Business

NG debt reaches a record P15.35 trillion

By means of Beatriz Marie D. Cruz, News reporter

The NATIONAL government’s (NG) outstanding debt rose to a new high of P15.35 trillion at the end of May.FThe Bureau of the Treasury (BTr) said on the impact of the peso’s weakness on foreign currency-denominated debt.

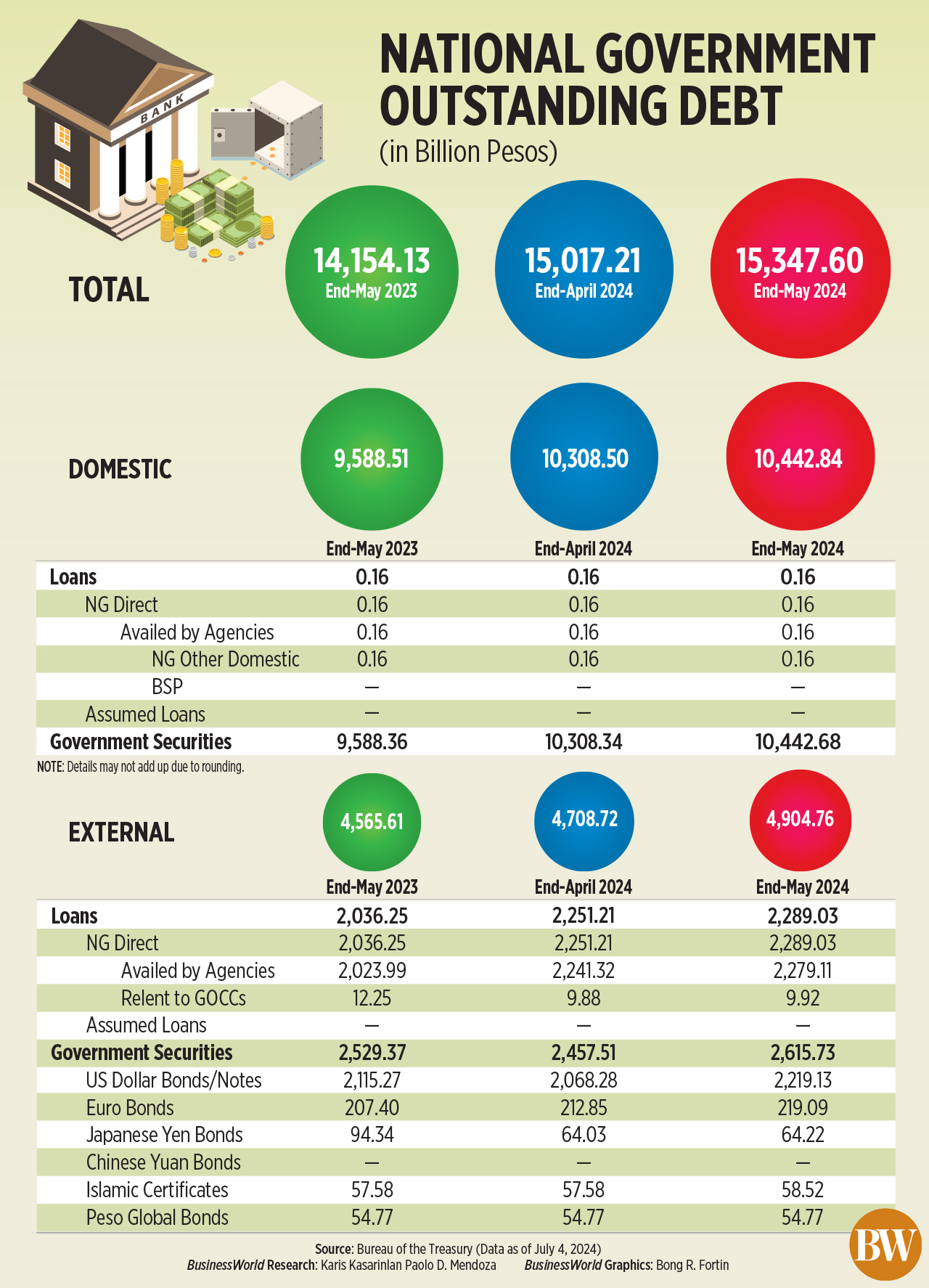

BTR data on Thursday showed outstanding debt rose 2.2% from P15.02 trillion at the end of April. Debt rose 8.4% from P14.15 trillion a year ago.

“Total debt increased by P330.39 billion or 2.2% from the end-of-April 2024 level, mainly due to the impact of local currency depreciation on the valuation of foreign currency-denominated debt,” the BTr said in a press release.

The peso closed at P58.52 against the dollar at the end of May, declining by P0.94 from its P57.58 Fready from the end of April.

The BTR said the majority, or 68% of the total debt burden, came from domestic sources.

At the end of May, outstanding domestic debt rose 1.3% to P10.44 trillion from P10.31 trillion in the previous month. Year on year, it rose 8.9% from P9.59 trillion.

“The increase was due to the net issuance of government bonds worth €131.66 billion and the €2.68 billion impact of the peso depreciation on domestic debt denominated in foreign currency,” BTR said.

Government bonds accounted for almost all of the domestic debt at P10.44 trillion, BTR data showed.

Meanwhile, external debt accounted for 31.96% of total outstanding debt.

At the end of May, external debt rose 4.2% to P4.9 trillion from P4.71 trillion at the end of April. It was also 7.4% higher than P4.57 trillion a year earlier.

“For May, the increase in external debt can be attributed to P122.04 billion in net available foreign loans and P76.94 billion in upward revaluation of U.S. dollar-denominated debt,” the BTr said.

“Meanwhile, the favorable movement of the third currency resulted in a downward revaluation effect of P2.94 billion.”

External debt consisted of P2.29 trillion in loans and P2.62 trillion in debt securities

Debt securities consisted of P2.22 trillion in US dollar bonds, P219 billion in Euro bonds, P64 billion in Japanese yen bonds, P58 billion in Islamic certificates and P54 billion in global peso bonds.

Meanwhile, NG’s guaranteed liabilities fell 1.6% to P350 billion in May from P356 billion in April. It also declined 7.8% from P379 billion in the same period in 2023.

“The decline in NG guarantees was due to the net reimbursement of both domestic and external guarantees amounting to P4.36 billion and P3.55 billion, respectively,” BTr said.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., attributed the rise in government debt to recent global bond issuance.

“The latest increase is largely due to the $2 billion global bond issuance in early May 2024,” he said in a Facebook Messenger chat.

The Philippines raised $2 billion (114.7 billion euros) in May from the issuance of dollar bonds in two tranches.

Mr. Ricafort also noted that high interest rates were increasing financing costs.

The central bank has kept its key policy rate at the highest point in more than seventeen years, namely 6.5%, since October 2023.

The recent depreciation of the peso has also contributed to higher debt burdens, Mr. Ricafort said. In May, the peso fell to the P58 level for the FFirst time since November 2022.

Stronger tax collections and other fiscal reform measures would help reduce the country’s debt burden, Mr. Ricafort said, but added that introducing new taxes should be the last option.

“The need for sustainable income is desperately needed. It comes at a time when interest rates are also rising,” Jonathan L. Ravelas, senior advisor at professional services firm Reyes Tacandong & Co., said in a Viber message.

The government plans to borrow €2.57 trillion this year, 75% of which will come from domestic sources and the rest from foreign sources.

As of the first quarter, NG’s debt as a percentage of gross domestic product (GDP) stood at 60.2%. This was less than 61.1% a year ago, but higher than 60.1% at the end of 2023.

The government is targeting a debt-to-GDP ratio of 60.3% by the end of the year, slightly above the 60% threshold considered achievable for developing economies. It aims to reduce this further to 55.9% by 2028.