Finance

The best beautiful seven stocks?

Metaplatforms (META) is perhaps the best Magnificent Seven share at the moment and, in my opinion, offers a buying opportunity. The social media company’s ad revenue and user base continue to grow, and its valuation leaves plenty of room for error. The recent earnings report and the long-term performance makes me bullish on the stock.

Net income increases without job losses

Net Income of Meta Platforms has soared in recent quarters, prompting the social media giant to offer its first quarterly dividend this year. Profits continued to move in that direction, up 73% year-over-year in the second quarter.

Efficiency has contributed significantly to the company’s rising profits. That’s code for firing more employees, but there are no significant cuts this quarter. While the first quarter of 2024 saw a 10% year-over-year decline in headcount, the second quarter saw only a 1% year-over-year decline in this area.

Meta Platforms’ ability to retain employees while delivering robust net income growth could position it well going forward. One downside to laying off many employees is the loss of talent and the difficulty in replacing people who have left. It is an encouraging development that this disadvantage was less noticeable in the second quarter, while net profit continued to rise.

The number of daily active users continues to increase

Facebook, Instagram and WhatsApp are three of the top social media platforms – all owned by Meta. Although these platforms are well-known, they continue to attract new users. Meta Platforms reported a 7% year-over-year increase in the number of daily active users across its family of apps. Reflecting high user growth, the company ended the quarter with 3.27 billion daily active users.

A growing user base allows metaplatforms to offer more ad placements for corporations, small businesses, and influencers. These additional advertising spots can help Meta Platforms achieve higher revenue growth for years to come.

A good appreciation

Valuing a stock is an important part of the analysis after considering fundamental factors. Meta Platforms certainly delivers with a price-to-earnings ratio of 27.5x. There are many companies with a similar valuation that are not delivering 73% annualized net income growth to their investors.

Alphabet (GOOG) (GOOGL) is the only Magnificent Seven stock trading at a lower valuation, and its year-over-year net profit growth pales in comparison to Meta Platforms. Furthermore, Facebook’s parent company should continue to benefit from rising revenue and earnings, which should further reduce its price-to-earnings ratio.

It’s also good to note that Meta Platforms’ net income growth has outpaced its year-to-date stock gains. Shares of Meta Platforms are up 49% this yearwhich is supported by rising profits.

A dividend growth story in the making

Meta Platforms does not only focus on growth investors. The company’s recent dividend program now makes it an attractive choice for dividend growth investors. Although Meta Platforms only has a 0.37% yield, it has the financial growth and cash position to support double-digit annualized dividend growth for years to come.

Meta Platforms, for example, ended the quarter with $58.08 billion in cash. It has sufficient resources to support dividend increases over time, but Meta Platforms doesn’t even need to tap those reserves for the dividend program.

The company returned $1.27 billion to its investors in dividend payments this quarter. In the same quarter, Meta Platforms spent $6.32 billion on share buybacks. Shifting some of the buyback funds to dividend payments is enough to increase the dividend by at least 10% per year for several years, but it is better for tax purposes that the capital goes to stock buybacks.

While we’ve discussed Meta Platforms’ net income growth, the company’s total GAAP profit came in at $13.5 billion this quarter. That’s enough money to support high dividends for years to come. Meta Platforms therefore owns a dividend growth stock that outperforms the market, while significantly increasing the dividend over the years. That setup should attract many dividend investors as it becomes clearer.

Is META Stock a Buy According to Analysts?

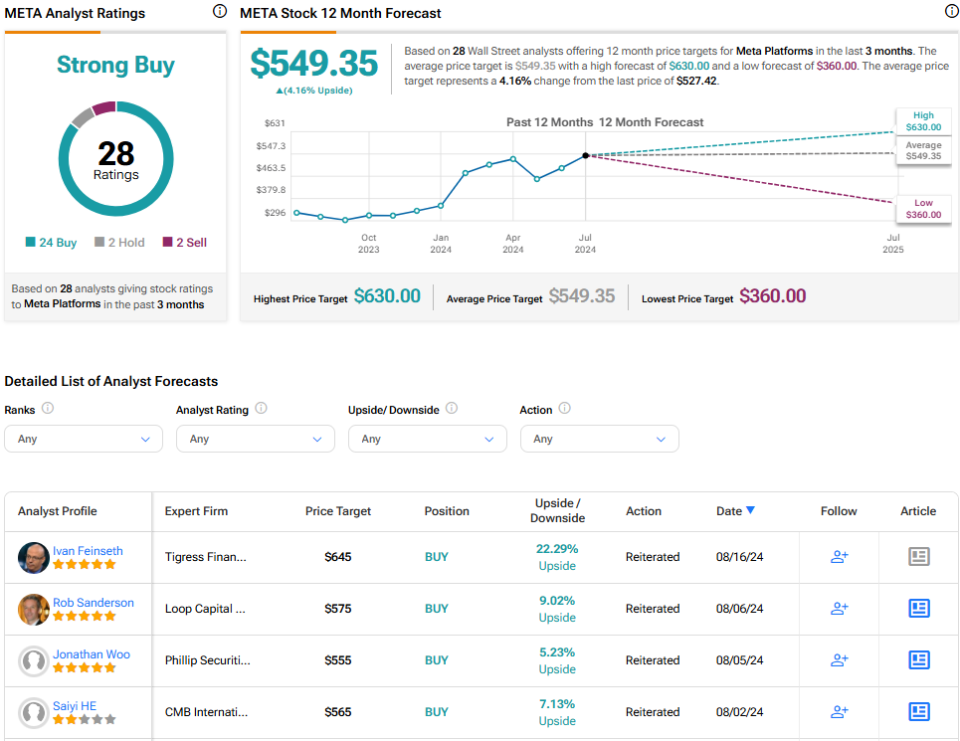

Meta Platforms is currently rated as a Strong Buy on TipRanks based on 24 Buy, two Hold, and two Sell ratings assigned in the last three months. The average META stock price target suggests an upside of 4.2% from current levels, but that’s a reflection of Meta Platforms’ recent stock gains. The top price target of $645 per share, assigned today, suggests the stock could gain another 22% from current levels.

View more META analyst ratings

The result of Meta Platforms Stock

Meta Platforms has delivered incredible revenue and net profit growth for its investors in recent quarters. Furthermore, rising profit margins have lowered the stock’s price-to-earnings ratio, even as it continued to outperform the market. Additionally, Meta Platforms continues to grow its user base, which will support higher revenues in the future.

It was encouraging to see Meta Platforms grow its net revenue by 73% year-over-year, while retaining the majority of its employees. It’s a sign that the company doesn’t have to rely on job losses to generate more profits. Many analysts believe that Meta Platforms can continue to deliver profits for long-term investors, and I agree with them.