Business

Remittances increased by 3.1% in April

By means of Luisa Maria Jacinta C. Jocson, News reporter

CASH TRANSFERS of Overseas Filipino workers (OFWs) rose 3.1% year-on-year in April, the Bangko Sentral ng Pilipinas (BSP) said on Monday.

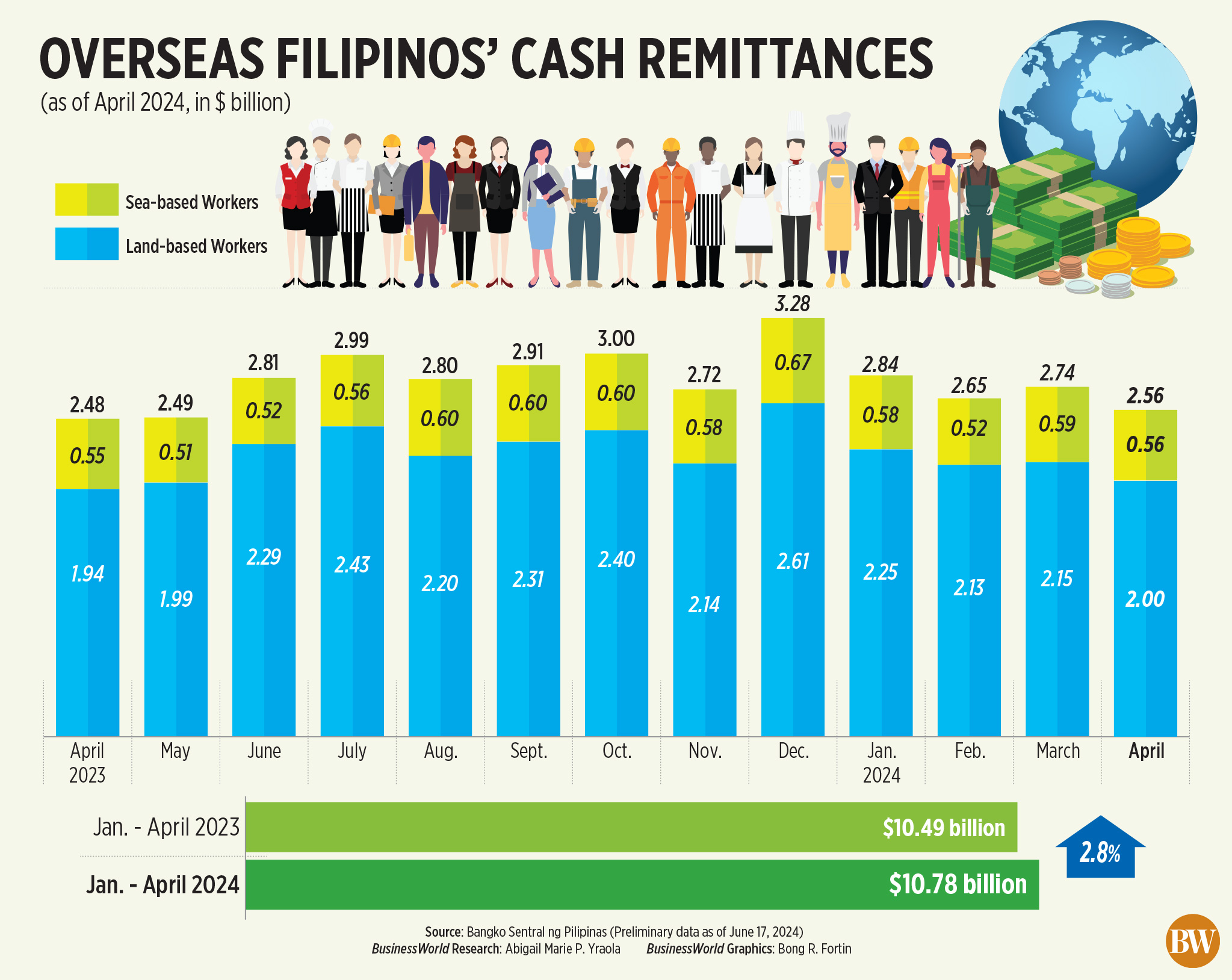

Central bank data shows that remittances through banks rose to $2.562 billion from $2.485 billion a year ago.

However, it was the lowest level in 11 months or since $2.494 billion in May 2023.

Month on month, remittances were 6.4% lower than the $2.738 billion in March.

Annual growth in remittances was also the fastest since 3.8% in December.

“The increase in remittances in April 2024 was due to the growth in receipts of both agricultural and maritime workers,” the BSP said.

Money sent home by land-based workers rose 3.2% to $2 billion, while remittances from offshore workers rose 2.8% to $560 million.

From January to April, remittances rose 2.8% to $10.782 billion, compared to $10.487 billion a year ago.

“The growth in remittances from the United States, Saudi Arabia and Singapore mainly contributed to the increase in remittances in the first four months of 2024,” the report said.

The United States accounted for 41.1% of total remittances in the first four months. It was followed by Singapore (7%), Saudi Arabia (6%), Japan (5.1%) and the United Kingdom (4.5%).

Other sources of remittances included the United Arab Emirates (4.2%), Canada (3.2%), Qatar (2.8%), Korea (2.7%) and Taiwan (2.7%).

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said the continued growth in remittances is a “bright spot” for the economy.

“Further reopening of the economy towards greater normality also led to an increase spending, with pent-up demand or even revenge spending by OFW families,” he said in a Viber message.

Mr Ricafort said the recent depreciation of the peso may have reduced the need for OFWs to send more remittances in US dollars and other foreign currencies.

In April, the peso closed at the P57 level for the Fthe first time since November 2022. The currency devalued further in May to the level of P58 per dollar.

“Since OFW remittances yield more peso equivalent for every US dollar sent, (this is) a source of comfort to OFWs and their families and dependents, especially when dealing with higher prices and interest payments since 2022 for any repayment or form of debt payment ”, said Mr Ricafort.

Meanwhile, BSP data showed that personal remittances from OFWs also rose 3.1% to $2.859 billion in April from $2.773 billion a year ago.

Remittances from workers with contracts of more than one year rose 3% to $2.16 billion year-on-year, while remittances sent by OFWs with contracts of less than one year rose 3.6% to $620 million.

In January and April, personal remittances rose 2.8% to $12.01 billion.

“In the coming months, single-digit or modest growth in OFW remittances will continue as OFW families continue to face relatively higher prices locally, requiring more remittances to be sent,” Mr Ricafort added.

The BSP expects remittances to grow 3% this year.