Business

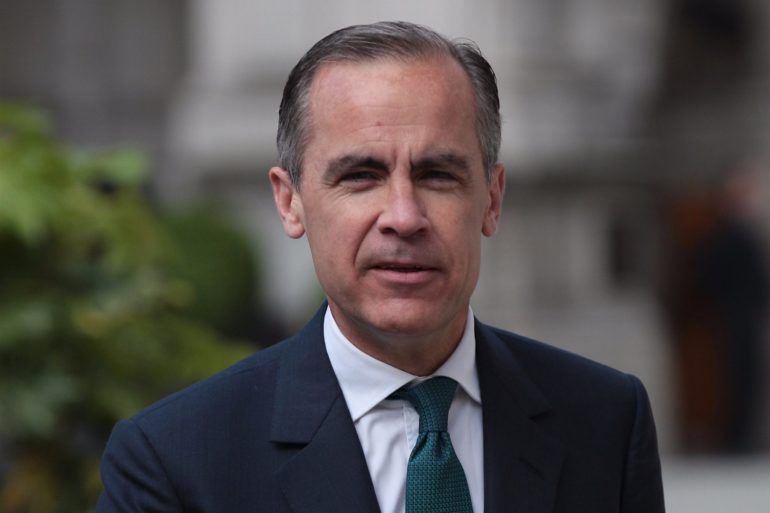

Mark Carney rules out role in future Labor government

Former Bank of England governor Mark Carney has definitively ruled out any role in a future Labor government.

When asked about the possibility of an official position and whether he had received any offers, Mr Carney laughed and replied: “My time in the British civil service is over.”

Mr Carney, who led the Bank of England from 2013 to 2020, has recently fueled speculation about a possible political career in Britain after formally backing Shadow Chancellor Rachel Reeves at the Labor Party conference last autumn. Moreover, he advises her on the establishment of a National Wealth Fund.

Despite these expressions of support, Mr. Carney, a Canadian financier, has steered clear of frontline politics. In his home country, he is being presented as a potential successor to Justin Trudeau as leader of the Liberal Party. Instead, since leaving the Bank of England, Mr Carney has focused on coordinating global efforts to finance net-zero initiatives.

Speaking at an event hosted by Deloitte at the London School of Economics, Mr Carney called for changes to government regulations to allow the Bank of England and the Financial Conduct Authority (FCA) to play a more active role in achieving net zero. He said: “The remit of the financial authorities, including the Bank of England, the FCA, must be renewed to ensure that they hierarchically support the government’s net zero target.”

These comments follow Chancellor Jeremy Hunt’s decision last year to de-emphasize climate change in the Bank of England’s targets, a move that Shadow Chancellor Rachel Reeves has vowed to reverse.

Mr Carney had a notable focus on climate change and green finance during his tenure at the Bank of England. However, his predecessor, Mervyn King, has argued that this focus on net zero distracted the Bank from its primary objective of controlling inflation.

In his speech, Mr Carney highlighted that global shocks have left the UK economy 40% smaller than it would have been if it had continued to grow at its pre-financial crisis pace. He noted that Britain and other countries are facing the biggest regime change in geopolitics and economic policy since the fall of the Berlin Wall.

Given these pressures and slow growth, Mr Carney emphasized that private capital should lead the net-zero transition. He warned Britain against attempts to match the US Inflation Reduction Act, citing a lack of fiscal capacity. “Budget constraints require a targeted approach and finding the right balance. These are big decisions to be made about boosting domestic activity and cheaper solutions through imports,” he concluded.