Finance

Meet the only ‘Magnificent Seven’ stocks that billionaires absolutely invest in

While Wall Street offers few guarantees, short-term volatility is one of them. Since the curtain rose on 2020, Wall Street’s three major stock indexes have traded bear and bull markets in consecutive years (through 2023).

When uncertainty plagues stocks, it is not uncommon for professional and retail investors to seek the safety of industry-leading stocks, such as the companies that make up the stock group.Beautiful seven.”

Patient Investors Are Drawn To The ‘Magnificent Seven’

The Magnificent Seven are seven of the largest and most influential listed companies. These seven titans are ranked in descending order of current market capitalization (as of April 5, 2024):

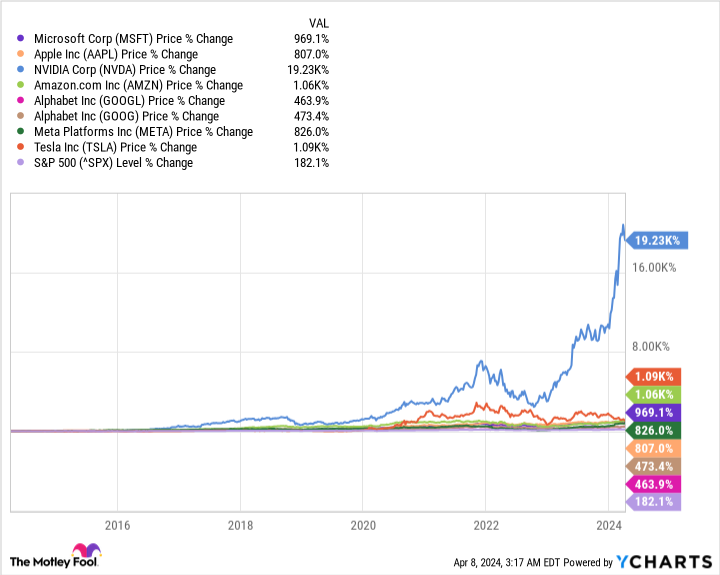

There are two defining qualities that have made the Magnificent Seven so popular with investors. For starters, they are undeniable outperformers. The benchmark for the past ten years S&P500 achieved a very strong 182%. By comparison, Nvidia shares are up about 19,230%, Amazon and Tesla shares are up more than 1,000%, and Alphabet is coming off a gain of “only” 464% versus its Class A shares (GOOGL ).

The other reason why investors have flocked to the Magnificent Seven is because they all offer clearly defined competitive advantages or seemingly impenetrable moats.

-

Microsoft’s cloud infrastructure service platform Azure ranks second in global market share. Meanwhile, Windows remains the clear leader in desktop operating systems.

-

Apple’s iPhone has taken a 50% or more share of the domestic smartphone market since introducing 5G-enabled versions in 2020. Apple also has the largest stock buyback program on Wall Street.

-

Nvidia’s graphics processing units (GPUs) are driving the artificial intelligence (AI) revolution. The company’s A100 and H100 GPUs are expected to account for a 90% share of GPUs deployed in AI-accelerated data centers this year.

-

Amazon is at the top of the pack in e-commerce and among cloud infrastructure service platforms. The e-commerce marketplace oversaw nearly 38% of U.S. online retail sales in 2023, while Amazon Web Services (AWS) gobbled up a 31% share of global spending on cloud infrastructure services in the quarter ended September.

-

Alphabet’s Google has a virtual monopoly on global Internet search, with a 91% share as of March 2024. Alphabet is also the parent company of the second most visited social network (YouTube) and the world’s No. 3 cloud infrastructure service platform (Google Cloud). ).

-

Meta Platforms’ social media networks attracted nearly 4 billion monthly active users (MAUs) during the quarter ended December. This also applies to Facebook, which alone brought in 3.07 billion MAUs.

-

Tesla is a leader in North America electric vehicle (EV) maker and the only pure-play EV manufacturer that generates recurring profits. Last year, Tesla produced almost 1.85 million electric vehicles.

Billionaire investors have sold all but one share of the ‘Magnificent Seven’

But despite the overwhelming success of the Magnificent Seven, many of Wall Street’s most prominent billionaire investors began pushing out these outperformers during the quarter ending in December.

All told, six of the seven Magnificent Seven stocks have been thrown out of billionaires’ portfolios or meaningfully reduced, including:

-

Nvidia: Eight highly successful billionaire money managers have reduced their positions in this AI titan, with Israel Englander of Millennium Management (1,689,322 shares sold), Jeff Yass of Susquehanna International (1,170,611 shares sold) and Steven Cohen of Point72 Asset Management (1,088,821 shares sold) in the lead.

-

Microsoft: Seven veteran billionaires were sellers of Microsoft stock in the quarter ending in December, including Ole Andreas Halvorsen of Viking Global Investors (3,024,399 shares sold) and Jim Simons of Renaissance Technologies (1,155,782 shares sold), both of whom positions of their respective funds closed .

-

Alphabet: Seven leading billionaire asset managers dumped Alphabet stock in the fourth quarter. Philippe Laffont of Coatue Management (3,302,342 shares sold), Stephen Mandel of Lone Pine Capital (3,113,001 shares sold) and Chase Coleman of Tiger Global Management (1,278,300 shares sold) were the respective top sellers.

-

Metaplatforms: Six regular billionaires gave Meta stock the boot in the quarter ending in December. Top sellers included Jeff Yass of Susquehanna (3,037,082 shares sold) and Chase Coleman of Tiger Global (1,430,767 shares sold).

-

Apple: Four respected billionaire money managers cut their stakes in Apple in the fourth quarter. This included Warren Buffett’s Berkshire Hathawaywho oversaw the sale of just over 10 million shares of Apple.

-

Tesla: A total of three well-known billionaire investors sold shares of EV maker Tesla in the last quarter of 2023. Billionaires John Overdeck and David Siegel, who co-founded Two Sigma Investments, saw their funds sell all 1,015,385 shares of Tesla they had bought. ownership from the previous quarter.

The one name missing from this list, and the one Magnificent Seven stock that billionaires are absolutely piling into, is e-commerce giant Amazon. During the fourth quarter there were eight billionaires added shares of Amazon to their respective funds, including (total shares purchased in brackets):

-

Ken Griffin of Citadel Advisors (4,321,477 shares)

-

Jim Simons of Renaissance Technologies (4,296,466 shares)

-

Chase Coleman of Tiger Global Management (947,440 shares)

-

Ken Fisher of Fisher Asset Management (888,369 shares)

-

John Overdeck and David Siegel of Two Sigma Investments (726,854 shares)

-

Steven Cohen of Point72 Asset Management (462,179 shares)

-

Israel Englander of Millennium Management (85,532 shares)

This is why billionaire investors can’t stop buying Amazon stock

If you’re wondering why billionaires are buying Amazon stock while reducing or reducing their stakes in the other Magnificent Seven stocks, look no further than Amazon’s trio of fast-growing supporting operating segments: AWS, advertising services, and subscription services.

While most people know Amazon for its leading online marketplace, e-commerce generates very low margins. Most of the cash flow and operating income that Amazon generates comes from its trio of supporting segments.

None of these segments are more important than AWS. Enterprise cloud spending is still relatively early in its growth trajectory, suggesting that continued double-digit revenue growth should be the expectation for AWS. Although this segment accounted for only a sixth of Amazon’s net sales last year, it generated about two-thirds of its operating income.

Amazon’s advertising business is another source of sustainable growth. In an average month, Amazon’s website is the destination for more than 2 billion visitors, many of whom are motivated shoppers. This makes Amazon one of the most important platforms that sellers want to target when they want to get their message(s) in front of consumers.

The third major operating division is subscription services. The last time Amazon updated its global Prime subscription number was April 2021, when then-CEO Jeff Bezos announced the company had surpassed 200 million. With Amazon getting the exclusive streaming rights Thursday night footballthere is a good chance that this subscription total has increased further.

Collectively, the appeal of these higher growth segments is cash flow generation. Throughout the 2010s, investors comfortably paid multiples of 23 to 37 times year-end cash flow to own Amazon stock. Patient investors can now buy Amazon stock for as little as 13 times consensus 2025 cash flow. Even as they approach their previous all-time high, Amazon shares are historically cheap.

Should You Invest $1,000 in Amazon Now?

Before you buy stock in Amazon, consider this:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor service has more than tripled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 8, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokeswoman for Facebook and sister of Mark Zuckerberg, CEO of Meta Platforms, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams has positions in Alphabet, Amazon and Meta Platforms. The Motley Fool holds positions in and recommends Alphabet, Amazon, Apple, Berkshire Hathaway, Meta Platforms, Microsoft, Nvidia, and Tesla. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

Meet the only ‘Magnificent Seven’ stocks that billionaires absolutely invest in was originally published by The Motley Fool