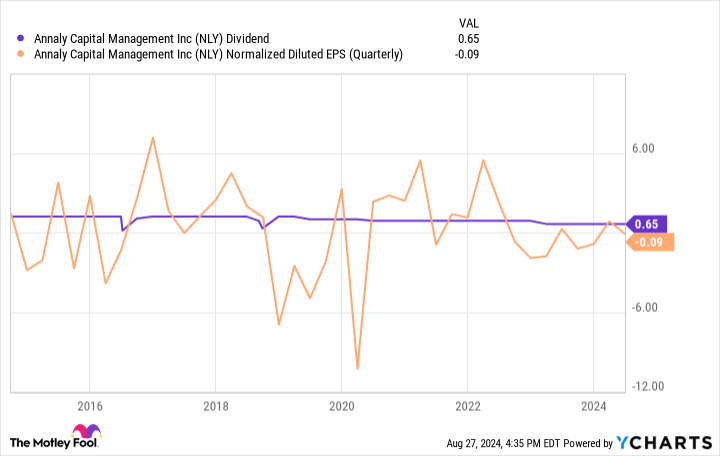

Don’t misread the message. For anyone who needs consistent, predictable investment income, Annaly Capital Management can be a rather difficult ticker to count on. The payout does not necessarily grow with inflation, as it grows at all. Sometimes it shrinks, due to the constant changes in the underlying mortgage lending market in which this REIT exclusively operates. The price of this ticker changes (often it is reduced) to ensure that the returns at any given time more accurately reflect prevailing risk-adjusted returns.

The REIT’s underlying earnings (also called available-for-distribution earnings) are also affected by changes in interest rates themselves, which may force the organization to adjust its dividend payments from time to time.

However, Annaly Capital Management is still an excellent defensive option in the event of market crashes, for a number of different but related reasons: (1) This company doesn’t necessarily rise and fall with the ebb and flow of the stock market, and (2 ) the dividend behind Annaly’s current 13% yield will be paid regardless of the market’s performance in the near future.

That is better than the average annual profit of the S&P 500.

To be clear, owning a stake in this REIT does not guarantee that you will be better off than not if the stock experiences a significant pullback. After all, there are no guarantees in this business. Everything can and will happen eventually.

But that’s not the point. The best thing you can do is give yourself the best chance to avoid the consequences of a major sell-off. Annaly at least offers you a reasonable opportunity to do that. In the meantime, a significant amount of cash is being handed out in an environment where growth shares may not make many gains for a while.

Keep it in perspective

The defensive advantages here are obvious, but interested investors should still keep things in perspective. Annaly is not well suited to serve as a key, fundamental holding in a long-term portfolio. And if your current goal is just to survive a market crash, you should think about picking up other types of defensive trades, like gold or bonds.

Nevertheless, Annaly Capital Management is a top candidate for at least a small portion of your portfolio right now, if only because it is so far removed from the mainstream stock market and yet able to generate stock market-like net returns.

Should You Invest $1,000 in Annaly Capital Management Now?

Consider the following before purchasing shares in Annaly Capital Management:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Annaly Capital Management wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $731,449!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 26, 2024

James Brumley has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has one disclosure policy.

Is the stock market going to crash? Who knows? That’s why I would own these high-yield dividend stocks. was originally published by The Motley Fool