Finance

The best energy stock to invest $1,000 in now

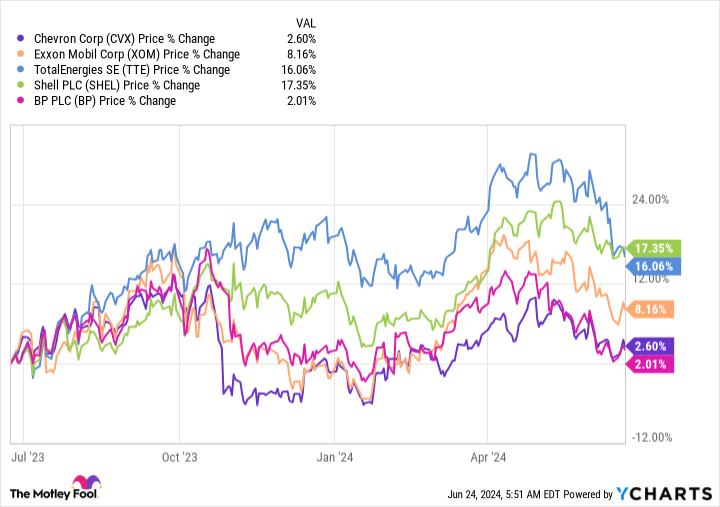

Chevron (NYSE:CVX) The stock has been at the bottom in terms of performance over the past year, with a gain of just 2%. ExxonMobil (NYSE:XOM) has increased by 8% during that period, and Shell (NYSE: SHEL) is up about 17%. But don’t count out Chevron when you look at the energy sector. In fact, this underperformance could make it the most attractive integrated energy stock you can buy today.

What’s Chevron’s problem?

Probably the only word that should be on investors’ lips right now is ‘why’. As in, why is Chevron lagging behind other integrated companies? energy companies with such a wide margin? A big part of the answer is that Chevron recently signed a purchase agreement Hes (NYSE: HES). But Hess is working with Exxon on a major capital investment in the oil sector. Exxon is trying to throw a wrench into the Chevron takeover by saying it can buy Hess out of that partnership.

That would make the Chevron acquisition much less desirable and could even lead to the deal being canceled. Another problem here is that figuring out who is right could lead to material delays and require legal wrangling, which would be expensive. This uncertainty has left a cloud over Chevron stock because investors generally don’t like uncertainty.

But that’s not all bad news, because Chevron has made a fairly large profit from it dividend yield of 4.2% compared to its closest competitor Exxon, which yields only 3.4%. And while Exxon has been raising its dividend for 42 years, it’s hard to complain about Chevron’s impressive streak of annual dividend increases, which has been going on for 37 years. Simply put, they are both reliable dividend stocks.

Chevron is better prepared for adversity

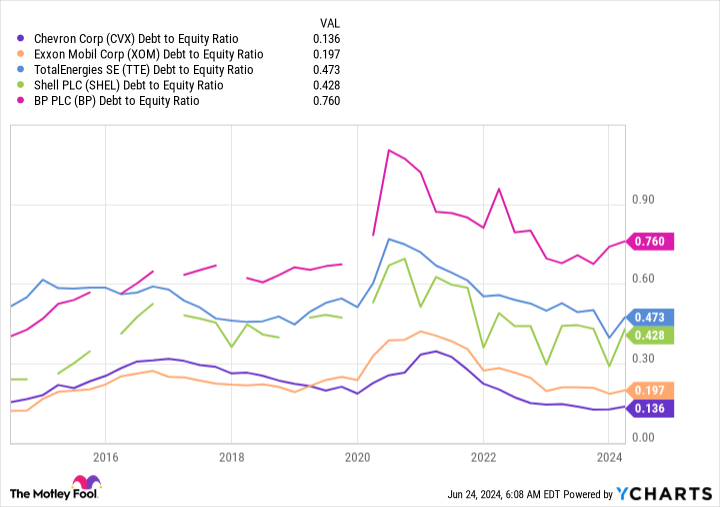

That said, while Exxon is not financially weak by any means, Chevron is currently in a better financial position than any of its closest competitors. Notably, Exxon’s debt-to-equity ratio is roughly 0.2 times, while Chevron’s is about 0.15 times. European colleagues make much more use of leverage. Chevron has the strongest balance sheet among integrated energy giants. Leverage is important because the energy sector is highly cyclical and sensitive to dramatic price fluctuations.

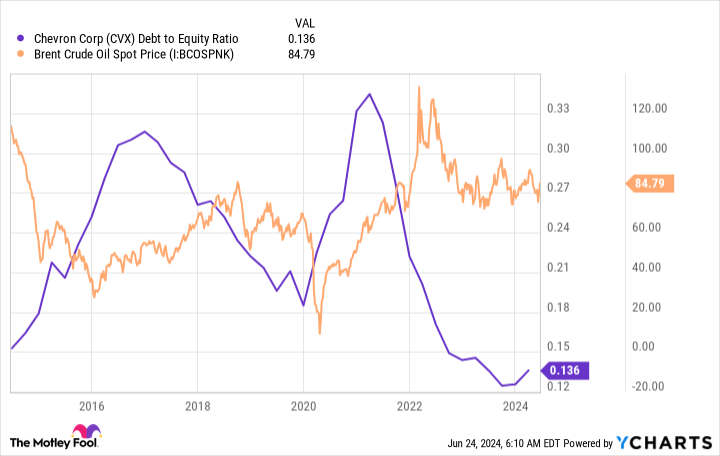

In short, when oil prices fall, companies like Chevron tend to take on additional debt to continue financing their businesses. In the case of Chevron and Exxon, that money is used to support the dividend. When oil prices improve, Chevron will pay off the debt it incurred so the country is prepared for the next downturn in the sector. The graph below shows this quite clearly.

So if you buy Chevron today, you will own the financially strongest company in the energy sector. And it has a more attractive return than its closest competitor, Exxon. But there’s one more factor to consider, and that’s the Hess deal. Even if Chevron doesn’t end up acquiring Hess, the company is big enough and financially strong enough that it could simply look for another company to buy. In other words, the negative sentiment here is largely based on a short-term problem.

Don’t be afraid to buy this industry laggard

Ultimately, Chevron is a well-managed energy company with a rock-solid financial foundation. Sure, there’s a very public negative hanging over the stock right now, but that won’t last forever, and Chevron is more than capable of addressing the problem. For investors who want to own energy stocks and think long term, Chevron is probably the best place today for $1,000 (or more).

Don’t miss this second chance at a potentially lucrative opportunity

Have you ever felt like you missed the boat on buying the most successful stocks? Then you would like to hear this.

On rare occasions, our expert team of analysts provides a “Double Down” Stocks recommendation for companies they think are about to pop. If you’re worried that you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you had invested $1,000 when we doubled in 2010, you would have $21,765!*

-

Apple: If you had invested $1,000 when we doubled in 2008, you would have $39,798!*

-

Netflix: If you had invested $1,000 when we doubled in 2004, you would have $363,957!*

We’re currently issuing ‘Double Down’ warnings for three incredible companies, and another opportunity like this may not happen anytime soon.

*Stock Advisor returns June 24, 2024

Ruben Gregg Brouwer has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Chevron. The Motley Fool has one disclosure policy.

The best energy stock to invest $1,000 in now was originally published by The Motley Fool