Finance

Nvidia just announced a stock split. Time to buy?

In recent months, investors have wondered whether this would be the case Nvidia (NASDAQ: NVDA) would launch a stock split. That’s after the tech giant’s shares soared to nearly $1,000 in recent years. And this week, it even hit $1,000 during the trading session following Nvidia’s earnings report and stock split announcement. After the split, the chip designer’s shares will trade at a much lower level.

But this move won’t change Nvidia’s $2.3 trillion market value. Instead, a stock split involves issuing more shares to current shareholders, which will result in more shares trading at a lower price; current shareholders will end up with the same dollar value of shares as before the split. The price drop will make the stock accessible to a wider range of investors, and Nvidia even said as part of the announcement that this was the motivation for making the move.

Now that Nvidia is taking the step many investors have been waiting for, is it time to buy the stock?

Why are investors interested in stock splits?

It’s important to note that it’s not a good idea to buy a stock just because the company has launched a split; it’s just a mechanical operation. A stock split itself will not push the value of a stock higher or lower. So now you might be wondering: If that’s the case, why are investors so interested in whether a company will split its stock?

In many cases, this move indicates that a company is optimistic about its future and believes its stock has what it takes to soar again. Overall, the company has performed well from an earnings perspective in recent years, and this has led to the share price gains we’ve already seen. By splitting its shares, a company implies that these gains are not over yet, and that the lower share price may rise again and eventually even return to pre-split levels.

Now let’s look at the Nvidia operation, a 10-for-1 stock split, effective June 7. This means that if you own one Nvidia share today, you will own ten after the split, but the value of your holdings remains the same. . And if you buy shares of Nvidia after the split, if they are still trading at $1,000 before the split, they will drop to $100 per share after the split.

This maneuver will make it easier for investors who don’t have access to it fractional shares or those who prefer to buy full shares for investment. And the $1,000 limit represents a psychological barrier for some investors, who would automatically hesitate to buy even if the valuation is reasonable. Nvidia’s stock split will remove this roadblock and clear the way for them to gain entry into this tech giant.

Nvidia’s five stock splits

Nvidia is no stranger to stock splits, having done five in the past 24 years. And every time Nvidia announced a split, the stock price was significantly lower than it is today, so I’m not surprised that Nvidia has now decided on this move.

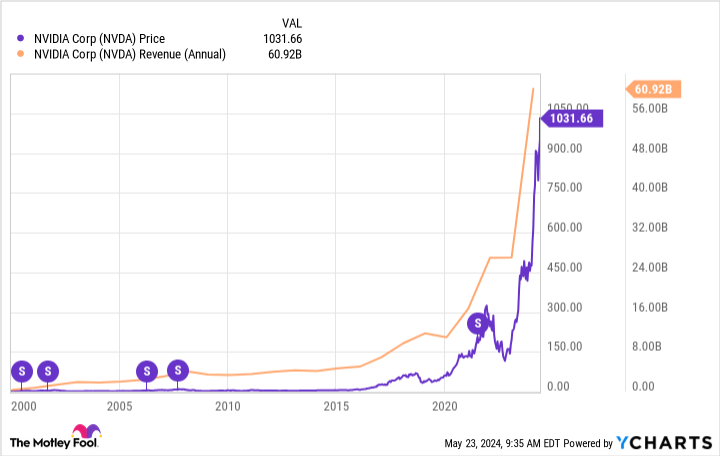

Let’s get back to our question: Is it time to buy the stock? It is, but not because of Nvidia’s upcoming stock split. Nvidia’s shares have risen following its previous stock splits, but this move is due to the company’s increasing revenue and increasing demand for its products.

And a look at Nvidia’s recent earnings report and the overall AI market give us reason to be optimistic about the future. The company reported triple-digit growth in revenue and net income in the first quarter of fiscal 2025, with revenue reaching record levels. At the same time, the gross margin increases to more than 78%, making Nvidia increasingly profitable.

The company says demand for its products and services is outpacing supply, and as Nvidia prepares to launch its new Blackwell architecture and most powerful chip ever, it’s easy to imagine demand remaining strong. Especially given the AI market forecasts. Analysts predict the market will reach more than $1 trillion by the end of the decade. All of this supports the idea of more growth for Nvidia.

Meanwhile, Nvidia stock trades for about 34 times forward earnings estimates, which seems very reasonable given its long-term prospects. That makes Nvidia a buy – whether you make the move before or after the stock split.

Should You Invest $1,000 in Nvidia Now?

Consider the following before buying shares in Nvidia:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $652,342!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns May 13, 2024

Adria Cimino has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Nvidia. The Motley Fool has one disclosure policy.

Nvidia just announced a stock split. Time to buy? was originally published by The Motley Fool