Business

PHL surprises with 6.3% GDP growth

By means of Abigail Marie P. Yraola, Deputy Head of Investigation

THE PHILIPPINE ECONOMY excame in faster than expected the second quarter, because higher government spending and investments oFFdetermine ‘anemic’ household consumptionThis was evident from government data.

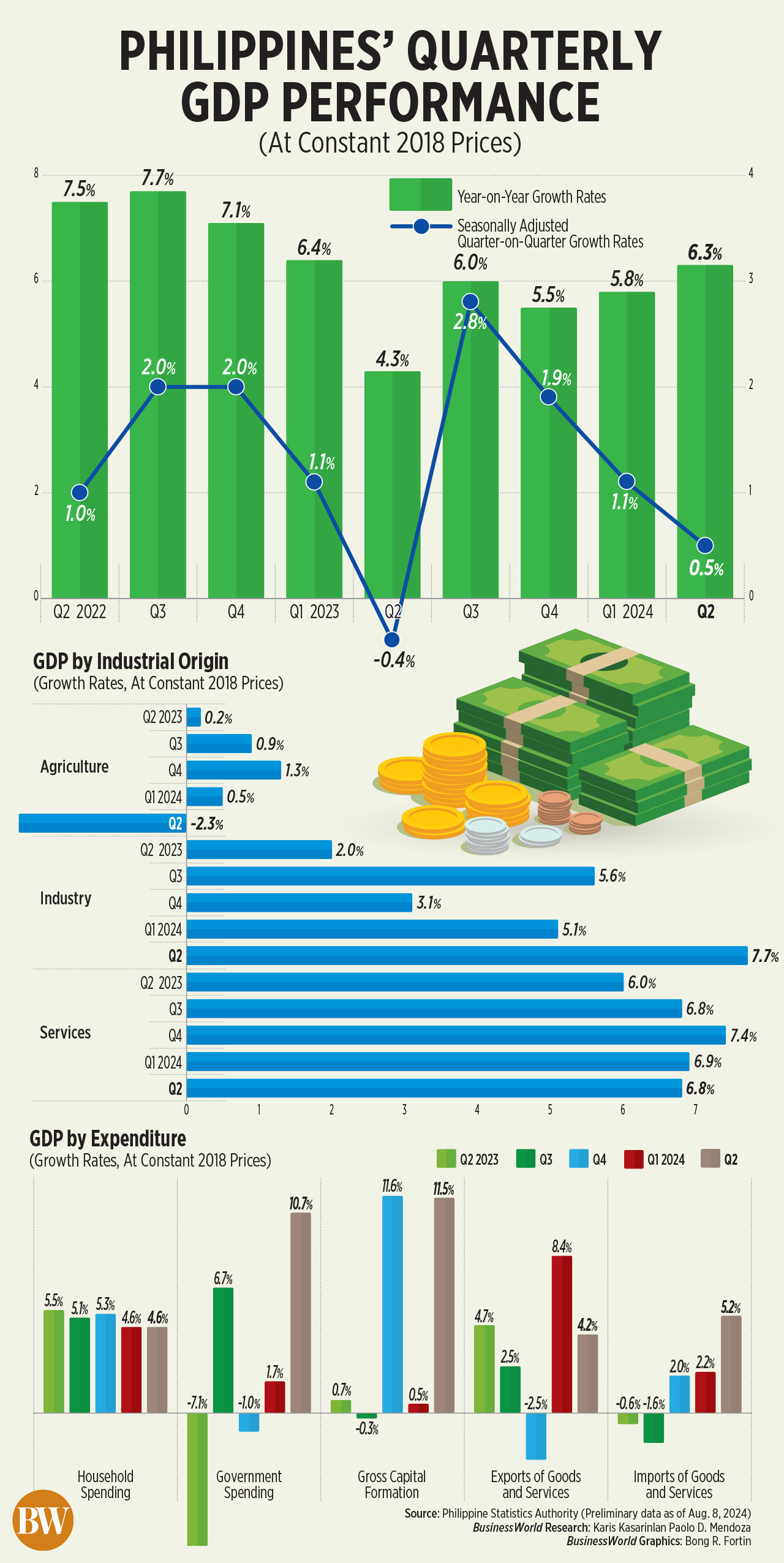

Preliminary data from the Philippine Statistics Authority (PSA) shows that gross domestic product (GDP) grew at an annual rate of 6.3% from April to June, the fastest in recent years. Ffive quarters or since the 6.4% in the Ffirst quarter of 2023.

This was stronger than the revised growth of 5.8% in the first quarter and 4.3% in the second quarter of 2023.

It also beat the average prediction of 6% in a Business poll of 19 economists last week.

On a quarterly, seasonally adjusted basis, the country’s GDP grew by 0.5%, up from 1.1%.

National Economic and Development Authority (NEDA) Secretary Arsenio M. Balisacan said the Philippines’ GDP print led to Asia’s best-performing economies in the second quarter.

At 6.3%, the Philippines’ GDP growth was the second fastest in the April to June period, behind Vietnam (6.9%). It was ahead of Malaysia (5.8%), Indonesia (5%) and China (4.7%).

“While these numbers are encouraging, our growth performance could have had an even greater impact on all Filipinos were it not for the highFand the interest rates the country has experienced,” Mr. Balisacan said during a news briefingFon Thursday.

For the FIn the first half, GDP growth averaged 6%, reaching the government’s target of 6-7% this year.

“In the second half (the economy) should grow [at least] 6% should be within that target range,” Mr. Balisacan said.

The main contributors to growth included construction (16%); wholesale and retail trade, repair of motor vehicles and motorcycles (5.8%), and financial and insurance activities (8.2%).

“On the demand side, the acceleration in GDP growth was driven by a significant increase in total investment of 11.5%, fueled by robust construction activities,” Mr. Balisacan said.

Gross capital formation, the investment component of the economy, grew 11.5% in the second quarter, but this was slower than growth of 0.5% in the previous quarter and 0.7% a year ago.

The public construction sector grew 21.8% in the second quarter, faster than the 12.1% a year ago, as the government ramped up infrastructure and rehabilitation projects. Private construction also rose 9.9%, faster than the 5.3% a year ago, while commercial construction increased 13.6%.

“Our impressive growth performance clearly shows that infrastructure is our way forward. We must build more, build better, and build faster so that Filipinos can reap the benefits of these high-impact projects as soon as possible,” Treasury Secretary Ralph G. Recto said in a separate statement.

Government spending rose 10.7%, faster than the 1.7% in the previous quarter and a reversal from the 7.1% contraction a year earlier. This was the fastest growth since the second quarter of 2022.

‘ANEMIC’ CONSUMPTION

Household final consumption, which makes up more than 70% of the economy, rose by 4.6% annually in the second quarter, a slowdown from 5.5% growth in the same quarter in 2023.

Mr Balisacan said household consumption expenditure remained “a bit anemic” in the second quarter.

“Growth is not as strong as you would expect… Which meant that the impact of the high inflation and high interest rates that were introduced months earlier, quarters earlier, are now being felt and are likely to continue,” he said.

According to the PSA, spending on health care, recreation and restaurants remained strong, but there was a decline in spending on clothing, footwear and home furnishings.

Miguel Chanco, chief economist at Pantheon Economics, said household spending fell 0.1% quarter-on-quarter, continuing the 0.2% decline in the first quarter.

“The main story from our perspective is that private consumption – the Philippines’ main driver – has entered a technical, albeit superficial, recession,” he said in a note.

“The main story from our perspective is that private consumption – the Philippines’ main driver – has entered a technical, albeit superficial, recession,” he said in a note.

Mr. Chanco said household spending is expected to remain subdued due to “deteriorating balance sheets and declining consumer confidence.”

“The only real bright spot in the second quarter GDP report was goods exports, which rose quarter-on-quarter for the first time in three quarters,” he said.

Exports of goods and services grew at an annual rate of 4.2% in the second quarter, a slowdown from growth of 8.4% in the previous quarter and 4.7% a year earlier.

Imports also grew at an annual rate of 5.2% between April and June, up from 2.2% in the first quarter and a reversal from the 0.6% contraction a year ago.

STRONGER THAN EXPECTED

“The stronger-than-expected GDP print was likely due to a faster growth pace for both the public and private construction sectors, as election-related expenditures have already begun well ahead of the May 2025 midterm elections,” said Bank of the Philippine Islands (BPI ). Economist Emilio S. Neri, Jr. said in an email.

However, Mr Neri noted that GDP data suggests growth for the second half and full year of 2024 is likely to fall below the government’s target for this year.

Shivaan Tandon, market economist at Capital Economics, said GDP growth picked up year-on-year on favorable base effects.

“The latest data suggests that after a year of resilience amid tight monetary policy and high inflation, domestic demand has now come under pressure and we expect this weakness to persist in the near term,” he said in a research note.

While falling inflation should support private consumption, Mr Tandon said the boost to real incomes would be offset by the slowdown in remittances.

Sunny Liu, chief economist at Oxford Economics, said GDP could grow 5.8% this year, an improvement from 2023 GDP growth of 5.5%.

“However, we remain wary of the potential real impact if recent volatility in global markets continues. There are downside risks to our forecasts,” she said in a research note.

Economist Aris D. Dacanay of HSBC ASEAN (Association of Southeast Asian Nations) said in a research note that GDP growth was in line with expectations, but private demand remained weak.

“Consumers may still have to reduce their spending due to the impact of high inflation, while private investors are likely to postpone some of their investment projects due to high interest rates,” he said.

TO CUT OR NOT

Meanwhile, ANZ Research economist Arindam Chakraborty and head of Asia Research Khoon Goh said investment growth will be the main driver of growth this year as external demand is unlikely to be robust.

“Overall, we don’t think Q2 and July GDP are inF“These data together justify a rate cut at next week’s policy meeting,” they said.

Inflation accelerated to a nine-month high in July, from 3.7% in June to 4.4%, exceeding the BSP target of 2-4%.

On the other hand, BPI’s Mr Neri said the likelihood of a rate cut on August 15 has increased slightly due to the GDP print.

“If that doesn’t happen in August, they can do an off-cycle reduction in early September or at their scheduled meeting in October [if monthly consumer price index] prints are decreasing compared to prints in July and August,” said Mr. Neri.