Business

Survey: BSP will cut interest rates by 25 basis points on August 15

By means of Luisa Maria Jacinta C. Jocson, Reporter

THE BANGKO SENTRAL ng Pilipinas (BSP) may cut interest rates for the first time in almost According to a majority of analysts surveyed, the policy was held at the policy-setting meeting four years ago this week Business world.

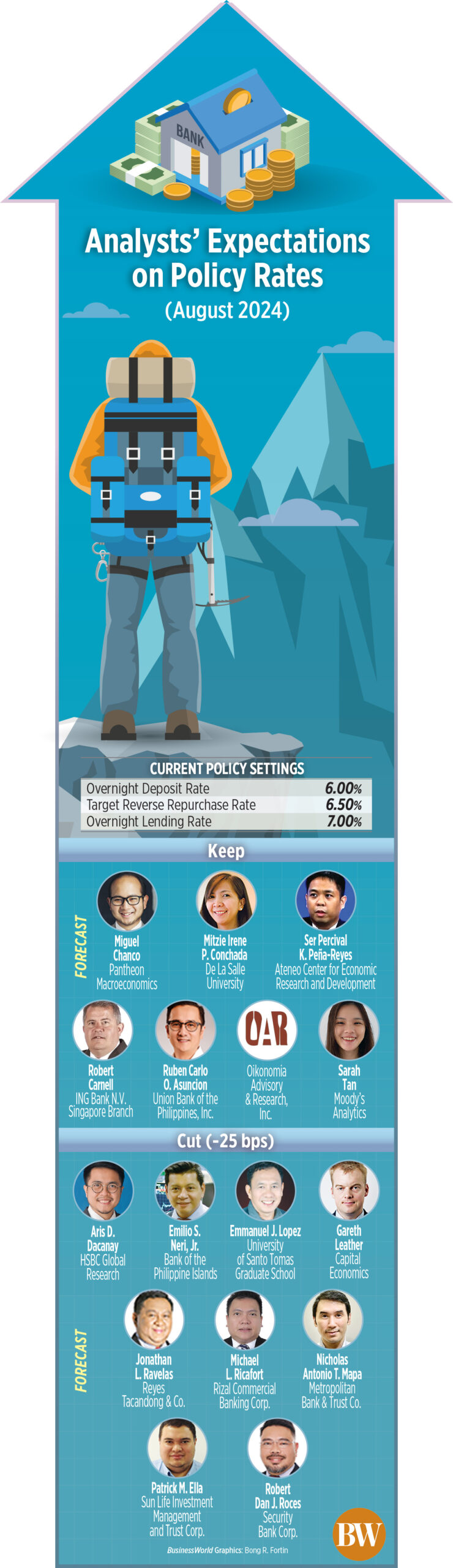

A Business world a survey conducted last week showed that nine out of sixteen analysts surveyed expect the Monetary Board to implement a 25 basis point (bp) interest rate cut at its meeting on Thursday (August 15), bringing the target reverse repurchase (RRP) rate to 6 .25% from the current 17-year high of 6.5%.

On the other hand, seven others expect the BSP to keep interest rates stable this week.

The last time the BSP cut rates was in November 2020, when it made a 25 basis point cut and raised the policy rate to 2% to support economic recovery during the coronavirus pandemic.

From May 2022 to October 2023, the BSP increased borrowing costs by 450 basis points.

Analysts said the central bank is likely to take second-quarter gross domestic product (GDP) growth figures into account.FHousehold spending was “anemic” while interest rates were high and interest rates were risingFlat.

“We expect the BSP to reduce the recommended retail price by 25 basis points on August 15. We believe the BSP has taken note of the components of GDP growth in the second quarter, which indicate continued weakness in household consumption demand and continued weak performance in the private construction sector,” said Bank of the Chief Economist of the Philippine Islands, Emilio S. Neri, Jr.

Philippine GDP grew 6.3% in the second quarter, faster than 5.8% in the previous quarter and 4.3% a year ago. This was also the fastest growth rate in the Netherlands Ffive quarters or since 6.4% in the Ffirst quarter of 2023.

In the second quarter, household consumption also slowed to 4.6%, compared to 5.5% a year ago. Private consumption represents about three-quarters of the economy.

“We expect the BSP to cut rates by 25 basis points at the August 15 monetary policy meeting, driven by several factors. While GDP growth in the second quarter was strong year-on-year, quarter-on-quarter growth of 0.5% fell well below the trend of 1.5%, indicating waning momentum,” said Robert Dan J. Roces, chief economist of Security Bank Corp.

On a seasonally adjusted basis, GDP grew by 0.5% in the second quarter, a slowdown from 1.1% in the previous quarter.

“The decision remains balanced with strong annual GDP Fthe numbers and inflation are rising, making the upcoming meeting a tight battle between maintaining current interest rates and making the expected cut. The outcome will be extremely meaningfulFThis is of great importance for the economic prospects of the Philippines,” Mr. Roces added.

Nicholas, chief economist of Metropolitan Bank & Trust Co Antonio T. Mapa said BSP Governor Eli M. Remolona Jr. has previously indicated that it could cut spending sooner than the US Federal Reserve.

“If Mr. Remolona takes a forward-looking approach to monetary policy, we could see the BSP implement a rate cut as early as next week,” he said in a report.

“Having implemented an aggressive tightening cycle in the face of similar US Fed rate hikes and domestic inflation, as well as an ’emergency’ rate hike last October, Mr Remolona appears eager to raise rates as soon as possible decrease,” he said. added.

KEEP PRIZES?

On the other hand, some analysts said they expect the BSP to keep interest rates stableFThe prospects are somewhat bleak.

If the BSP holds on August 15, it would be the seventh consecutive meeting in which the central bank leaves rates unchanged.

“With GDP growth optimistic on an annual basis but sharply lower quarter-on-quarter, with a technical recession ‘only’ for consumption, the BSP could postpone its rate cut on the 15th.eas policymakers will prioritize the return of disinFlater this year,” Ruben Carlo O. Asuncion, chief economist at Union Bank of the Philippines, Inc., said in an email.

Household spending fell 0.1% quarter-over-quarter, extending the 0.2% decline in the US Ffirst quarter.

National Economic and Development Authority Secretary Arsenio M. Balisacan said last week that GDP growth was not as strong as expected amid the impact of increased economic growth.Fand high interest rates.

Sarah Tan, an economist at Moody’s Analytics, said the BSP can hold its ground amid concerns about thisFDevelopment could possibly accelerate again.

“Even though we expect July to already arriveFlation read to be the peak, the prospects for Philippine inFLately the situation has become a bit murkier. The damage caused by Typhoon Carina could continue in the coming months and electricity prices are also expected to rise,” she said in an email.

Head inFInflation accelerated to a nine-month high of 4.4% in July. The July print also ended seven months in a rowFsettlement within the central bank’s target bandwidth of 2-4%.

The first seven months head onFInterest rates averaged 3.7%, above the central bank’s annual forecast of 3.3%.

Mr Remolona said last week that it is “slightly less likely” to cut rates at the August meeting, while interest rate markets are “slightly worse than expected”.Flation print.

The central bank chief said they could consider cutting spending if growth is ‘unexpectedly weak’ and if it remains containedFExpectations point to a lower inFlation is progressing.

Mr. Asuncion expects the BSP to cut rates by October, in line with the Fed’s schedule.

“More broadly, the BSP is unlikely to leapfrog the US Federal Reserve. We expect that from the Fed FThe first rate cut will come in September, followed by the BSP in October,” Ms Tan added.

The Fed kept its policy rate at the same range of 5.25%-5.5% at the end of July as it had been for more than a year, but indicated that a rate cut could come as early as September ifFThe situation continued to cool, Reuters reported.

Economist Mitzie Irene P. Conchada of De La Salle University also noted other external developments that could push the BSP to leave interest rates unchanged.

“Given the recent developments (slowdown) in the stock market in major economies such as the US, I believe the BSP will maintain its interest rates on August 15. The potential recession in the US could hit developing economies such as the Philippines,” she said in an email.

OUTLOOK

Patrick M. Ella, an economist at Sun Life Investment Management and Trust Corp., said the central bank should be able to continue its easing cycle for the rest of the year.

“Any increase in inflation in July or even August should not distract from the BSP’s interest rate cut plan as itFThe trends in July and August are transient due to the weather changes,” he said.

HSBC economist for ASEAN (Association of Southeast Asian Nations) Aris D. Dacanay said the BSP could cut rates by a total of 50 basis points this year, bringing the benchmark rate to 6% by the end of the year.

“For 2025, we expect the BSP to ease monetary policy faster than the Fed, reaching the end of the 5% easing cycle by the third quarter of 2025,” he added.

Analysts also pointed out the possibility of an oFf-cycle interest rate reduction.

“An off-cycle rate cut, if the Fed initiates rate easing in September, cannot be rejected either. We expect a modest cut of 25 basis points if the BSP continues with the oFinterest rate cut on the f cycle,” Mr. Asuncion said.

Mr Remolona previously said they were “always open” to off-cycle rate cuts.

The BSP recently provided an oFf-cycle movement in October 2023, when rates were raised by 25 basis points.

“Still, we won’t be surprised if BSP has one or two more waitsFlation prints before they decide to do their work Ffirst reduction of 25 bp. If that doesn’t happen in August, they could do an off-cycle reduction in early September or at their scheduled meeting in October,” Mr Neri said.

Mr. Mapa said the expected easing of the BSP could help “revive capital expenditure, which has been dominated by government spending lately.”

“If the BSP chooses to pause next week, we believe the rhetoric from both the BSP Governor and the Finance Minister suggests that rate cuts could be implemented through an ’emergency’ policy meeting, possibly once August arrives.FThe information will be reported in early September,” he said.

The remaining policy-setting meetings of the Monetary Board will follow after August 15 this year they are on October 17 and December 19.