Business

May inflation likely to reach 4% – poll

By means of Luisa Maria Jacinta C. Jocson, News reporter

HEADLINE INFLATION likely For the fourth month in a row, the economy accelerated in May, mainly due to a spike in electricity costs, analysts said.

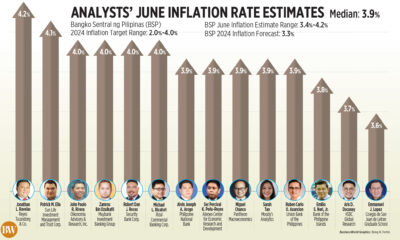

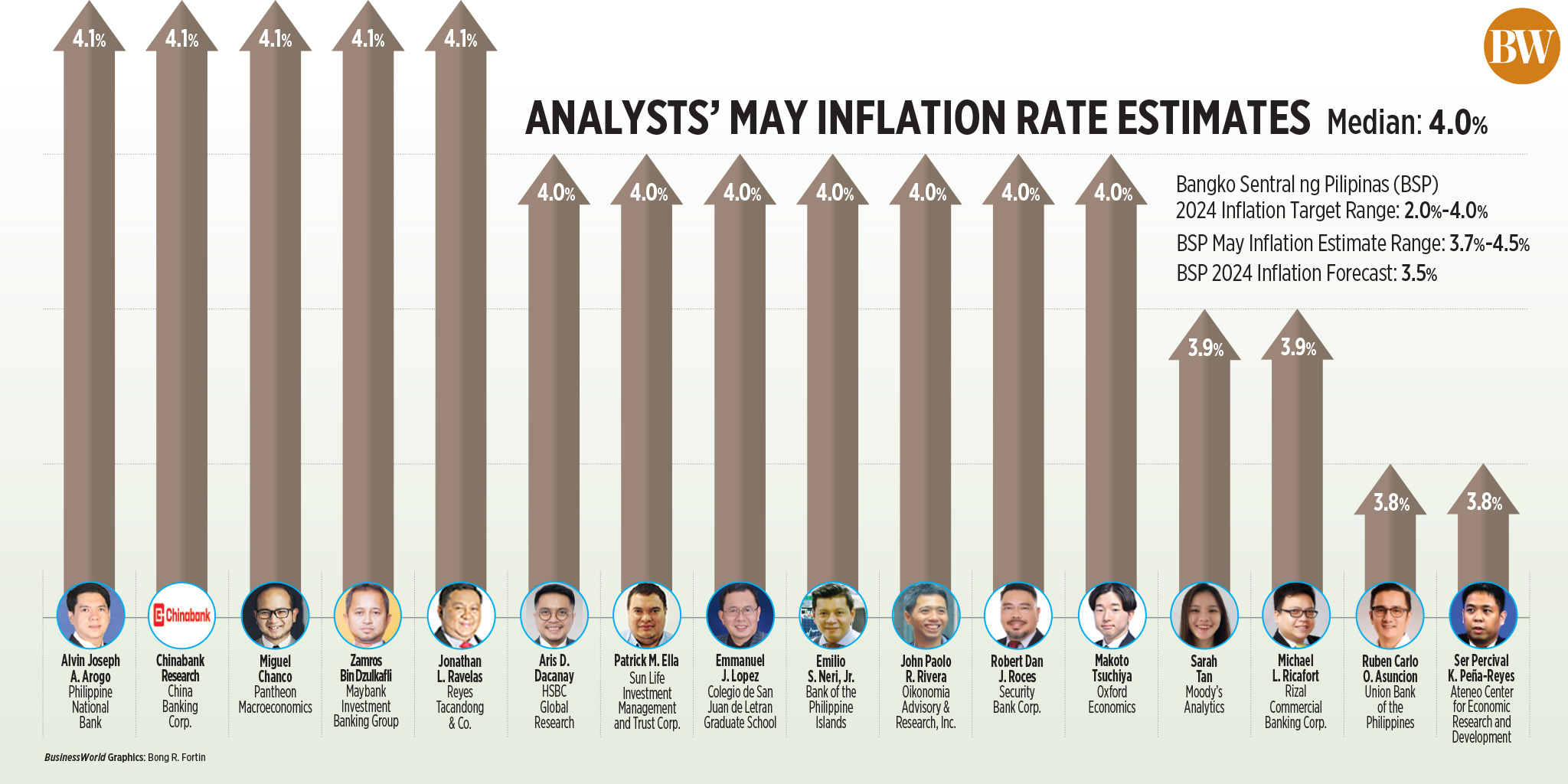

a Business a poll of 16 analysts in May yielded an average estimate of 4% for the consumer price index (CPI). This is within the 3.7-4.5% forecast of the Bangko Sentral ng Pilipinas (BSP) for this month.

If realized, inflation in May would be faster than 3.8% in April, but slower than the 6.1% a year earlier.

It would also be the sixth month in a row in which inflation would settle within the central bank’s target range of 2-4%.

The Philippine Statistics Authority will release May in MayFdata on Wednesday (June 5).

“We expect CPI inflation to rise to 4% in May. The increase is largely due to adverse base effects, and sequential momentum was likely limited,” Makoto Tsuchiya, an economist at Oxford Economics, said in an email.

“Even with a modest month-on-month rebound, base effects remain unfavorable, and we still expect inflation to accelerate to 4% annualized – reaching the BSP upper bound,” said HSBC economist for ASEAN (Association of Southeast Asian Nations). Aris D. Dacanay said in an email.

Analysts said the faster inFThe increase in May is mainly due to higher electricity rates.

“Upward price pressure will come from higher electricity rates as retailers pass on higher costs to the Wholesale Electricity Spot Market, amid a jump in electricity demand as temperatures spiked across the country in May,” said Moody’s Analytics economist Sarah Tan in an email.

“That also resulted in power shortages, prompting authorities to issue the red and yellow warnings,” she added.

The National Grid Corp. of the Philippines had placed the power grids of Luzon and Visayas on red alert for 12 and eight days respectively in May.

A total of 27 and 26 days of yellow alert have been issued over Luzon and Visayas, respectively. Mindanao was under yellow alert for two days.

“The heat wave has increased demand and prices for electricity, with the latest increase in electricity rates from Manila Electric Co. (Meralco),” said Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp. in an email.

Customers in areas served by Meralco saw their overall rate increase by P0.4621 per kilowatt hour (kWh) to P11.4139 per kWh in May as a result of the increase in generation costs.

“However, this upward pressure was tempered by lower costs of key food items such as rice, fish and fruit, and rollbacks in LPG and domestic pump prices,” Chinabank Research said.

Security Bank Corp. Chief Economist Robert Dan J. Roces said food price growth is likely to have slowed in May, although rice will still remain a “major culprit”.

In April it risesFGrowth was recorded at 23.9%, down from 24.4% in March. Rice inflation in March was the fastest since February 2009.

Department of Agriculture data showed that the average price of a kilogram of local well-milled rice ranged from P48-55 at the end of May, while regular milled rice averaged P45-52 per kilogram.

UPTREND

Chinabank Research said it expects to catch upFwill “continue the recent upward trend and remain above the BSP target until July unless signiFThere will be no price reversals.”

This was said by Zamros Bin Dzulkafli, economist at Maybank Investment Banking GroupFInterest rates are likely to exceed the target range of 2-4% from May to July, in line with central bank expectations.

The BSP anticipates more quicklyFlation from May to July, but expected indoorsFto achieve the target after July.

“We expect the headline to come inFThe expectation is that the BSP will hover around 4% in the coming months, but this is unlikely to make the BSP more aggressive as such an overshoot is already priced in. by the central bank,” Mr Tsuchiya said.

Mrs Tan said if she was insideFIf rates remain below the upper limit of the target, this would further strengthen the case for a rate cut in August.

“This is dependent on subsequent measurements before the August policy meeting remaining below or at the upper limit, which we expect. Otherwise the FThe first reduction may not come until the fourth quarter,” she added.

BSP Governor Eli M. Remolona Jr. previously said the central bank could cut interest rates as early as August, possibly by 25 basis points (bps).

Emilio S. Neri Jr., chief economist of the Bank of the Philippine Islands, said he expects the Monetary Board to “keep policy neutral” at its June 27 meeting.

“The rhetoric could become even less aggressive, especially if headlines fall short of expectations,” he added.

‘I doubt the May print will be a signFicant oneFThis will influence the BSP’s thinking in June, assuming the breach of the 4% barrier is only small and core to itFThe situation remains subdued and stable,” said Miguel Chanco, chief emerging Asia economist at Pantheon.

The Monetary Board has kept its key policy rate stable at a 17-year high of 6.5% for a period of 17 years Ffirst consecutive meeting in May.

From May 2022 to October 2023, the central bank increased borrowing costs by 450 basis points toFlat.

NO RATE INCREASE

Ms Tan noted that the BSP is unlikely to implement a rate hike this year.

“Inflation is unlikely to sharply exceed the BSP’s top target of 4%, so we do not expect further increases. A cooldown in core inflation will also give the BSP confidence to keep the policy rate stable,” she said.

Philippine National Bank (PNB) economist Alvin Joseph A. Arogo said the BSP should not cut interest rates until 2011.Fcan establish itself “sustainably” within the objective.

“Furthermore, our monetary authorities must not cut ahead of the Fed or risk further exchange rate weakening. If the Fed eases by 25 bps each in September and December, it will open the room for the BSP to follow suit in October and December,” Mr Arogo added.

On May 21, the peso closed at P58.27 against the dollar Fat the P58 per dollar level for the first time since November 10, 2022.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said a rate cut would likely come later this year, but not before the U.S. Federal Reserve.

“InsideFDespite the drought, the situation is stagnating in the short term eFIn addition to a benign core, we believe risks to the outlook have diminished, supporting a BSP rate cut later this year,” he said in an email.

“We do not believe the BSP will cut its policy rate in the presence of the Fed because the Monetary Board will wait until El Niño effects have dissipated, local food supplies have normalized and rice inflation has declined significantly,” he added.

The Federal Reserve is more likely to make a long-awaited rate cut in September after a report emerged from the US Commerce DepartmentFThe economy made some progress toward the Fed’s 2% target last month and spending has weakened, traders expect, according to Reuters.

After the data release, traders estimated about a 53% chance of a rate cut in September, compared to about 49% before the report.

Mr Dacanay also said that interest rate cuts are not a problemFf the table until the Fed becomes more dovish.

“The timing will be important to provide some support to the peso during the BSP easing cycle,” he added.