Business

PHL’s ongoing transition to a cashless society

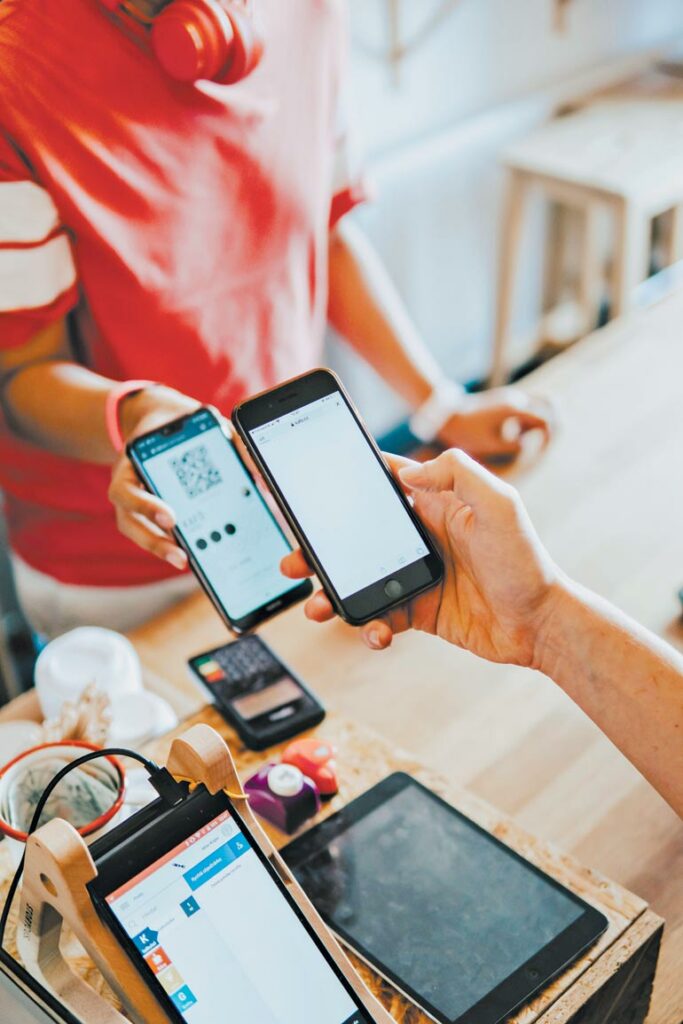

In a country with a strong digital presence, many Filipinos have incorporated digitalization into their lifestyle. Clear evidence of this is the increasing adoption of digital payments among individuals and businesses, paving the way for a cashless society.

In view of the country’s transition to a “cash-lite” society, the Bangko Sentral ng Pilipinas (BSP) has effectively shifted retail payments to digital channels, paving the way for more businesses to join the new revolution of digital payments and banking. Cash payments, including cards, mobile wallets and QR codes, continue to play an important role in the growth of digital payments in the country.

BSP Vice Governor Mamerto E. Tangonan previously noted that the use of digital payments has reached its peak during and after the coronavirus disease 2019 (COVID-19) pandemic. He noted that digital retail payments started at 1% in 2013, then rose to a 42.1% share in 2022 and finally reached the 50% mark in 2023.

In 2022, the BSP reported that the total transaction volume reached 4.85 billion, of which 2.04 billion were through digital platforms. The report also states that the main drivers of this growth are payments to merchants, person-to-person transfers, salaries and wage payments.

Adding to this, a recent survey by Visa found that most Filipinos are not only familiar with contactless cards but also use them for transactions. The data shows that digital payments are seeing increasing responses across age groups, with 55% using QR codes and 32% opting for contactless cards.

Looking at these figures, the progress of digital payments in the country looks positive, opening up opportunities for easier access to financial services.

Global management consultancy McKinsey & Company said the rise of digital financial services and mobile wallets are leading the way to such success. With all the buzz of fintech innovation, industry players are moving quickly to bring digital banking and services across sectors, especially in rural areas and often overlooked sectors where access to financial services can be difficult.

McKinsey highlighted that the country’s banking population is expected to reach 85 million by 2030, representing a significant increase of 30% from 65 million in 2022. This growth is fueled by its tech-savvy customer base, which is actively seeking innovative financial services.

Moreover, according to Visa’s recent research, younger generations are the ones driving the growth of cashless or digital payments in the country. The data showed that mobile wallets lead the way, being used in 87% of transactions, while contactless payments account for 70% of transactions. The survey also found that 78% of mobile wallet users scan QR codes, while 38% pay via QR codes.

Going cashless is not only useful for local transactions, but also for purchases abroad. For example, to ensure a hassle-free trip, many Filipinos are opting for digital payments or cashless transactions. Visa has reported that 55% of Filipino consumers use cash payment; and now QR codes are catching the attention of Filipinos even while traveling.

The trend of using contactless payments in transactions and in stores has led to a significant number of Filipinos (43%) carrying less cash in their wallets as most establishments and services have become the biggest users of digital payments in recent years.

To accelerate the adoption of digital payments in the country, initiatives are being seen from the public sector. For example, Bills Pay PH is a simplified platform that allows users to pay their bills. This initiative targets all Filipinos and improves access to financial services more easily. QR PH, a national standard for quick response codes, enables merchants and consumers to conduct digital transactions smoothly and easily. Furthermore, the Paleng-QR PH program maximizes the use of QR codes as digital payments in public markets and tricycle interchanges.

Boost from digital banks

With such steps towards digitizing payments and transactions over the years, the days of carrying around wads of cash are indeed over as Filipino consumers fully embrace the cashless society. And digital banks are seen to further promote this transition.

In the recent 5e Regional Macroeconomic Conference Series, Maria Lourdes Jocelyn S. Pineda, vice president of the Digital Bank Association of the Philippines, emphasized that going digital is necessary for the industry, especially as the country fully embraces digital transactions.

Following the increased use of digital payments in recent years, the BSP has announced digital banking as a new banking category. Thanks to its user-friendly features, 24/7 operations and higher interest rates, digital banking sets a new standard for banking in the digital age. The country currently has six BSP-licensed digital banks, namely Maya Bank, GoTyme, Overseas Filipino Bank, Tonik Bank, UnionDigital and UNOBank.

Because technology is at the core of digital banks, cybersecurity measures are essential to protect consumers. To achieve this, digital banks have made strides in strengthening their cybersecurity practices, risk management and policies. Thanks to these developments, digital banks can expect a significant increase in their loan portfolios this year.

“We are always vigilant and we invest heavily in technology because we cannot afford to make mistakes,” said Ms. Pineda.

The cashless landscape will indeed continue as more Filipinos switch to cash payments and industry players are optimistic about it.

“Filipinos are becoming increasingly comfortable with cash payments, and we are confident they will continue to embrace new innovations in the digital payments landscape,” Jeff Navarro, country manager for Visa, said in an article on Visa’s website discussed the rise of cash transactions. . — Angela Kiara S. Brillantes