Finance

Nvidia shares shoot up 10% to a record high

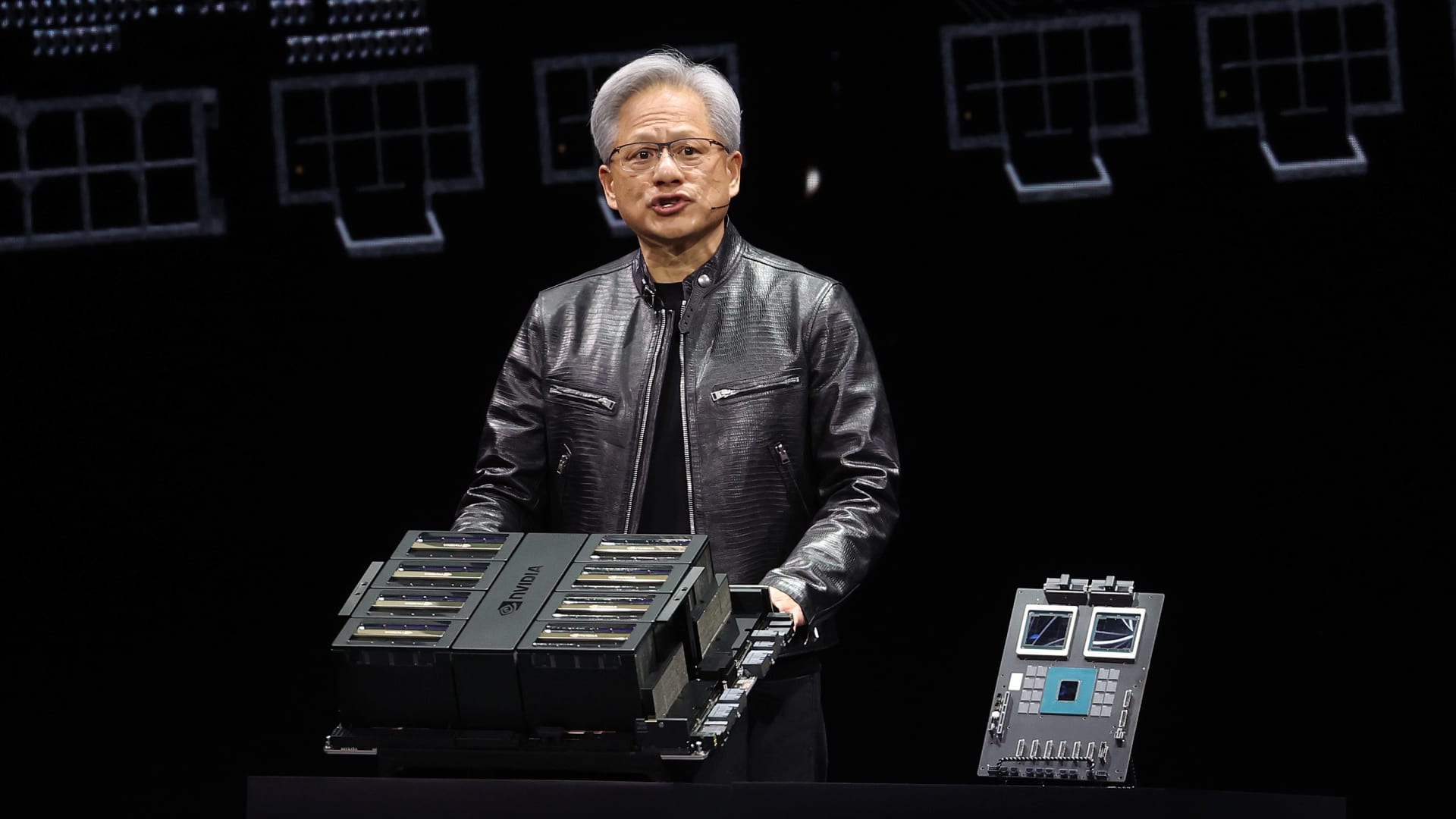

Nvidia CEO Jensen Huang delivers a keynote speech during the Nvidia GTC Artificial Intelligence Conference at SAP Center on March 18, 2024 in San Jose, California.

Justin Sullivan | Getty Images

Nvidia Shares rose more than 10% on Thursday after the company reported earnings on Wednesday that beat Wall Street estimates and showed there is still huge demand for its artificial intelligence chips. The company’s data center revenue grew by a whopping 427% during the quarter.

First-quarter revenue was higher than expected at $26.04 billion, compared to the LSEG estimate of $24.65 billion. And the question does not waver.

The company issued strong guidance, saying it expects revenue of $28 billion for the current quarter, surpassing the LSEG estimate of $26.61 billion.

Shares surpassed $1,000 for the first time, hitting an all-time high of $1,051.96 in intraday trading and are up about 111% this year. The previous high of $953.86 was reached on May 21.

Despite some analysts fearing an ‘air pocket’, others have become even more optimistic about the company since the results. Bernstein’s Stacy Rasgon raised the company’s price target to $1,300, writing in a letter to investors that the saga surrounding the company is “clearly nowhere near its end, or probably nowhere near its peak.” He wrote that stocks look cheap.

Jefferies raised its price target on the stock to $1,350 on a surge in its new AI graphics processors, called Blackwell, and expectations of an acceleration in the “size of the beats” later this year when the platform launches.

Nvidia posted net income of $14.88 billion, or $5.98 per share, a dramatic increase from the $2.04 billion, or 82 cents per share, it reported in last year’s quarter.

Nvidia announced a 10-for-1 stock split on Wednesday, with shares set to begin trading on a split-adjusted basis on June 10.