Finance

Missed Nvidia? This incredibly cheap semiconductor stock is crushing Nvidia in a key market right now and could rise 55%.

Nvidia has been one of the best performing stocks on the market over the past year with outstanding gains of 215%, which isn’t surprising considering the company has absolutely dominated the stock market. artificial intelligence (AI) chips and witnessed remarkable growth in sales and profits.

However, there is one company where Nvidia is still missing. The company’s revenue from the automotive segment reached $1.1 billion in fiscal 2024, up 21% from the previous year. The segment performed mediocrely in the final quarter of the fiscal year, with revenue down 4% year-over-year to $281 million.

Nvidia is trying to make a dent in the car chip market for a very long timeever with customers like Tesla. However, Nvidia has so far failed to make it big in this industry. The automotive chip market was worth an estimated $51 billion last year, making it the third largest end market for chips.

Nvidia’s automotive revenues last year indicate that it managed to capture just 2% of this market, which may seem a bit surprising considering the company is known for dominating the markets in which it operates. However, there is one company that is making solid progress in the automotive chip market and looks set to become a major player in this space in the future: Qualcomm (NASDAQ: QCOM).

Let’s take a look at the reasons why the car market could give Qualcomm a nice boost.

Qualcomm’s automotive chip pipeline is expanding at an impressive pace

In the second quarter of fiscal 2024 (which ended March 24), Qualcomm posted $603 million in automotive revenue, an impressive 35% more than the same period a year ago. It’s worth noting that the chipmaker’s automotive revenues grew faster than its total sales, which rose just 1% year over year to $9.38 billion.

The automotive industry accounted for 6.5% of Qualcomm’s total revenue in the previous quarter. While that’s not very important, investors should keep in mind that the automotive sector produced 4.8% of its sales in the same period last year. More importantly, this segment appears to be taking the lead for the company in a more meaningful way.

That’s because Qualcomm left the previous quarter with a $45 billion auto design profits pipeline. A design win means Qualcomm’s automotive chips have been selected for use by automakers, or Original Equipment Manufacturers (OEMs), and should translate into revenue once those products enter production.

The company generated $1.2 billion in auto revenue in the first six months of the current fiscal year, up 33% from the same period the previous year. So Qualcomm’s six-month auto revenue is greater than what Nvidia generated from this segment in the last fiscal year. Furthermore, Qualcomm management is confident that its automotive business will continue to grow faster than the end market, indicating that the company is on track to gain more market share.

Third-party estimates predict that the automotive chip market could see annual growth of more than 10% through 2032 and generate annual revenues of $128 billion. So management’s claim that Qualcomm is growing much faster than the end market is true. Additionally, Qualcomm’s automotive pipeline has grown 50% in 18 months since its auto investor day in September 2022.

This sales funnel could continue to improve given the long-term growth opportunities present in the automotive chip market and the fact that Qualcomm delivers an end-to-end platform that enables multiple functionalities such as digital cockpits, automated driving and mobile connectivity. , among other things.

The stock is poised for healthy gains

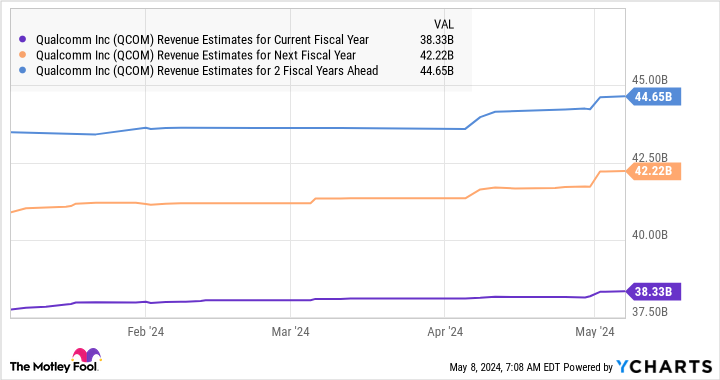

Qualcomm expects the auto industry to generate more than $4 billion in annual revenue by fiscal 2026. That would be more than double the $1.87 billion the company generated from this segment in fiscal 2023, translating into three-year revenue growth of 29 percent. %. Thanks to the company’s impressive growth in markets such as automotive, analysts have upgraded their growth expectations for Qualcomm.

The estimated 2026 revenue of $44 billion suggests that the auto industry could account for 10% of the company’s revenue within a few years, based on Qualcomm’s revenue expectations of $4 billion. Furthermore, the $45 billion pipeline is an indication that the segment will make a greater contribution to the company’s business in the long term.

Assuming Qualcomm achieves $44.6 billion in fiscal 2026 and seven times revenue at that point, in line with U.S. tech sector revenue figures, its market capitalization could rise to $312 billion. That would represent a 55% jump from current levels. Qualcomm currently trades at 5.5 times sales, which is a discount to the technology sector.

The acceleration of the automotive and AI-related catalysts in the smartphone market could lead to the market rewarding Qualcomm with a higher earnings multiple, potentially leading to more profits than what was forecast in the previous section. That’s why investors looking for a growth stock should immediately consider buying Qualcomm, as it has multiple catalysts and is much cheaper than Nvidia, which currently trades at an expensive 37 times revenue.

Should You Invest $1,000 in Qualcomm Now?

Consider the following before buying shares in Qualcomm:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $550,688!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 6, 2024

Hard Chauhan has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Nvidia, Qualcomm, and Tesla. The Motley Fool has one disclosure policy.

Missed Nvidia? This incredibly cheap semiconductor stock is crushing Nvidia in a key market right now and could rise 55%. was originally published by The Motley Fool