Finance

The bad economic history of protectionism – Econlib

Protectionism is currently in vogue and is receiving support from both the left and the right. This isn’t the first time. While the popularity of protectionism waxes and wanes, it remains persistent. Every revival is caused by variations on the same argument, especially the fledgling industry argument.

The argument is simple: protectionism, through tariffs or subsidies, helps young industries grow by shielding them from foreign competition until they can compete on their own, ultimately leading to more economic growth than would otherwise have been the case. Like right-wing public intellectual Oren Cass recently summarized“The way America went from colonial backwater to this global industrial behemoth was not a free market and free trade. It was aggressive protection of our domestic market.”

The problem is that with each revival the same answer can be given: the increase in domestic production of sheltered industries is not worth the lost welfare of consumers. In fact, there is not a single part of Cass’s statement that is consistent with American economic history.

Let’s start with the last part of Cass’s commentary which talks about “aggressively protecting our domestic market.” Protectionism by definition should increase production in the protected industries. However, the magnitude of the increase is evident, as evidenced by often-cited case studies such as the steel industry in American economic history very small– smaller than what protectionists had promised when they initially called for tariffs. One reason this is the case is the rates can also increase the price of some inputs (such as capital inputs).which reduced productivity growth in the future. So there may have been a one-off increase in production, but the trend was ultimately slowed by the tariffs.

On the cost side, it is important to recognize that tariffs, by increasing the prices of certain inputs, also increase costs for industries that rely on these inputs. This is particularly damaging to industries engaged in intense international competition for export markets. Economic historian Douglas Irwin was able to demonstrate that this effect was one for postbellum America what was actually a 10% export tax. All this without taking into account the costs for the consumer. Returning to the case of steel protection (one of the often mentioned cases historically), we find that consumers are significantly worse off. In other words, the “aggressive protection” was a bad thing.

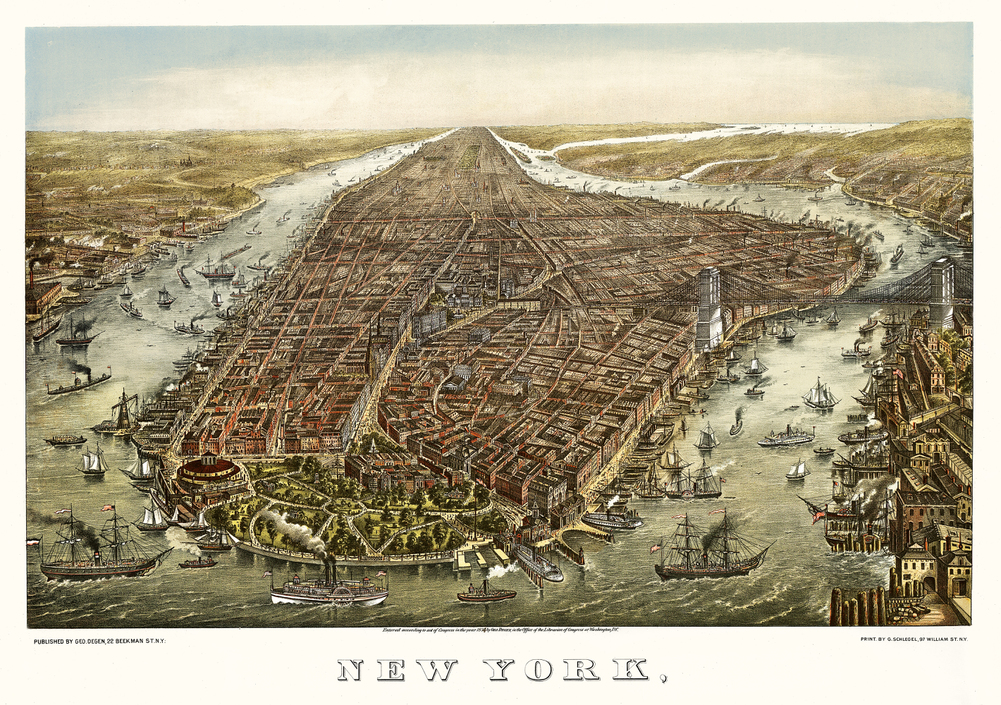

The first part of Cass’s comment, however, is even more seriously incorrect. America in the 18th century was far from a “backwoods country.” Economic historians such as Jeffrey Williamson and Peter Lindert have shown that by 1774 the average American colonist enjoyed a significantly higher income than the average Englishman– a fact consistent with the large numbers of immigrants moving to America. My own research further shows that America at least was 30% richer than the second richest region in America at the timethe French settlers in Quebec. It is remarkable that this period before 1774 coincided with what was essentially the “freest” trade era of American economic history. From 1760 to 1775, after the conquest of Canada, the North Atlantic Ocean functioned as a free trade zone encompassing America, Canada and Great Britain. Most protectionist legislation (such as the Navigation Acts) was either too small to matter or was widely ignored.

To make good on the claim he makes, Cass commits a common crime in economic history: focusing on growth in periods like 1790 to 1860 or 1865 to 1913 without considering the broader context. What these eras have in common is that they immediately followed highly destructive wars. For example, the American Revolutionary War erased America’s economic advantage over Britain, with incomes falling by about 20% as a result of the devastation. Likewise, the American Civil War had a devastating impact on the economy. Although both post-war periods saw impressive growth, this was largely catch-up growth: an accelerated economic recovery as the country rebuilt after the turmoil of the war. Cass and other protectionists often choose periods of protectionism and attribute any observed growth to their favored policies. This tactic, like a magician’s sleight of hand, is designed to blind the audience by masking the real factors at play.

The case for tariffs as a driver of economic growth has always been weak, and no amount of rebranding every few decades can change this fundamental flaw.

[Editor’s Note: Readers may also be interested in Geloso’s contributions to the Liberty Matters Forum, “Did the American Colonies Pay Too High Cost?” at the Online Library of Liberty.]

Vincent Geloso is an assistant professor of economics at George Mason University.