Business

Net inflows of foreign direct investment rose sharply in January

By means of Luisa Maria Jacinta C. Jocson, News reporter

NET INFLOW of foreign direct investment Foreign direct investment into the Philippines has almost doubled In January, amid strong demand for local debt instruments, the Bangko Sentral ng Pilipinas (BSP) reported on Wednesday.

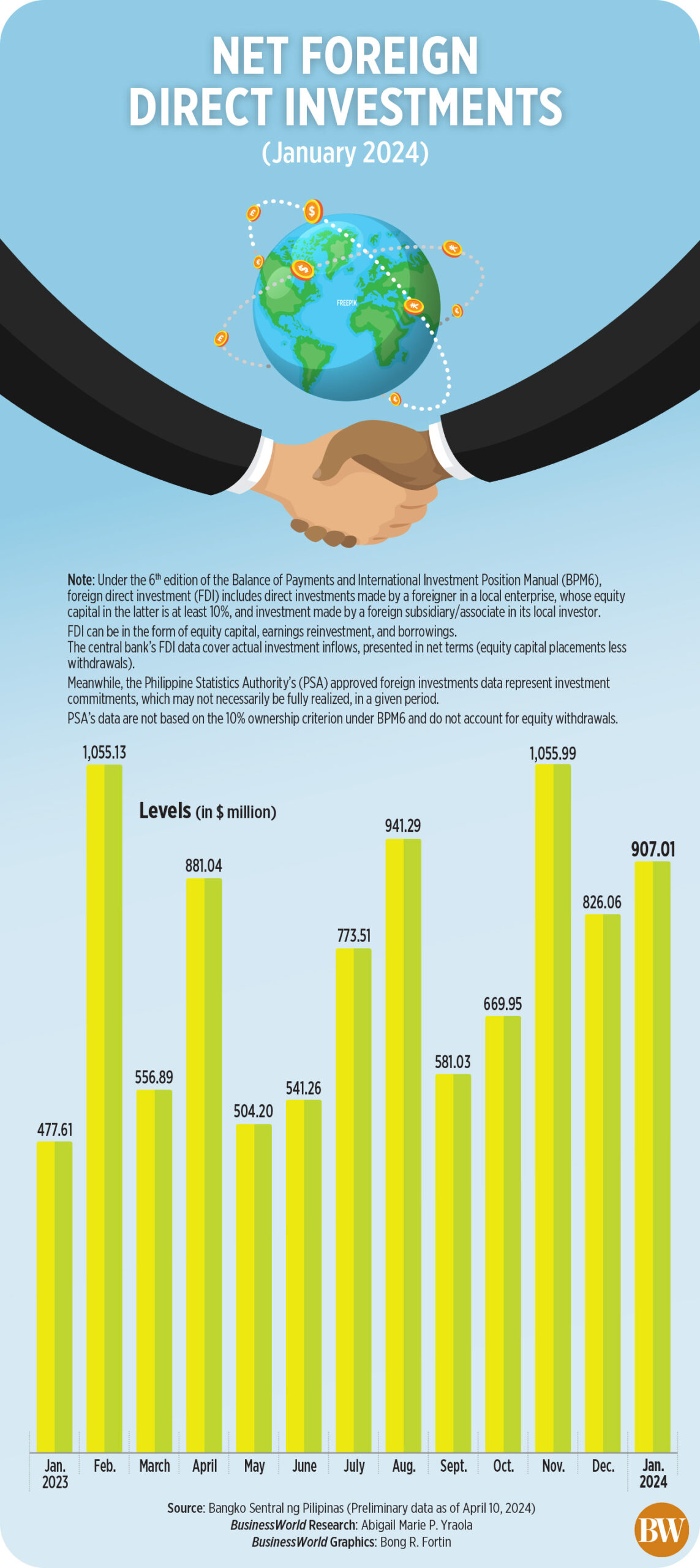

Preliminary BSP data showed net foreign direct investment inflowsFThe lows rose 89.9% to $907 million in January, compared to $478 million in the same month in 2023.

Month after month, net inFThe lows rose 9.8% from the $826 million recorded in December.

Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said the growth in foreign direct investment inFThe January trough was largely driven by the increase in net investments in debt instruments.

BSP data shows that non-residents’ net investments in debt instruments almost tripled (173.2%) to $820 million in January, compared to $300 million in the same month in 2023.

“The triple-digit growth may be due to strong demand for local debt instruments as interest from foreign investors increased due to earlier-than-expected interest rate cuts by the US Fed and market optimism from the potential reversal in monetary policy,” he said. a Viber message.

In January, markets still expected the US Federal Reserve to cut interest rates as early as March.

Now markets are lowering their expectations for future Fed rate cuts, with some now expecting easing to begin in July instead of June. The Federal Open Market Committee kept the Fed funds rate unchanged at a range of 5.25-5.5% at its March meeting. Between March 2022 and July 2023, it raised rates by a total of 525 basis points.

BSP data also showed net investments in equity, excluding reinvestment of net distributed profitsFlow of $11 million, a reversal from the $93 million inFlows from a year ago.

Broken down, equity placements fell 33.5% from $149 million to $99 million, while withdrawals rose 97.2% from $56 million to $110 million.

Earnings reinvestment increased 16.4% from $85 million in January 2023 to $99 million.

Investments in stocks and mutual fund shares fell 50.8% to $87 million in January, compared to $178 million a year ago.

Investments in equity placements came mainly from Japan (69%) and the United States (19%). These were mainly invested in the manufacturing, real estate, construction and wholesale and retail sectors.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said the higher foreign direct investment will bring net gainsFThe low point in January could partly be attributed to improved economic conditions Fperformance of the financial markets.

He cited the declining trend in inflation in January, which raised hopes for rate cuts later this year.

Inflation slowed to a three-year low of 2.8% in January, the slowest since 2.3% in October 2020. It was also within the central bank’s target of 2-4%.

“Increased foreign direct investment could also have been partly achieved through some realized investment commitments made for more than a year during the government’s various foreign trips,” Mr Ricafort added.

Looking ahead, he said foreign direct investment could pick up further if interest rate cuts were to take place in the second half of the year.

BSP Governor Eli M. Remolona, Jr. said that when he comes inFIf interest rates continue to decline and economic growth turns out to be weaker than expected, the Monetary Board could cut rates as early as the third quarter.

The BSP expects to record net foreign direct investmentFlow of $9 billion at the end of 2024.