Finance

Missed Texas Roadhouse shares? Buy Portillo’s stock instead.

Restaurant business Texas Roadhouse (NASDAQ: TXRH) has been a huge winner over the past decade. However, I grudgingly admit that I have missed some big wins. And I have no one to blame but myself.

More than a decade ago, Texas Roadhouse was one of the first stocks I ever bought. I have held for many years and reinvested dividends on the way, which was a big win for my nascent portfolio. However, I sold my position during the first year of the pandemic because I thought the restaurant industry was in for a longer recovery season.

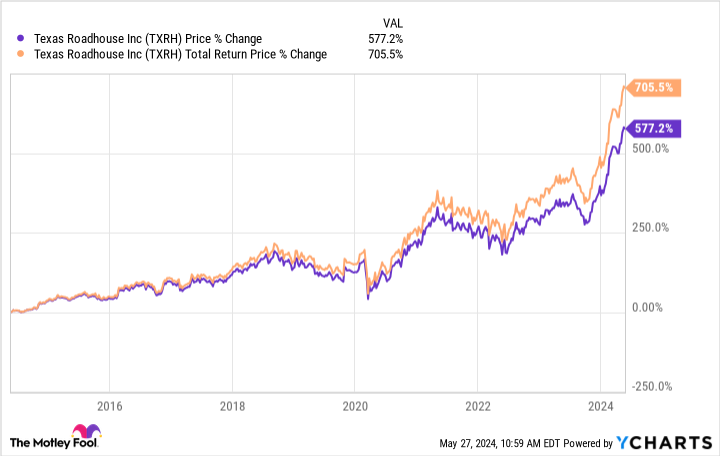

Ultimately, I let short-term thinking cloud my long-term judgment; it can happen to any of us. As a result, I have missed out on big gains since I sold, as the chart below shows.

To be clear, Texas Roadhouse probably still has good days ahead of it, so investors haven’t completely “missed out” today. The company’s flagship restaurant chain is highly profitable and still growing. And it’s nurturing two small but promising restaurant concepts with Bubba’s 33 and Jagger’s, providing additional opportunities for long-term investors.

That said, I think it’s fair to say that growth for Texas Roadhouse over the next decade won’t be as great as it has been over the past decade. But for those looking for a new idea, the opportunity is with Chicago’s restaurant company Portillos (NASDAQ: PTLO) is similar to investing in Texas Roadhouse 10 years ago. This is why.

Why Portillo’s could be a great stock pick

I want to identify some of the things that have made Texas Roadhouse a good company to invest in. First, these restaurants are popular. In 2013, locations averaged $4.3 million in sales volumes and same-store sales increased 3% this year. With continued same-store sales growth, average volumes are now a whopping $7.8 million – I’d say that’s pretty popular.

Portillos might agree with Texas Roadhouse on this one. As of the first quarter of 2024, Portillo’s average unit volume is a whopping $9 million. And while same-store sales fell a modest 1% in the first quarter, sales volume has consistently increased since the 2021 IPO.

Second, Texas Roadhouse has a good profit margin at the restaurant level – a metric that excludes expenses that are not essential to restaurant operations. Ten years ago, the company already had a profit margin at restaurant level of 17%. In the most recent quarter this was still around 17%, which is encouraging.

Portillo’s can also hold its own here, even if it measures things differently than Texas Roadhouse. Portillo’s looks at adjusted earnings before interest, taxes, depreciation and amortization (EBITDA). Given the extent to which this is adjusted, it will obviously be higher. All this said, Portillo’s adjusted EBITDA margin at the restaurant level is about 22% – not too shabby.

The point is that Texas Roadhouse had (and has) a great economy – an economy largely shared by Portillo’s. When a restaurant chain has done that large unit economy this way it can be a great investment as the chain expands. And that’s what’s going to happen for Portillo’s.

The upside potential

Portillo’s today has fewer than 90 locations, relatively concentrated in the Midwest. But one day it hopes to have 600 locations – that’s a huge leap.

Granted, growth for Portillo’s will come at a measured pace. Management expects to grow its restaurant base by just 11% this year, and the growth rate could be similar in the coming years. At this rate, Portillo’s would still have fewer than 250 locations in ten years.

However, this could be the growth Portillo needs for the stock to perform well. Consider that Texas Roadhouse had 420 locations at the end of 2013 and 741 locations at the end of 2023 – an increase of only 76% in ten years. Portillo’s could grow more feasibly than this, given its smaller starting point.

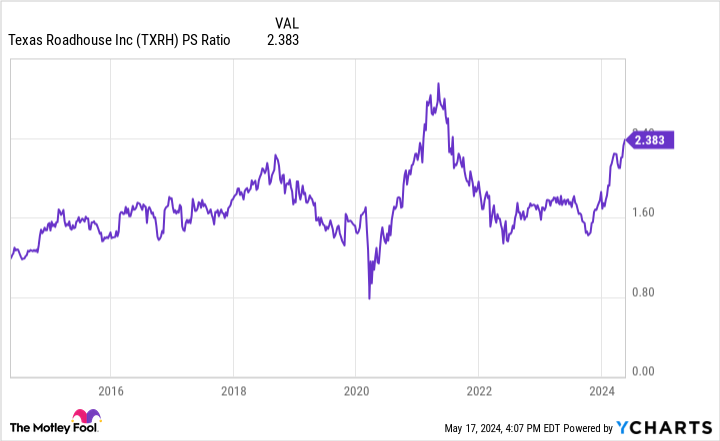

A final consideration is valuation. Consider that a decade ago, Texas Roadhouse stock traded at a downright cheap price-to-sales value (P/S) of just one. Today the price-earnings ratio has doubled to two.

According to legendary investor Warren Buffett, the valuation of a stock can have a major impact on an investment. If a valuation is expensive and comes to a more reasonable level over time, it neutralizes the positive impact of business growth. With this in mind, Texas Roadhouse stock benefited from a cheap starting position a decade ago.

Likewise, investors who buy Portillo shares today are getting a good deal. The stock is flirting with an all-time low and the price-earnings ratio is a paltry 0.9. That’s a great price for a restaurant company with good economics and ambitious long-term growth plans.

In conclusion, I think buying Portillo’s stock today is like buying Texas Roadhouse stock a decade ago. So if you missed out on big investment returns from the popular steakhouse, don’t miss out on big returns from this Chicago favorite.

Should you invest $1,000 in Portillo’s now?

Consider the following before purchasing shares in Portillo’s:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Portillo’s wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $671,728!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 28, 2024

Jon Goyle has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Texas Roadhouse. The Motley Fool has one disclosure policy.

Missed Texas Roadhouse shares? Buy Portillo’s stock instead. was originally published by The Motley Fool