Finance

Should You Buy the Post-Earnings Dip?

Palantir shares (NYSE:PLTR) then fell by about 16% its first-quarter earnings report, which prompts me to consider whether this downturn presents a buying opportunity. Notably, Palantir showed another quarter of solid revenue growth, promising customer base expansion and strong profitability metrics. That said, concerns remain about the stock’s high valuation. Therefore, despite my belief in Palantir’s long-term prospects as a shareholder, I remain neutral on the stock at this point and don’t believe the dip is worth buying.

Accelerating growth, driven by government and commercial customers

Palantir’s first quarter marked a period of accelerating growth, driven by solid performance in both the government and commercial segments of the company. Revenues totaled $634.4 million, up 20.8% year over year. This implies an acceleration from last year’s growth of 17.7% and the third consecutive quarter of consecutive accelerating revenue growth. Let’s take a closer look at both of Palantir’s first quarter segments to better understand what exactly drove this result.

Government revenue fueled by domestic acceleration and international expansion

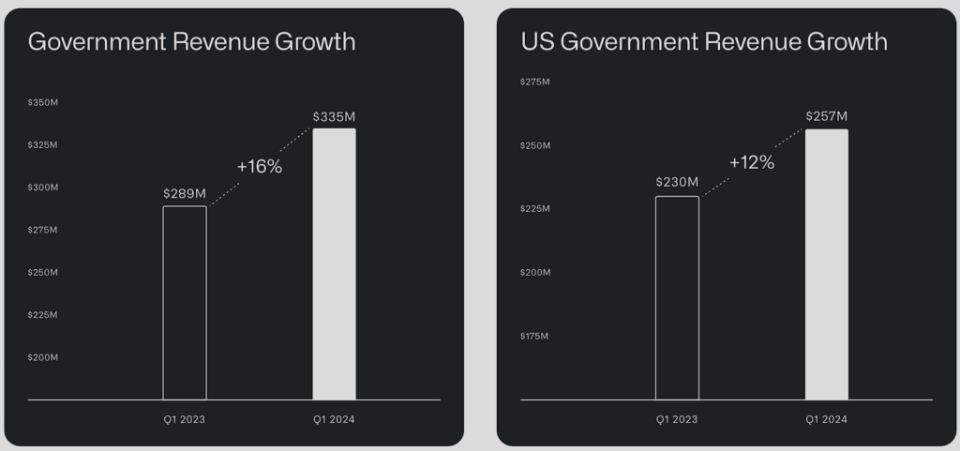

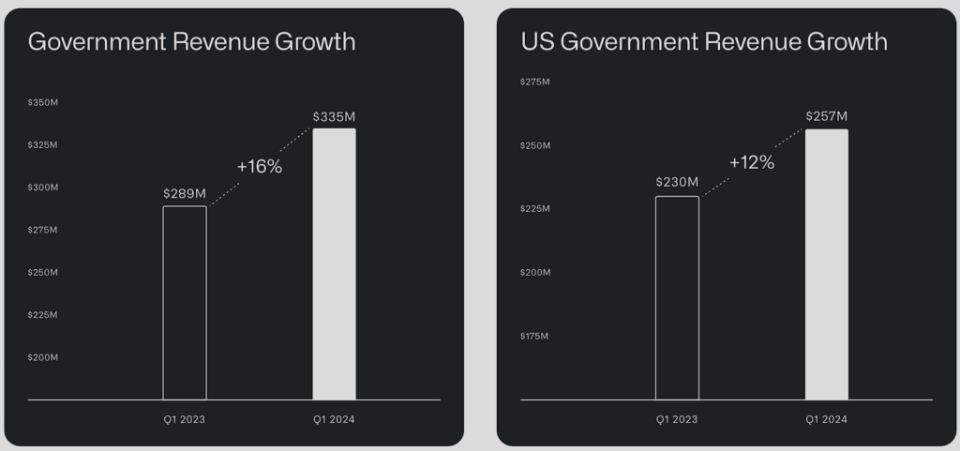

Starting with Palantir’s Government segment, which accounted for approximately 53% of the revenue mix in the first quarter, total revenue growth in this segment was 16%, at $335 million. This growth was mainly driven by an acceleration of sales in the domestic division and rapid international expansion.

Domestically, US government first-quarter revenue growth accelerated, up 12% year-over-year and 8% quarter-over-quarter to $257 million. This compared to a 3% quarter-over-quarter increase in the fourth quarter, with Palantir’s software becoming increasingly important to the US government in today’s volatile geopolitical environment. Palantir’s International Government division continued to grow the segment, with revenues increasing 33% to $79 million.

In a major milestone in the first quarter, the US Army awarded Palantir an exclusive prime contract worth more than $178.4 million to develop a next-generation targeting node as part of the TITAN program. This marks a historic moment for Palantir as it became the first software company ever to win a prime contract for a hardware system. This effectively positions Palantir to establish itself as a top supplier, comparable to giants like Lockheed Martin (NYSE:LMT) or Northrop Grumman (NYSE:NOC) in the field of weapons and space products.

Commercial revenues increase after rapid expansion of the customer base

Moving into Palantir’s commercial segment, revenues saw another notable increase, driven by increasing adoption of the company’s artificial intelligence (AIP) platform and solid customer base expansion.

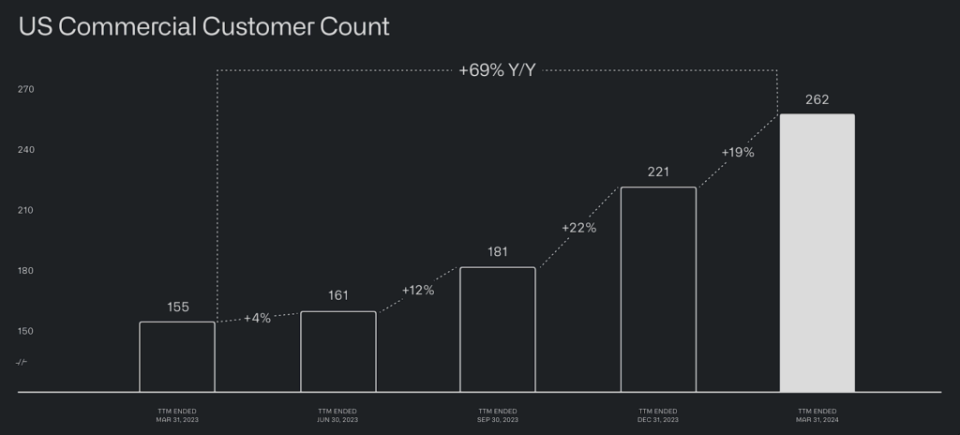

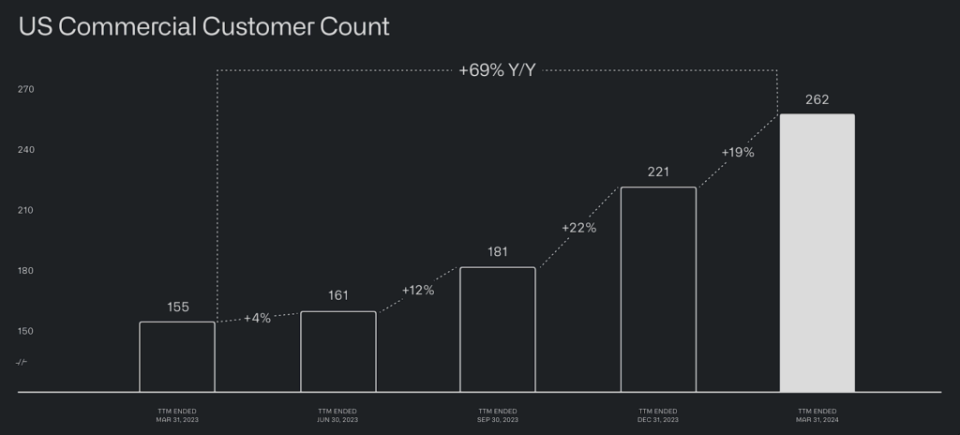

In an earlier update on PalantirI highlighted the critical role of Bootcamps in strengthening Palantir’s enterprise customer base. Palantir organizes these hands-on workshops to demonstrate the capabilities of its software, and in particular its AIP. Successful demonstrations should enable potential customers to realize the value proposition Palantir offers and potentially commit to a contract.

This strategy seems to be working extremely well for the company. In the first quarter, Palantir added 41 net new customers in the U.S. commercial segment (see image below). This marked a 69% increase in Palantir’s customer base year-over-year and 19% quarter-over-quarter. Palantir also registered a significant acceleration here, compared to the quarter-over-quarter growth of 8% in the first quarter of last year.

Profitability is improving rapidly, but valuation concerns remain

Palantir’s strong sales growth has gradually enabled the company to achieve better unit economic performance, improving profitability metrics. The company’s adjusted operating margin came in at 36%, compared to 34% in the previous quarter and 24% last year, marking the sixth consecutive quarter of expansion. It led to adjusted operating income of $226.5 million, an increase of 81% compared to last year. Additionally, Palantir’s adjusted free cash flow came in at $149 million, also delivering a remarkable 23% margin.

With additional cash flowing into Palantir’s balance sheet, the company ended the quarter with a record cash position of $3.87 billion while maintaining a debt-free status. Nevertheless, investors should still consider the underlying risks associated with Palantir’s current valuation, no matter how impressive its profitability numbers and robust financial position are.

Ultimately, Palantir still trades at about 65 times this year’s expected earnings per share (EPS) and 54 times next year’s expected earnings per share (EPS). The acceleration in revenue growth and continued margin expansion could allow the company to grow to these multiples sooner or later. Still, Palantir’s investment scenario offers a significantly lower margin of safety compared to last year’s levels, even after the earnings dip – and this comes from a shareholder with high expectations.

Is PLTR Stock a Buy According to Analysts?

Current sentiment on Wall Street appears bearish, even after Palantir’s share price drop after earnings reports. According to Wall Street, Palantir Technologies has a consensus rating of Moderate Sell, based on two Buys, five Holds, and six Sells in the last three months. At $19.67, the average PLTR stock price target suggests a downside potential of 4.5%.

If you’re wondering which analyst to follow if you want to buy and sell PLTR stock, the most profitable analyst covering the stock (over a one-year period) is Bank of America’s Mariana Perez (NYSE:BAC) Securities, with an average return of 61.42% per rating and a success rate of 92%. Click on the image below for more information.

The takeaway

In summary, Palantir’s first quarter report reflects continued acceleration in revenue growth, evident in both the government and commercial segments. As governments increasingly rely on Palantir’s software in a volatile geopolitical environment and corporate customers gradually become aware of AIP’s capabilities, Palantir’s long-term prospects appear more promising than ever.

However, ongoing concerns about the stock’s valuation cannot be overlooked. While Palantir shows promise for long-term investors, and I am one of them, a neutral stance on the stock seems reasonable given its high valuation multiples. Accordingly, if I wanted to take a position in Palantir, I wouldn’t buy the stock during this dip. I’d rather wait for a potentially more attractive entry point.