Finance

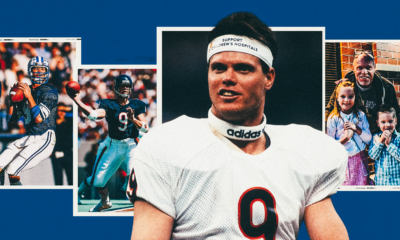

Jim Simons, quantitative investing pioneer who generated eye-popping returns, dies at 86

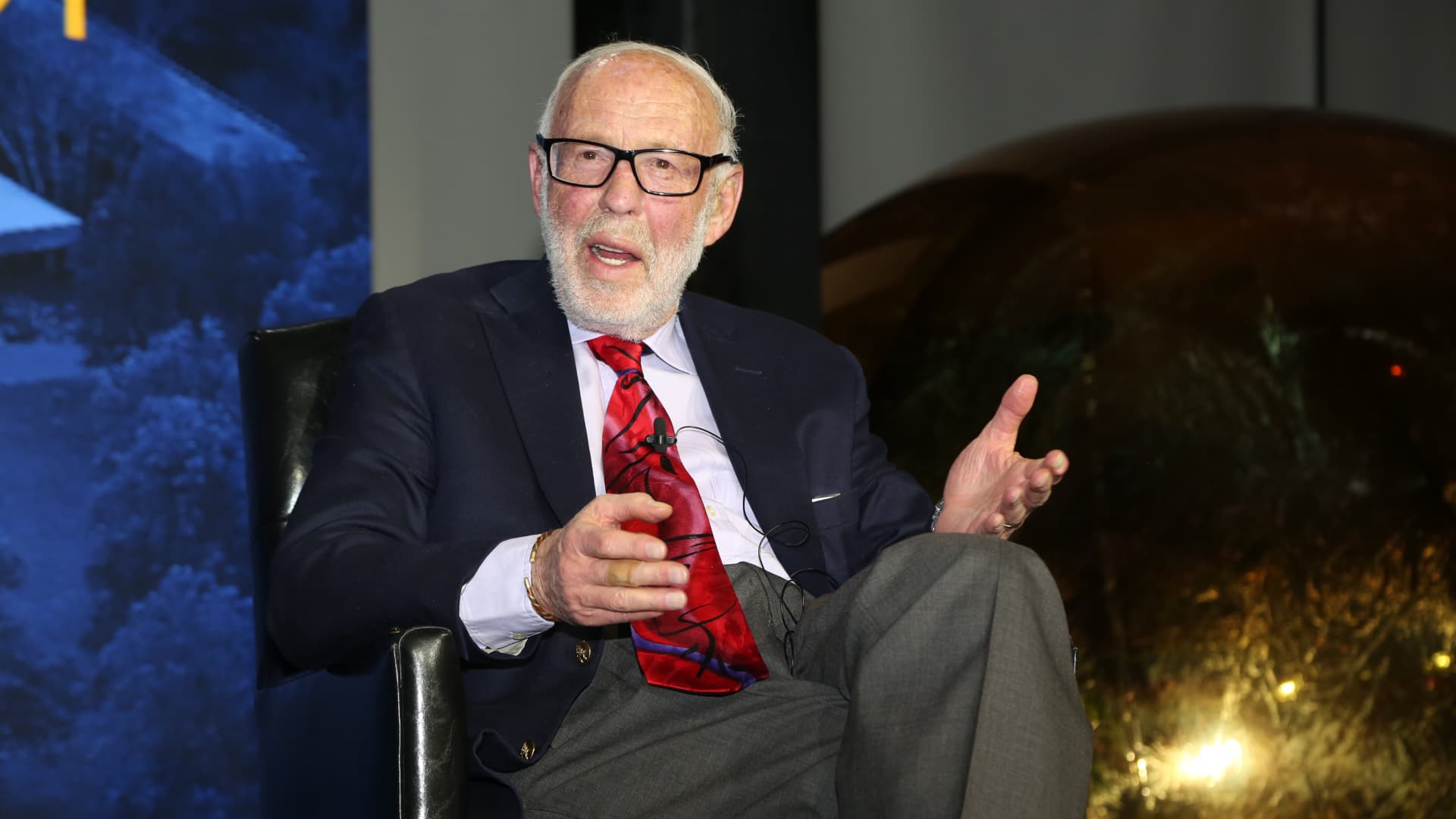

Jim Simons attends the IAS Einstein Gala at Pier 60 at Chelsea Piers in New York City.

Sylvain Gaboury | Patrick Mcmullan | Getty Images

Jim Simons, a mathematician who founded the most successful quantitative hedge fund of all time, died Friday in New York City, his foundation announced on its website.

Groundbreaking mathematical models and algorithms to make investment decisions, Simons left behind a track record at Renaissance Technologies that rivals that of legends like Warren Buffett and George Soros. His flagship Medallion Fund achieved an annual return of 66% between 1988 and 2018, according to Gregory Zuckerman’s book.The man who solved the market.”

During the Vietnam War, he worked as a codebreaker for US intelligence, monitored the Soviet Union and successfully cracked a Russian code.

Simons earned a bachelor’s degree in mathematics from the Massachusetts Institute of Technology in 1958 and received his doctorate in mathematics from the University of California, Berkeley at age 23. The quantitative guru founded what became Renaissance in 1978 at the age of 40. after leaving academia and deciding to try his hand at trading.

Unlike most investors who studied fundamentals like sales, profits and profit margins to assess a company’s value, Simons relied entirely on an automated trading system to take advantage of market inefficiencies and trading patterns.

“I have no opinion on any stock. … The computer has its opinions and we follow them slavishly,” Simons said in a CNBC interview in 2016.

His Medallion Fund made more than $100 billion in trading profits between 1988 and 2018, with an annualized return of 39% after fees. The fund was closed for new money in 1993, and Simons did not allow its employees to invest in it until 2005.

Quantitative strategies that rely on trend-following models have become popular on Wall Street since Simons revolutionized trading starting in the 1980s. According to a JPMorgan estimate, quant funds now account for more than 20% of all equity assets.

According to Forbes, Simons’ net worth was estimated at approximately $31.4 billion when he died.

The quantitative guru previously chaired the mathematics department at Stony Brook University in New York, and his mathematical breakthroughs are of great importance to fields such as string theory, topology and condensed matter physics, according to his foundation.

Simons and his wife settled down the Simons Foundation in 1994 and have given away billions of dollars to philanthropic causes, including those in support of mathematical and scientific research.

He was active in the work of the foundation until the end of his life. Simons is survived by his wife, three children, five grandchildren and one great-grandchild.