Business

The budget surplus will decline in April as expenditures rise

By means of Luisa Maria Jacinta C. Jocson, News reporter

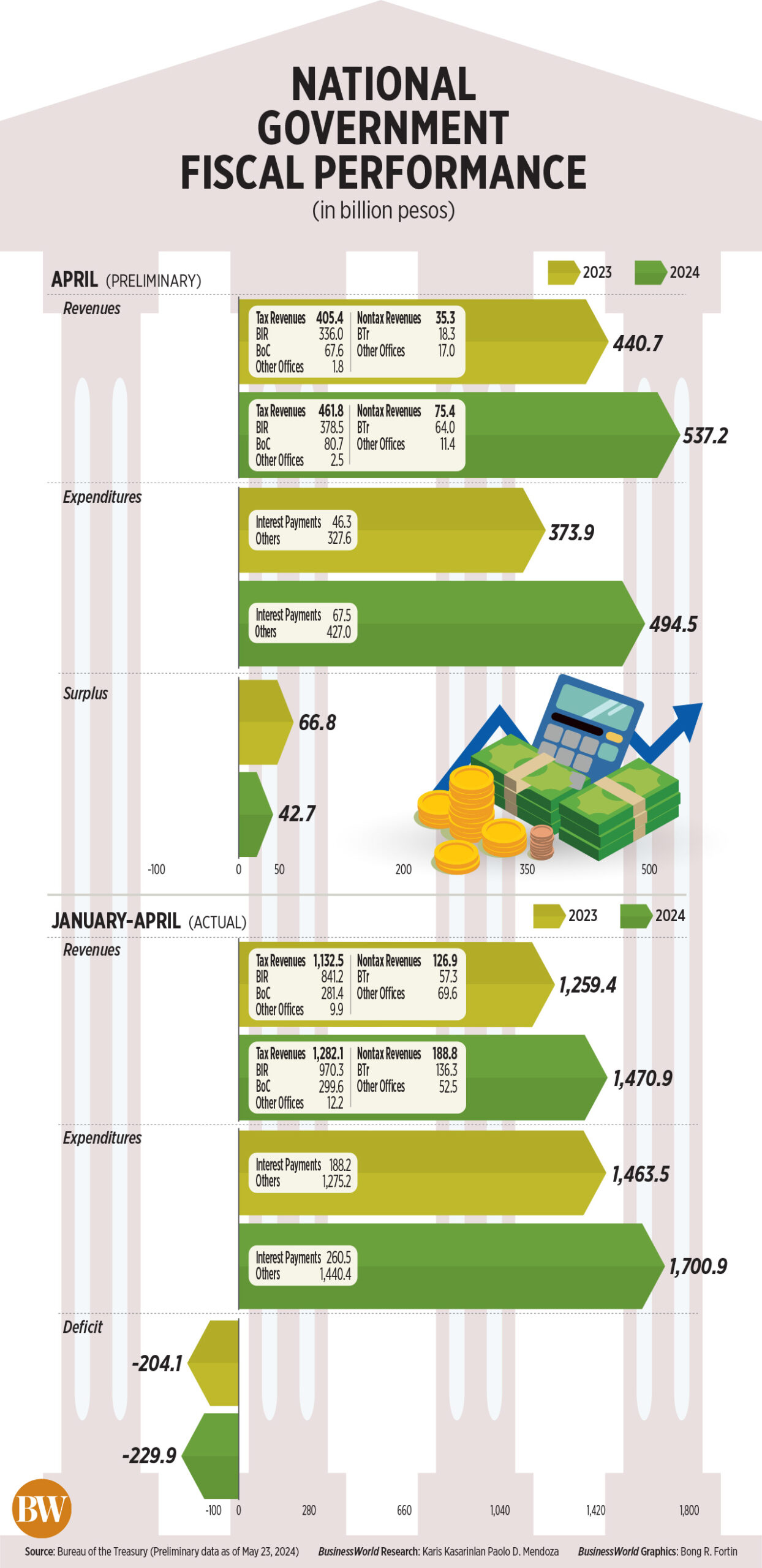

THE NATIONAL GOVERNMENT The budget surplus (NG) narrowed in April as expenditures rose 32%, more than the 22% increase in revenues, the Bureau of the Treasury said.

Data from the BTr shows that the NG’s budget surplus shrank by 36.03% to 42.7 billion euros in April, compared to the post-crisis surplus of 66.8 billion euros.in the same month a year ago.

Month after month, the budget balance moved from P195.9 billion to a surplusFIT in March.

State expenditures rose 32.25% to P494.5 billion in April from P373.9 billion in the same month in 2023.

“The expansion was driven by higher releases from the National Tax Allotment (NTA) and subsidies to Government Managed and Controlled Companies (GOCCs), including releases to Power Sector Assets and Liabilities Management Corp. (PSALM)… as well as the release of the 4e capitalization tranche of the Coconut Farmers Industry Trust Fund,” the BTR said in a statement.

Broken down, interest payments rose 45.93% to P67.5 billion in April from P46.3 billion in the same month in 2023.

“The increase was attributed to the timing of payments for domestic securities and the impact of foreign exchange Ffluctuations on foreign loans,” the BTR said.

Primary expenditures, which refer to total expenditures minus interest payments, rose 30.32% to P427 billion in April from P327.6 billion a year ago.

Meanwhile, government revenues rose 21.9% to P537.2 billion in April from P440.7 billion in the same month a year ago.

“The increase in tax revenues was fueled by double-digit growth in tax revenue collections, while the increase in non-tax revenues was driven by strong dividend payments,” the BTr said.

BTR data showed that tax revenues rose 13.9% to P461.8 billion in April, compared to P405.4 billion a year earlier.

Bureau of Internal Revenue (BIR) collections rose 12.65% to P378.5 billion, reflecting “overperformance in all major tax types compared to the same period in 2023.”

“Both income tax and value added tax (VAT) recorded double-digit growth as annual income tax returns and VAT payments for the first quarter of 2024 are due in that month,” it added.

The revenue of the Bureau of Customs (BoC). rose 19.52% to P80.7 billion in April.

Meanwhile, non-tax revenues more than doubled during the month from P35.3 billion in April 2023 to P75.4 billion.

Revenue generated by the BTR increased 250% to P64 billion in April. This comes as the Finance Department increased GOCCs’ mandatory dividend payments to the national government to 75% of their annual net profit in 2023, up from 50% previously.

Non-tax income from other offIce fell 32.89% to P11.4 billion from P17 billion last year due to the “one-time remittance of disposition proceeds from the Bases Conversion and Development Authority (BCDA) last year.”

Security Bank Corp. Chief Economist Robert Dan J. Roces said the budget surplus narrowed in April due to the “significant acceleration of government spending.”

“This suggests that the government has been actively investing in various programs and projects, which offers upside to Gross Domestic Product (GDP) in 2024; Government spending is expected to pick up further in the second quarter and beyond,” he said in a Viber message.

Mr Roces said the pace and scale of state spending will depend on “the priorities of the government, the absorptive capacity of the executive agencies and the overall Fiscal space.”

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said the surplus had been expected since the deadline for the FThe annual income tax return was submitted on April 15.

“However, the budget surplus is smaller than a year ago due to faster annual government spending, partly due to higherFHigher interest rates and the weaker peso exchange rate caused the government’s debt service costs to rise,” he added.

Headline inflation accelerated for the third month in a row from 3.7% in March to 3.8% in April.

The BSP maintained its benchmark interest rate at a 17-year high of 6.5% for a period of 17 years Ffirst consecutive meeting in May.

THE DEFICIT WILL BE INCREASED IN FOUR MONTHS

In the first four months of the year the NG’s budget deficit widened to P229.9 billion from the P204.1 billion gap a year ago, while revenues and expenditures grew at almost the same pace.

Revenues rose 16.8% to P1.47 trillion in the January-April period from P1.26 trillion a year ago.

Tax revenues rose 13.21% to P1.28 trillion, while BIR revenues rose 15.35% to P970.3 billion. BoC collections rose 6.47% to P299.6 billion.

Non-tax revenues rose 48.8% to P188.8 billion in the period from P126.9 billion a year ago.

BTR income more than doubled to P136.3 billion due to “higher income from interest on advances and the NG share of the Philippine Amusement and Gaming Corp.”Fit which contributed to the intensityFdividend payment made.”

Revenue from other offices fell 24.56% to P52.5 billion in the four-month period “mainly due to one-time transfers of the balance of the unconditional cash transfer program and BCDA of the Department of Social Welfare and Development.”

Meanwhile, government expenditures rose 16.22% to P1.7 trillion from P1.46 trillion in the same period in 2023.

Interest payments rose 38.39% to P260.5 billion, while primary expenditures rose 12.95% to P1.44 trillion.

“The increase in the budget for the current year theFicit… is the result of the expansionary fiscal policy and government consolidation eFfortresses aimed at supporting the economy,” Mr Roces said.

“While the theFOnce the situation has eased, the NG will try to strike a balance between providing necessary incentives and maintaining them Fiscal sustainability in the medium to long term,” he added.

BTR data also showed that the revenues of the NG eFfort ratio was 15.28% in the Ffirst quarter. This was better than the 14.58% in the same period a year ago.

Government fiscal effort ratio rose to 13.43% in the United States Ffirst three months, slightly higher than the 12.95% in 2023.

Spending efforts improved to 19.74% at the end of March, compared to 19.4% a year earlier.

Separate data from the Ministry of Finance showed the deficit ratio stood at 4.46% at the end of March. This was lower than the 4.82% as of March 2023 and the 6.2% at the end of 2023.

The NG’s budget deficit this year is limited to 5.6% of GDP, equivalent to 1.48 trillion euros.