Finance

Looking for passive income? Here are 5 ultra-high yield dividend stocks to buy and hold for a decade

There are countless ways to generate passive income. One of the best ways to supplement portfolio growth is to look for dividend stocks.

But when it comes to dividend income, did you know that some opportunities can be more reliable than others?

Let’s break down five companies that are established dividend payers, and assess why holding each of these stocks over time can lead to huge gains for your portfolio.

1. Hercules Capital

Hercules capital (NYSE:HTGC) is a business development company (BDC). BDCs are a reliable source of dividend income because these companies must pay out at least 90% of their dividends taxable income to investors per year.

While there are many types of BDCs, Hercules focuses primarily on high-interest loans to startups in the technology, life sciences and renewable energy sectors. Although start-ups can be risky, Hercules has demonstrated that it applies robust due diligence processes before making an investment. Over the years, the company has worked with notable companies including Impossible Foods, Enphase energyAnd Lyft.

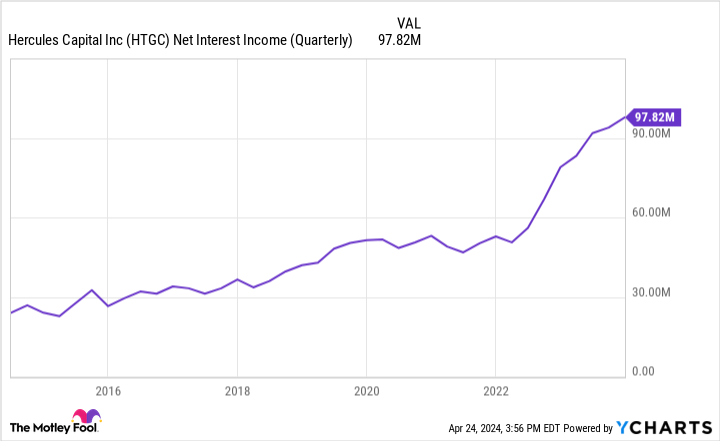

The continued increase in the company’s net interest income is undermining Hercules’ strong performance and its proven ability to reward shareholders.

Over the past 10 years, Hercules shares have delivered a total return of 275%. This not only highlights the importance of reinvesting dividends, but also highlights that Hercules has been a lucrative investment in the long term.

With its juicy 10.4% dividend yield, this could be a great opportunity to acquire shares in Hercules stock.

2. Ares capital

Another prominent BDC is Ares Capital (NASDAQ: ARCC). Unlike Hercules, Ares doesn’t typically work with high-profile tech companies that have raised money from venture capital firms.

On the contrary, many of the companies in Ares’ portfolio are lower mid-market companies that are overlooked by investment banks and private equity investors.

While Hercules specializes in basic debt instruments like term loans or revolvers (think a corporate line of credit), Ares also offers more advanced products, including leveraged buyouts (LBOs).

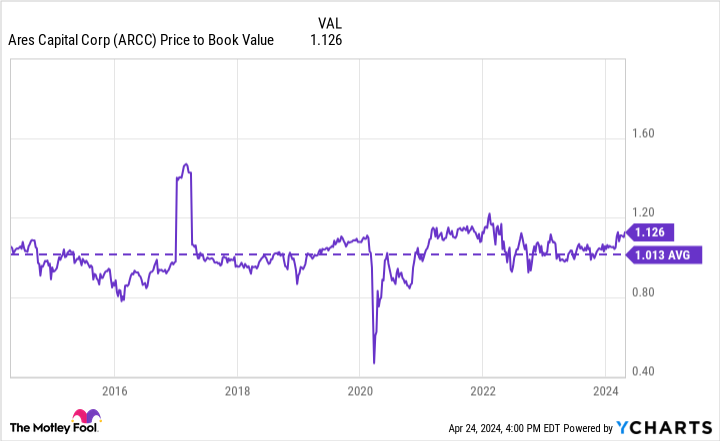

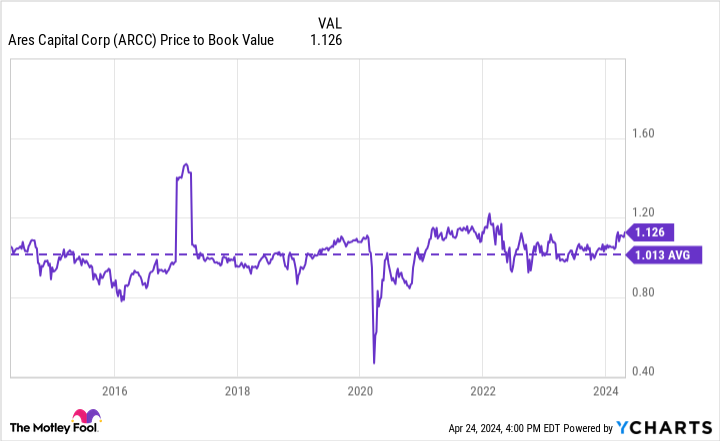

With a price-to-book ratio (P/B) of just 1.1, Ares shares are essentially trading in line with its 10-year average. Considering the company’s total returns, it has outperformed S&P500 Over the past three and five year periods, I think now seems like a good time to buy some shares in Ares at a 9.3% yield and prepare to hold them for the long term.

3. Rhythm capital

Real estate investment trusts (REITs) are another great source of dividend income.

Rhythmic Capital (NYSE:RITM) is a REIT specializing in financial services, including lending, as well as commercial real estate and single-family rentals.

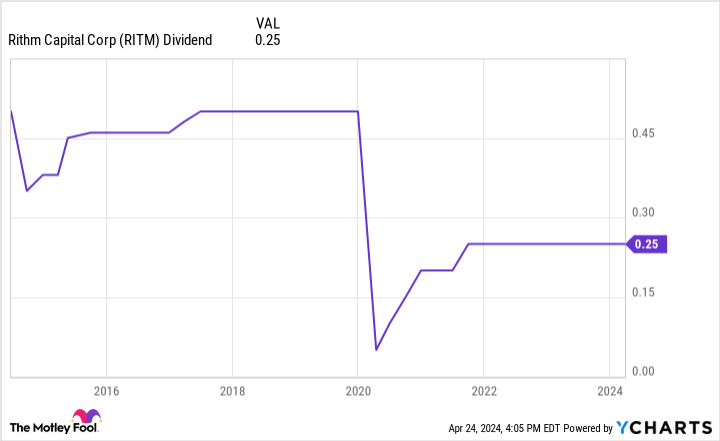

One drawback investors may encounter with Rithm is the company’s exposure to broader real estate themes. Persistent inflation and high borrowing costs have affected consumers, businesses and even homeowners or renters. To me, the biggest target is what the Federal Reserve will decide to do this year regarding interest rates.

The chart below illustrates how these macroeconomic variables can specifically impact Rithm’s business. While the dividend is lower than in recent years, I think the bigger idea is that holding on for the long term could be a good decision.

With the stock trading below $11 per share, this could be a tempting time to consider buying shares at a 9.2% yield and the possibility of a rising dividend depending on the broader macro environment.

4. Energy transfer

Outside of financial services, investors can find lucrative sources of dividend income from the energy sector. Energy transfer (NYSE:ET) is a Master Limited Partnership (MLP) active in the natural gas industry.

MLPs have an interesting operating structure because these entities pass along income and losses to their investors. This can be an attractive feature for income investors.

MLPs also tend to distribute excess profits to limited partners (LPs). These payments are known as distributions and are similar to dividends.

One risk worth mentioning is that the energy sector could experience more pronounced volatility than other sectors. For example, current geopolitical conditions in Europe and the Middle East have had a major influence on legislative policies surrounding the energy industry.

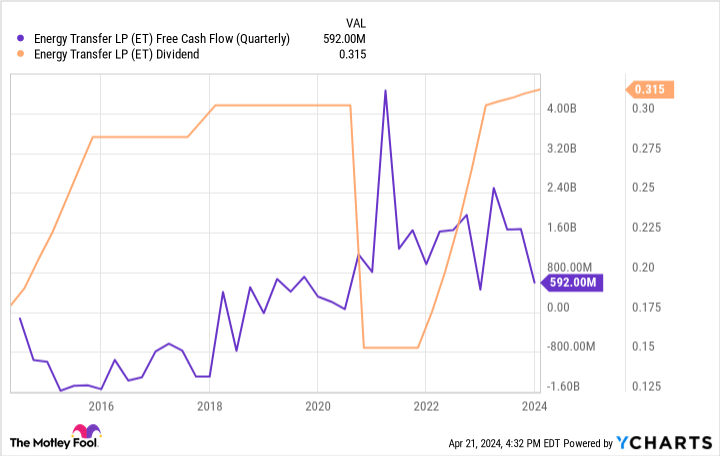

However, energy transfer is better insulated from these risks. A common theme among MLPs is that these companies often enter into long-term, fixed-fee contracts with their clients. Essentially, this leaves Energy Transfer much less exposed to commodity-based risks compared to other types of energy companies.

The chart below illustrates Energy Transfer’s free cash flow over the past 10 years. While this has improved dramatically over the past decade, the trends of more recent years show that even more stable companies like MLPs can experience some degree of volatility.

Nevertheless, Energy Transfer has made a point of raising benefits to historically high levels. I think this shows management’s decisions to prioritize shareholders.

5. Partners for business products

The last company on my list is a midstream energy specialist Partners for business products (NYSE:EPD).

Earlier this year, Enterprise Products Partners announced it was acquiring joint venture interests from Western midstream partners. In early April, the company also announced it was breaking ground on a series of new natural gas power plants in the Permian Basin. Of all its projects, Enterprise Products Partners currently has approximately $6.5 billion in approved new operations under construction.

What I like most about Enterprise Products Partners is the company’s ability to navigate challenging economic periods while rewarding shareholders. Over the past fifteen years, the economy has witnessed the Great Recession of 2008-2009, the prolonged decline in oil prices between 2014 and 2016, and most recently the COVID-19 pandemic.

During this period, the company’s adjusted cash flow from operating activities (CFFO) increased from $1.29 per unit at the end of 2009 to $3.70 at the end of 2023. Given the company’s 7.1% return on investment and strong long-term performance , Now could be an interesting time to consider buying some shares.

Should You Invest $1,000 in Ares Capital Now?

Consider the following before purchasing shares in Ares Capital:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Ares Capital wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $537,557!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 22, 2024

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Enphase Energy. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has one disclosure policy.

Looking for passive income? Here are 5 ultra-high yield dividend stocks to buy and hold for a decade was originally published by The Motley Fool