Business

Philippine economy grows by 5.7%

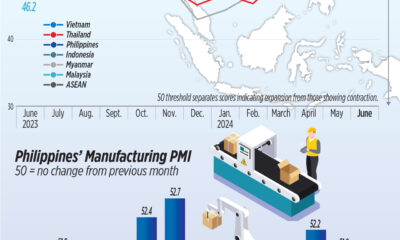

THE PHILIPPINE ECONOMY grew by 5.7% in the FIt outpaced most of its peers in Southeast Asia despite slowing consumption and government spending, according to the local statistics bureau.

But growth was below the average forecast of 5.9% by 20 economists in a year Business poll from last week. The lower than expected growth calls for the Philippine central bank to keep interest rates stable next week, despite an acceleration in interest rates.Flat.

“Despite several risks and challenges, the economic outlook for the Philippines remains bright in the short and medium term,” National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan told a newsletter.Fon Thursday.

“With hard work and the right policies, we are up to dateFI am sure we will achieve our growth target of 6-7% this year,” he added.

The Philippines’ first-quarter growth is about the same as Vietnam’s (5.6%) and higher than China (5.3%), Indonesia (5.1%) and Malaysia (3.9% ).

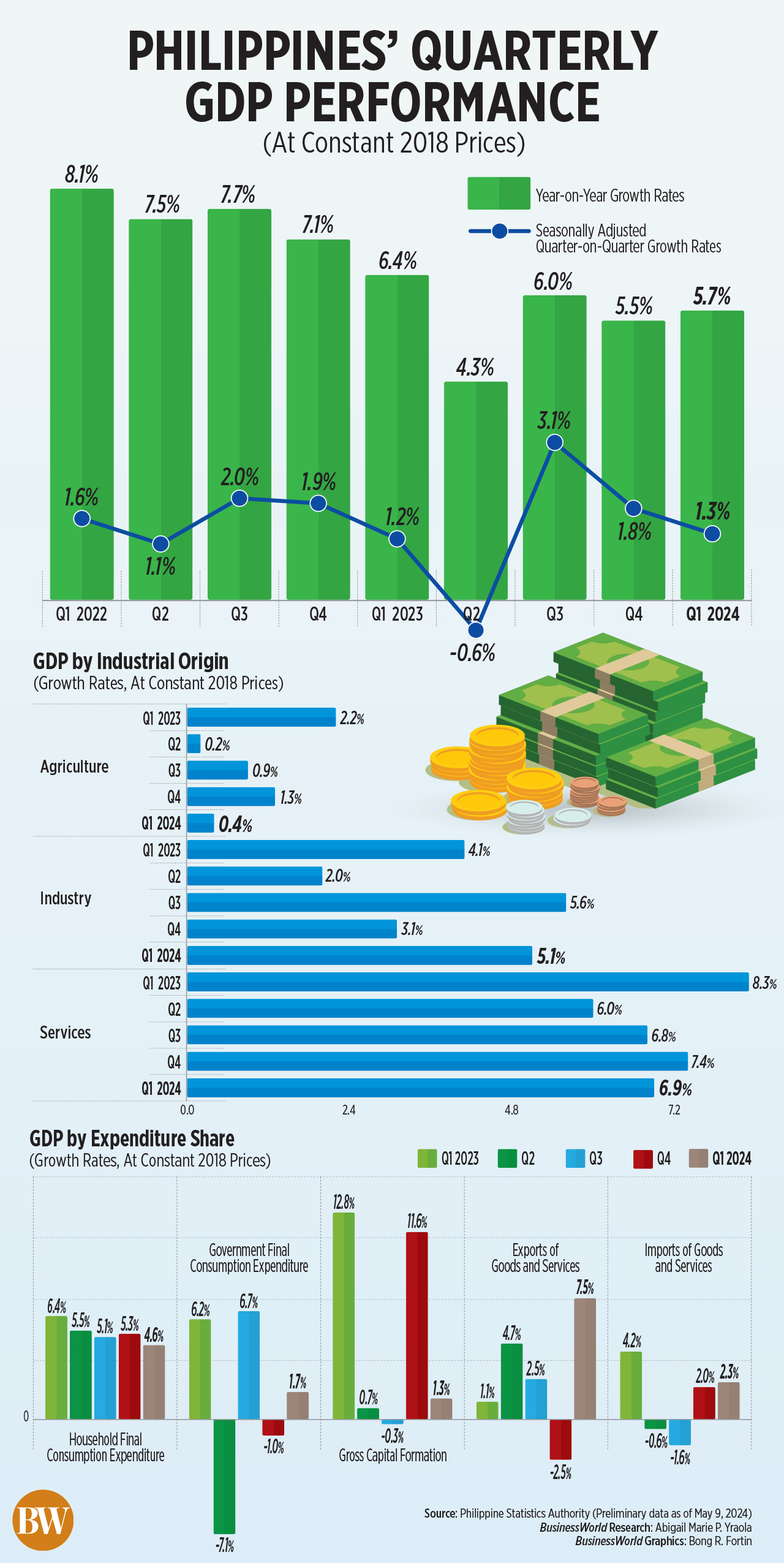

Growth in the past quarter was better than the 5.5% in the previous quarter. On a quarterly basis, the economy grew 1.3%, according to the Philippine Statistics Authority.

Mr. Balisacan said the growth shows the resilience of the Philippine economy, which posted the fastest progress in Southeast Asia last year. But interest rates are at a 17-year high and red hotFThis can limit economic activity.

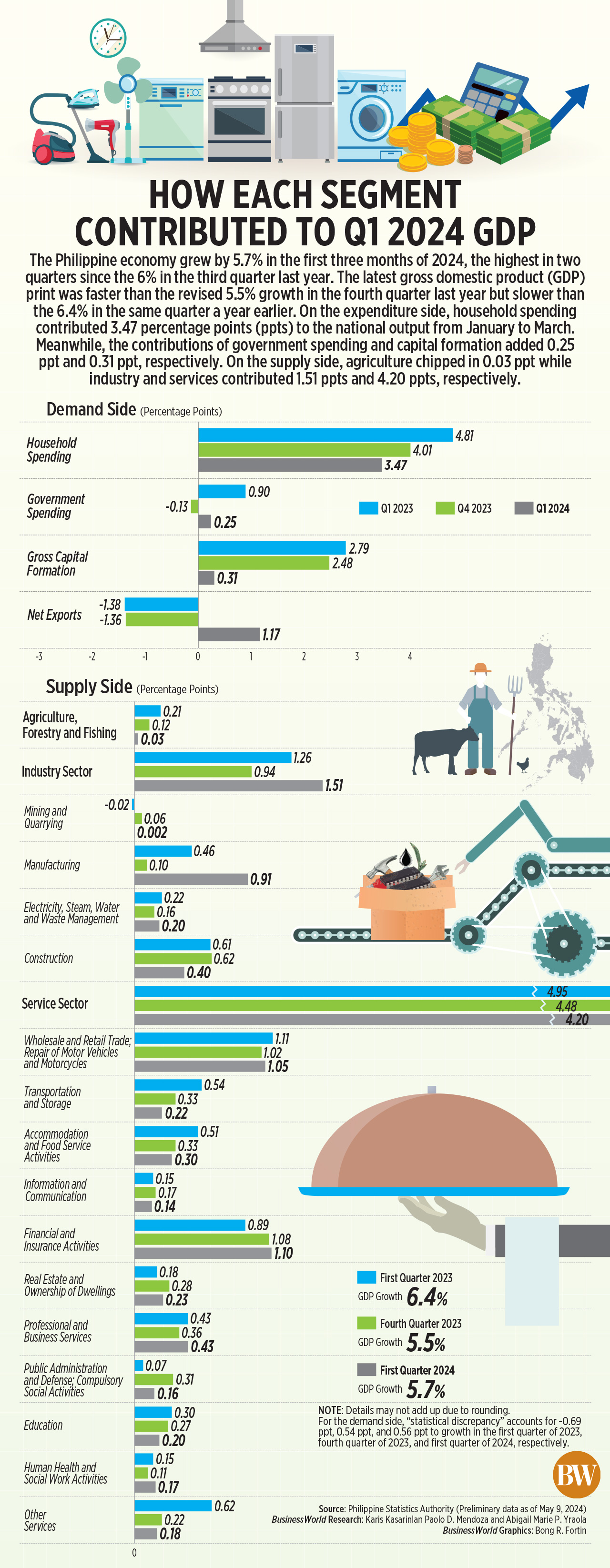

Household spending, which accounts for more than 70% of economic output, rose 4.6% last quarter, the slowest increase after a coronavirus pandemic.

Mr. Balisacan attributed the weaker consumption to rising prices of key food items and El Niño.

“Moderate growth” in domestic demand reflected less favorable business sentiment, he said. Construction slowed due to prolonged periods of extreme heat.

State spending growth also slowed to 1.7%, while investments rose 1.3%, from 11.6% in the fourth quarter.

“The consumption of durable equipment is also quite low,” Mr. Balisacan said. “That’s the likely eFdue to the high interest rates.”

“Globally, inflation is falling faster than previously expected. We should see this continued improvement. Even domestically, we should eventually see an easing of interest rates,” he added.

InFInflation accelerated for the third month in a row to 3.8% in April. In March this was 3.7% and in February 3.4%.

“As domestic and external headwinds persist in 2024, the government will continue to promote growth-enhancing strategies to boost economic expansion and ensure the Philippines remains on track with its medium- to long-term goals,” said Finance Secretary Ralph G. Recto. in a separate statement.

To finance the P5.767 trillion national budget for 2024, the agency is boosting resource mobilization efforts to collect P4.3 trillion in revenue. “The government is on track to achieve this goal, with total revenues already reaching approximately $1.41 trillion by the end of April,” he said.

The finance chief also said the government is trying to improve non-tax revenue to generate more money without imposing additional taxes, mainly through dividend payments from state-owned enterprises.

MODERATE GROWTH

MODERATE GROWTH

Nicholas Antonio T. Mapa, senior economist at ING Bank NV Manila, said FThe first quarter economic output data reinforces expectations that full-year growth will remain below the government’s 6-7% target.

“We do not expect any adjustment to the current policy settings,” he said in a note. “However, there has been a continued slowdownFThe letdown and disappointment on the growth front could convince the Bangko Sentral ng Pilipinas (BSP) to cut rates once the US Fed does so later this year.”

Makoto Tsuchiya, assistant economist at Oxford Economics, expects private consumption to “remain more or less at current levels.” “The decline was larger than we expected, but the direction is consistent with our narrative that household spending will be subdued this year,” he said in an email.

Despite weaker momentum due to gloomy export and investment prospects, Mr Makoto said growth was likely to improve this quarter.

Aris Dacanay, economist at HSBC Global Research, expects growth to moderate in the second half due to the fundamental evolution.Ffects. “The longer the BSP keeps monetary policy tight, the greater the drag on growth is likely to be,” he said in a note.

The economic recovery is unlikely to be robust due to “rising unemployment, stabilizing incomes and higher borrowing costs,” ANZ Research economist Debalika Sarkar and chief economist Sanjay Mathur said in a separate note.

Mr. Balisacan said so FGrowth in the first quarter reflected the lagged effects of the central bank’s aggressive rate hikes that began in May 2022.

“What is encouraging, however, is that despite these developments, our exports have been able to recover from last year’s high negative figures, especially in the Ffirst quarter and in the fourth quarter,” he said.

Exports grew by 7.5% in the Ffirst quarter, while imports increased by 2.3%.

Growth in the services sector, which made the largest contribution to the economy of all major industries, slowed to 6.9%.

The contribution was 4.2 percentage points, followed by industry with 1.51 points and agriculture with 0.03 points. Agricultural growth also slowed to 0.4%, compared to 2.2% a year ago. Industry growth accelerated to 5.1% from 4.1% a year earlier.

Shivaan Tandon, economist at Capital Economics Emerging Asia, said weaker economic performance is likely to continue.

“We expect further weakening in the remainder of the year as tight monetary policy, slower growth in remittances and weaker export demand will weigh on activity,” he said in a note.

The Philippine Stock Exchange index fell 1.75% or 116.72 points to close at 6,542.46, while the peso Fended half a centavo stronger at P57.38 per dollar. — Mariedel Irish U. Catilogo