Technology

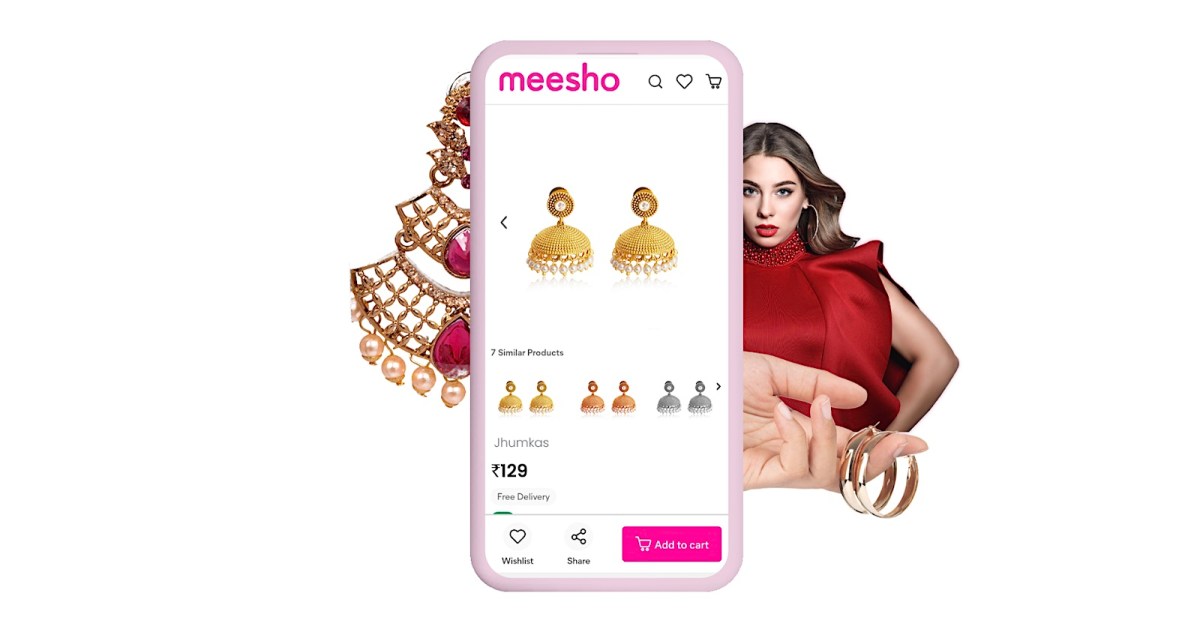

Meesho, an Indian social commerce platform with 150 million transacting users, raises $275 million

Meesho, a leading e-commerce startup in India with approximately 150 million transacting users, has secured $275 million in a new funding round. revealed in a securities depository.

The new funding is part of a larger funding round that will likely include secondary transactions and amount to more than $500 million, people familiar with the matter told JS.

The Bengaluru-headquartered startup, which operates a social commerce platform, is valued at around $3.9 billion in the round, the people said, requesting anonymity as deliberations are still ongoing. The startup, which has raised more than $1.2 billion to date, was valued at $4.9 billion when it last raised capital in September 2021.

There have been a few investors trying to get into Meesho, including WestBridge Capital and Norwest Venture Partners. WestBridge bought Meesho shares last year from Venture Highway, an early backer. The company counts Meta, Fidelity, Peak XV, Prosus Ventures, B Capital and SoftBank among its backers.

Indian daily newspaper The Economic Times first reported the new financing.

Meesho is one of the fastest growing e-commerce startups in the country. It had a run-rate GMV of more than $5 billion, Bernstein analysts estimated earlier this year.

Meesho has successfully captured the attention of value-conscious Indians with its attractively priced, diverse and unbranded range of goods. The startup’s value proposition seems to resonate well with low-to-middle-income customers, who form the bulk of India’s consumer class.

With 440,000 annual sellers and over 120 million listings, Meesho has one of the largest ranges of goods across platforms, catering to the complex and heterogeneous preferences of the Indian market, Jefferies wrote in a recent note to clients.

Traditional e-commerce platforms in India primarily target high-income consumers and branded suppliers, resulting in average order values (AOVs) well above ₹1,000 (approximately $12). In contrast, Meesho’s AOV is usually below ₹350.

“Meesho’s algorithm prioritizes listings by taking into account multiple factors including seller rating, product rating, customer reviews, customers’ past shopping behavior, product popularity, etc. Therefore, price also affects discoverability a product listing on the market,” Jefferies analysts write.

“Meesho’s fulfillment costs are much lower than those of comparable companies, allowing the platform to offer lower prices to the customer versus the competition. To reduce costs, Meesho follows an asset-light model and outsources delivery. Meesho holds nearly half of India’s annual e-logistics transportation share of 3PLs, the Jefferies note said.

But the competition is increasing. Amazon India recently launched Bazaar, a ‘special store’ offering affordable and trendy fashion and lifestyle products.