Business

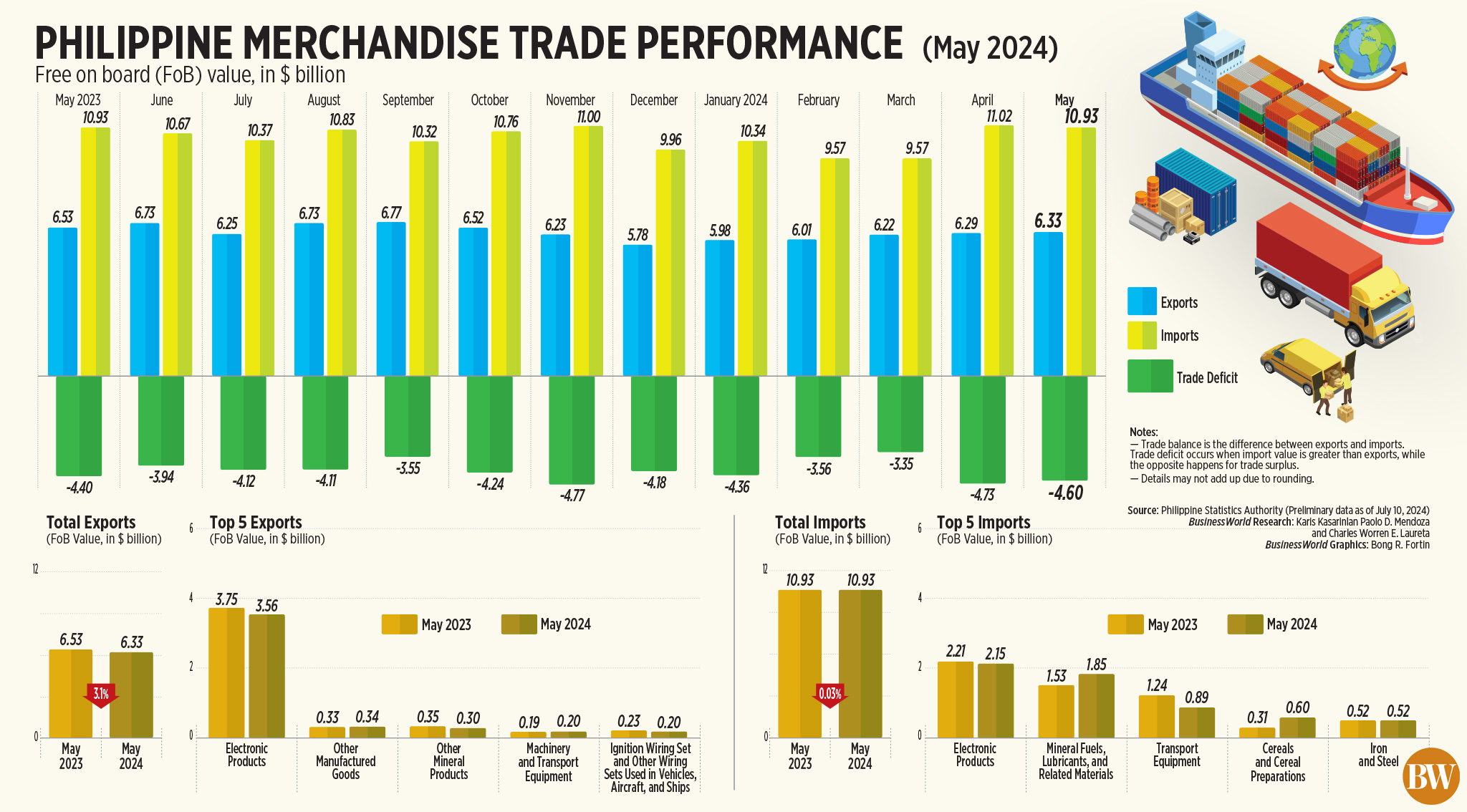

PHL posts a trade deficit of $4.6 billion in May

The Philippines’ Trade Gap increased slightly in May, as did exports and imports contracted on a Anannually, the statistics agency said Wednesday.

Preliminary data from the Philippine Statistics Authority (PSA) shows that the country’s balance of trade in goods – the TueFratio between exports and imports – amounted to $4.601 billionFicit in May, slightly larger than the $4.4 billion gap a year ago.

However, the May trade gap narrowed from $4.73 billionFIT in April.

“The modest reduction in the trade deficit was exactly in line with our expectations and was mainly driven by the fading of adverse seasonal effects on exports and imports.Ffects,” Pantheon head of emerging economies Miguel Chanco said in an emailed note.

For the period January to May, the trade is theFicit shrank 13.08% to $20.59 billion, compared to the $23.69 billion gap a year ago.

The country’s trade balance in goods has been in the red for 108 consecutive months (nine years), or since the $64.95 million surplus in May 2015.

PSA data shows the value of exports fell 3.1% to $6.33 billion in May, compared to $6.53 billion in the same month a year ago. Month on month, exports rose 0.6%, compared to $6.29 billion in April.

Despite the decline, May saw the highest export value in seven months, or since $6.52 billion in October 2023.

Year to date, exports grew by 7.81% annually to $30.84 billion.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said exports are favorableFcompared to the weaker peso against the US dollar in May.

In mid-May, the peso fell to the level of P58 per dollar for the Ffor the first time in 18 months or since November 2022. The peso closed at P58.52 against the dollar at the end of May, declining by P0.94 against its rate. P57.58 Fready from the end of April.

Meanwhile, PSA data showed May imports fell 0.03% to $10.929 billion from $10.93 billion a year ago, and 0.8% from $11.02 billion in April.

For the first fiFive months ago, imports fell 1.66% to $51.43 billion.

“Imports remained flat year-on-year and declined only slightly in US dollar terms compared to April, resulting in a less favorable deficit than we had hoped. The net result of no change in the deFicit was in line with expectations and should not have any substantial or lasting impact on the Philippine peso,” said Robert Carnell, regional head of research, Asia-PaciFic at ING Economy, said in an email.

The Development Budget Coordination Committee expects growth of 5% and 2% in exports and imports respectively this year.

ELECTRONIC EXPORTS DECREASE

Manufactured products that are made up 80.3% of total exports fell by 3.5% to $5.08 billion in May, compared to $5.27 billion last year, PSA said.

Exports of electronic goods, which account for more than half of manufactured products, fell 5.1% to $3.56 billion in May, compared with $3.75 billion a year ago. Semiconductor exports fell 13.3% to $2.75 billion in May.

“Broadly speaking, electronic exports, which make up the lion’s share of the Philippine export basket, were marginally lower than the previous month, but nothing to worry about. There were also some better figures for industrial exports,” Mr Carnell said.

Exports of mineral products, which accounted for 10% of total exports, fell 8.4% to $633.63 million in May.

The United States was again the top destination for Philippine-made goods, with exports worth $1.08 billion or 17% of total exports in May.

Hong Kong, the top export destination in April, fell to second place with an export value of $904.79 million or 14.3% of the May total. This was followed by Japan ($882.7 million or 13.9%) and China ($847.12 million or 13.4%).

“By country, exports to mainland China remain weak, down 9.1% year-on-year, but imports to Hong Kong are holding up much better and are likely also destined for mainland China,” he said Carnell.

Mr. Chanco noted that shipments to other markets were stable, if not up slightly, month-over-month.

“Overall export momentum has weakened in recent months, but the solid year-on-year performance of exports in Korea – a bigger player in the semiconductor space – suggests that Philippine export growth should recover in the near term,” he said.

Philippine exports to South Korea totaled $265.23 million in May.

Meanwhile, PSA data showed that imports of raw materials and intermediate products, which accounted for 37% of total imports, rose 0.6% to $4.09 billion in May.

Imports of capital goods, which had a share of 25.6%, fell by 11.5% to $2.8 billion, while imported consumer goods rose by 0.4% to $2.14 billion.

In terms of import value, the top three commodity groups were electronic products ($2.15 billion); mineral fuels, lubricants and related materials ($1.85 billion); and transportation equipment ($891.7 million).

In May, China was the top source of imported goods, valued at $2.73 billion or 25% of total imports.

This was followed by South Korea ($989.6 million or 9.1% of the total), Indonesia ($972.15 million or 8.9%) and the United States ($748.19 million or 6.8%). — Beatriz Marie D. Cruz