Business

June inflation likely within target

By means of Luisa Maria Jacinta C. Jocson, News reporter

HEADLINE INFLATION likely remained stable in June and According to analysts, interest rates remained within the central bank’s target of 2-4% for the seventh month in a row.

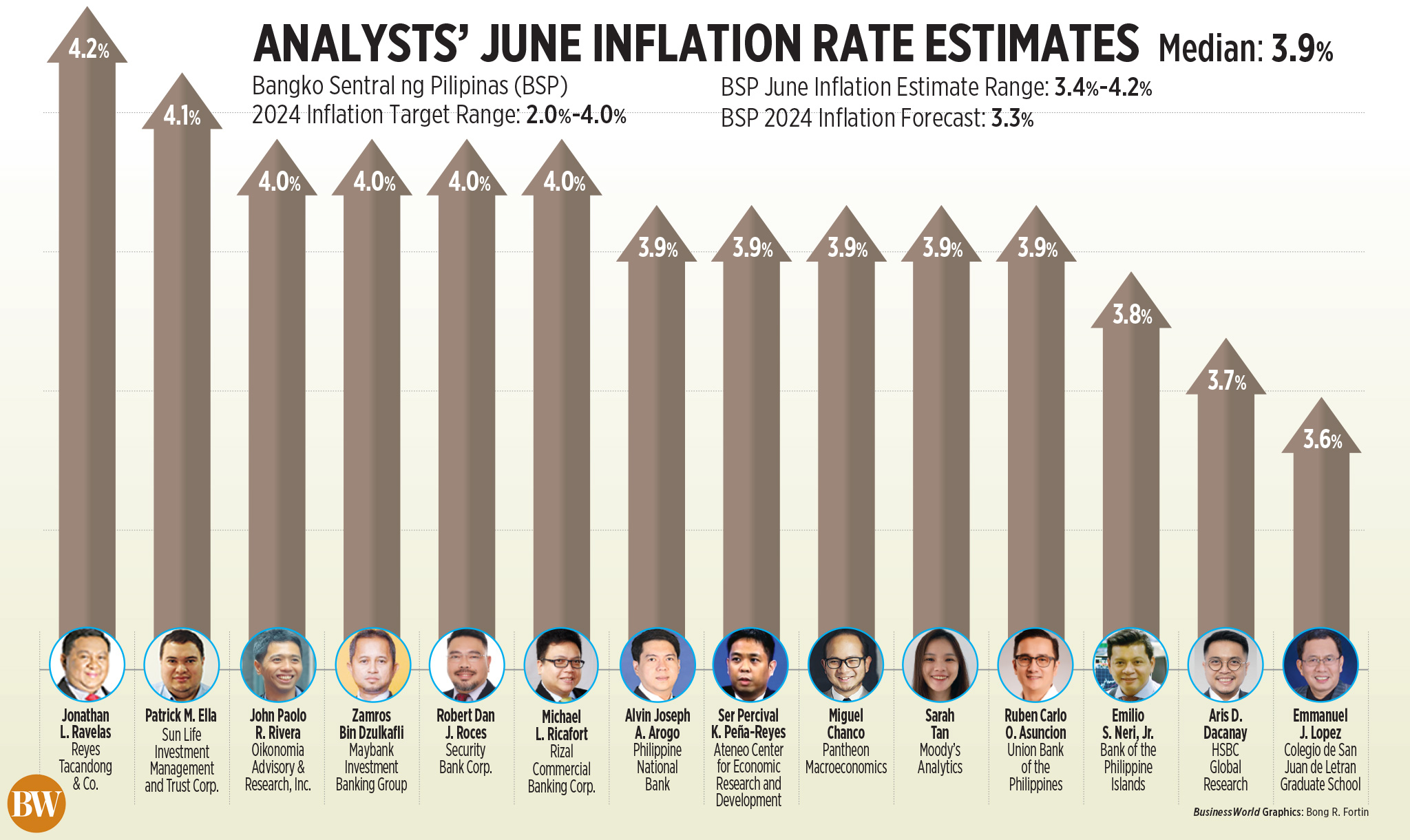

a Business a poll of 14 analysts in June yielded an average estimate of 3.9% for the consumer price index (CPI). This is within the 3.4-4.2% forecast of the Bangko Sentral ng Pilipinas (BSP) for this month.

If realized, in JuneFThe interest rate would correspond to the 3.9% in April. It will also be slower than the 5.4% print in the same month a year ago.

The Philippine Statistics Authority (PSA) will release the figures in JuneFation data on Friday (July 5).

“We expect insideFThe interest rate will remain unchanged in June at 3.9% on an annual basis. Rising rice prices in recent months have largely stabilized as we have passed the peak of the dry spell,” Sarah Tan, an economist at Moody’s Analytics, said in an email.

The staple grain is one of the major contributors to the country’s inflation. Rice inflation fell to 23% in May from 23.9% a month earlier, marking the second straight month of lower inflation as global rice prices fell.

“We predict that insideFInflation remained at 3.9% in June. However, for the next six months of 2024, we think inflation could decline to an average of 2.6%. This is mainly due to the impact of the lower tariff on imported rice,” Philippine National Bank economist Alvin Joseph A. Arogo said in an email.

Rice prices are expected to fall further after President Ferdinand R. Marcos Jr. signed Executive Order No. 62 last month, lowering tariffs.Ffs on rice imports to 15%, compared to 35% previously.

The month of June also saw lower electricity rates, HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris Dacanay said in an email.

“Electricity rates in the Philippines fell by about 17% year over year due to an order by energy authorities to spread out the collections that distributors would need to cover their wholesale electricity purchases in May, as opposed to a one-time, large price adjustment . This means a large drop in the inFprospects,” he said.

Residential customers served by Manila Electric Co. served saw their electricity bill drop by €1.9623 per kilowatt hour (kWh) in June. This brought the total rate down from P11.4139 per kWh in May to P9.4516 per kWh in June.

This comes after the Energy Regulatory Commission ordered all distribution companies and electric cooperatives to implement staggered collection of levies on their purchases from the Wholesale Electricity Spot Market in May.

On the other hand, analysts also mentioned upside risks that could fuel gainsFlat.

“The upward price pressure in June likely came from other agricultural products besides rice. For example, pechay – a leafy vegetable commonly used in Philippine cuisine – and ginger are reported to have higher average retail prices in the Philippines, according to authorities Ffirst half of June, compared to May,” Ms Tan said.

Mr Dacanay also commentedFlationary pressure from vegetables and fruits such as calamansi, snow cabbage and eggplant.

“Persistent peso weakness and increased food intakeFThis could further increase inflationary pressures,” said Zamros Bin DzulkaFli, an economist at Maybank Investment Banking Group, in an email.

The peso devalued 10 centavos to P58.61 against the dollar as of end-June from P58.51 at end-May.

The weakest closing rate of the month was P58.86 per dollar on June 26. This was the worst closing price of the month. Fready within 20 months.

POLICY IMPACT

Chief Economist Emilio S. Neri, Jr. of the Bank of the Philippine Islands said that if successfulFAlthough interest rates may remain close to the target in the coming months, this could increase the likelihood of a rate cut.

“If the numbers for both June and July remain close to or below 4%, we think the likelihood of a BSP rate cut in August will be quite high, regardless of whether the Federal Open Market Committee cuts rates in July or not” , he said. a Viber message.

BSP Governor Eli M. Remolona, Jr. said last week that the central bank is on track to cut rates by its Aug. 15 meeting.

Security Bank Corp. Chief Economist Robert Dan J. Roces saidFInflation is expected to remain high, but will decline in July and August and be back within target in September.

The BSP is watchingFThis could potentially exceed the 2-4% target in July before returning to target.

Rizal Commercial Banking Corp. chief economist Michael L. Ricafort said in a Viber message that inFIn the period from June to July, inflation could be slightly above the 4% level in the middle of the base eFfects then return within the target range from August to December.

“Assuming the June print remains within the target range, I think the BSP may feel guiltyFFrom the next meeting (August), we will gradually start easing as June should mark the peak of headline inflation for the year,” said Pantheon chief emerging economies economist Miguel Chanco.

Ms Tan said the central bank will want to waitFto facilitate it even further before making any move.

“We expect insideFInterest rates will moderate in the third quarter, allowing the BSP to plan for easing monetary policy,” she said.

At its policy meeting last week, the BSP said an improved inflation outlook would allow for a “less restrictive” policy.

“Nevertheless, the BSP warned that there are uncertainties in external conditions that could prevent inflation from falling at the expected pace. Should the inFlation print for competition or convenience from June from May, this gives the BSP conFI tend to start the cycle of policy easing sooner rather than later,” Ms Tan added.

On the other hand, Union Bank of the Philippines, Inc. chief economist Ruben Carlo O. Asuncion said the BSP could delay the easing until the fourth quarter.

“We feel that the weak peso is associated with the recent oil price increases and advocate that the BSP postpone its rate cut until the fourth quarter, when the US Fed is also expected to cut its policy rate,” he said in an email.

Mr. Asuncion said the BSP may want to keep interest rates high for now to “mitigate the risk of a build-up of cost pressures from this combination of peso weakness and high oil prices, which could conspire to reignite faster second round price increases .Ffects later in the year,” he added.

Mr Remolona has said the BSP intervenes in the peso “occasionally” to ensure it does not depreciate sharply.

“However, the BSP may not want to wait for the US Fed to delay its interest rate cuts until early next year, as sky-high real interest rates across the local curve – a byproduct of the BSP’s high interest rate policy – could depress production and investment activities severely limit next year,” Mr. Asuncion added.

The Development Budget Coordination Committee expects the peso to fluctuate between P56 and P58 this year.