Business

Stocks may rise on inflation data, with the peso at the center

PHILIPPINE STOCKS may rise in the coming days due to continued bargain hunting following last week’s sharp market decline, with the peso and the release of Philippine May inflation data the main trading drivers.

On Friday, the Philippine Stock Exchange index (PSEi) rose 0.96% or 61.35 points to close at 6,433.10, while the broader all-stock index rose 1.11% or 38.30 points to end at 3,463.87.

However, week on week, the PSEi fell by 2.82% or 186.79 points from the closing level of 6,619.89 on May 24.

“Last week we saw bearish technical developments in the local market. The market fell in the first four trading days, exceeding the 200-day exponential moving average. Moreover, it hit a new low this year at 6,341.54. The MACD (moving average convergence/divergence) line has crossed below the signal line, implying bearish momentum,” said senior research analyst Japhet Louis O. Tantiangco of Philstocks Financial, Inc. in a Viber message.

There could be more bargain hunting in the market this week as the PSEi remains at attractive levels, Mr Tantiangco said.

“However, its direction is still expected to depend on upcoming data. “The local currency, which has been a concern over the past week, poses downside risks to the stock market if it continues to weaken,” he said.

“Investors are also expected to pay attention to May inflation figures in the Philippines. Inflation pressures that are faster than the previous month’s 3.8%, especially inflation that exceeds the upper limit of the government’s target of 2-4%, could also weigh on market sentiment. Investors can also look to our upcoming April labor market data for clues about the strength of our local economy,” said Mr. Tantiangco.

The Philippine Statistics Authority will release May inflation data on Wednesday (June 5) and preliminary April Labor Force Survey results on Thursday (June 6).

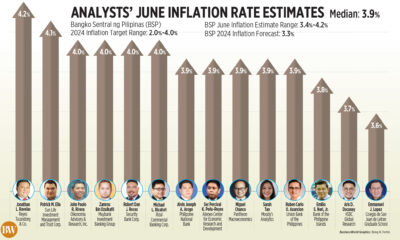

a Business a poll of 16 analysts yielded an average estimate of 4% for headline inflation in May, within the Bangko Sentral ng Pilipinas (BSP) forecast of 3.7-4.5% for the month.

If realized, this would increase from 3.8% in April, but slower than the 6.1% in the same month a year earlier. This would also be at the high end of the central bank’s annual target of 2-4%.

Mr Tantiangco said the PSEi could continue to test the 6,400 support level this week.

Meanwhile, Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., estimated key support for the PSEi at 6,360 and major resistance at 6,560 from 6,610.

For its part, 2TradeAsia.com placed the immediate support of the PSEi at 6,200-6,300 and the resistance at 6,600.

The May inflation data could provide hints about the BSP’s future policy path, the report said in a market note.

“The consensus at the start of the year predicted around two to four rate cuts of 25 basis points from mid-2024. So far these have been zero. Optimism has largely evaporated and is reflected in valuations,” the online broker added. — RMD Ochaaf