Business

Production growth in May slows down

By means of Beatriz Marie D. Cruz, News reporter

Factory activity in the Philippines grew at a slower pace in May as employment for the Philippines fell Ffirst time inside FFive months, S&P Global said Monday.

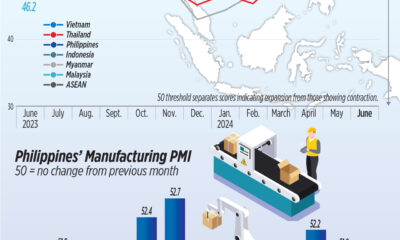

The S&P Global Philippines Manufacturing Purchasing Managers’ Index (PMI) came in at 51.9, down slightly from 52.2 in April, indicating a “modest improvement” in factory activity.

A PMI reading above 50 indicates improved business conditions compared to the previous month, while a reading below 50 shows the opposite.

“The [Philippine] The manufacturing sector continued to report further gains midway through the second quarter, with new growth continuing orders and output,” Maryam Baluch, economist at S&P Global Market Intelligence services, the report said.

“However, companies struggled to maintain their workforce, resulting in job losses the first time in five months.”

The Philippines’ PMI reading remained the second fastest among the four Association of Southeast Asian Nations member states in May, behind Indonesia and Myanmar (52.1) and ahead of Vietnam (50.3).

PMI data for Thailand and Malaysia were not available at the time of publication.

For the Philippines, S&P Global found that overall sales growth continued in May, although it “decelerated fractionally” from April onwards.

“Nonetheless, further improvement in underlying demand trends and a growing customer base have helped extend the current increase to nine consecutive months,” the report said.

New export orders rose for the fourth month in a row and “at the most pronounced pace since December 2016,” S&P Global said.

“The growth in new sales from abroad was widely attributed to improved demand trends in key export markets and new customers,” it added.

Strong sales growth prompted factories to increase production, S&P Global said. Factory production grew at its fastest pace yet this year.

Even as manufacturing grew, S&P Global noted that manufacturing jobs fell for the first time since December 2023.

“The pace of decline was the fastest in nine months FIRMS attributes this largely to voluntary departures,” the report said. “However, backlogs continued to decline, indicating that many businesses were able to cope with the continued increase in demand.”

Meanwhile, manufacturers continued to increase inputs for the sixth month in a row. Pre-production inventories also rose at the fastest pace in thirteen months.

“Stocks of FFinished goods also rose in May, although the pace of growth was the weakest in the current three-month expansion streak,” S&P Global said.

Input prices fell for the FThe first time since April 2020, when some companies said they had switched to ‘competitively priced’ suppliers.

“However, charges continued to rise, indicating that FIrms wanted to maintain and increase their margins,” Ms Baluch said.

S&P Global said Philippine manufacturers were hopeful of improved demand and plan to expand operations and launch new products. It noted that expectations for the 12-month US manufacturing outlook rose Ffirst time inside Ffive months.

“Moderate inflationary pressures and a further improvement in the demand picture indicate that economic growth is likely to continue in the coming months. Reflecting the positive sentiment, optimism rose to its highest level in nine months,” said Ms Baluch.

PMI measures a country’s manufacturing activity based on the weighted average of Ffive indices — new orders (30%), production (25%), employment (20%), supplier delivery times (15%) and purchasing inventories (10%).

“The recovery in external demand can still be attributed to the cyclical recovery in global electronics trade. The slower hiring may be a one-time eventFF. Prints for the coming months may improve in July,” Emilio S. Neri, Jr., chief economist of the Bank of the Philippine Islands, said in a Viber message.

Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message that the strong external demand can be traced to the “continued recovery in key export markets, weakening the Philippine peso, making exports more competitive, the growth of digitalization and e-commerce driving demand for electronics, a recovery in global travel and tourism, and generally a better economic outlook.”

However, supply chain bottlenecks, rising shipping costs and a possible slowdown in key markets could hamper growth in the manufacturing sector in the coming months, Mr Roces added.

Ruben Carlo O. Asuncion, chief economist of Union Bank of the Philippines, Inc., said some manufacturers may not have the capacity to meet the rising demand.

“Some companies may not have been able to respond by employing more people and meeting the higher demand,” he said in a Viber message.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said in an email that the slower manufacturing activity in May can be partly attributed to the heat wave that led to some reduction in business activities, as well as tight power supplies.