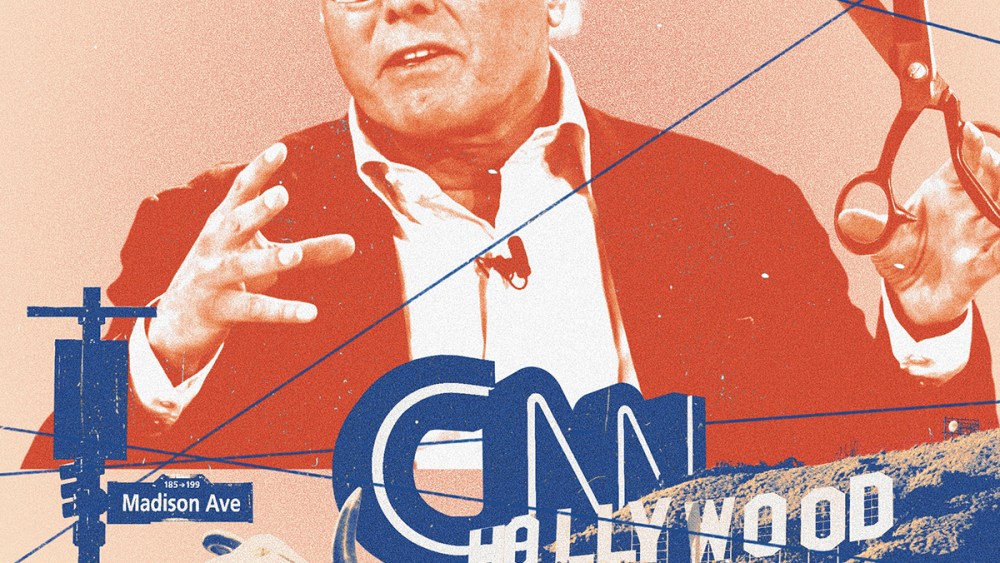

Entertainment

The decisions of the CEO of Warner Bros. Discovery, NBA and CNN, have upset partners

Just a year ago, Warner Bros. Discovery rode the pop culture tsunami that was “Barbie.” In recent days it has become clear that the rosy glow of that box office juggernaut has long faded.

Since the beginning of the year, WBD has been embroiled in major public battles seemingly of its own making. There is talk of a legal war with the NBA. The company continues to draw a hard line with Madison Avenue on the upfront price for ad sales, in an era when such tactics are not well received. WBD-owned CNN’s reporters are demoralized. And in the coming months, the company is preparing for icy negotiations with MVPDs that will undoubtedly reflect the decline in viewership at its cable networks, the likely loss of the NBA and decisions that will put large portions of the company’s linear programming on Max. will push back. .

Last week, WBD announced that it has written down $9.1 billion in value for its collection of cable channels — a nod to the harsh reality that the days of double-digit annual growth in affiliate fees and advertising are not coming back.

In a call with investors last week, WBD CEO David Zaslav attributed the decline to “a generational disruption impacting our industry,” noting that “even two years ago, market valuations and prevailing conditions for traditional media companies were very different than now. ”

Wall Street’s confidence in Zaslav’s ability to turn things around is waning. The company’s share price has sunk to an all-time low. And debate is mounting around the prospect of a dismantling of Warner’s assets.

“In our view, the current setup as a consolidated publicly traded company is not working,” Jessica Reif Ehrlich, an influential analyst at BofA Securities, wrote in July. “At current levels, we believe that exploring strategic options for WBD would create greater shareholder value versus the status quo.” She added: “All options must be on the table.”

Given the storm that has hit beloved brands like HBO, TNT, CNN and Warner Bros. envelops, there has to be a shake-up in management, right?

Wrong. It is unlikely that Zaslav will leave anytime soon. The company’s overall financial health is better than it appears, with executives committed to maintaining an investment-grade rating. Zaslav and his top lieutenants have focused tightly on WBD’s balance sheet, which is filled with $37 billion in debt that rested on the company’s shoulders when Discovery Communications merged with AT&T’s WarnerMedia in April 2022. years – some of it is even on a 40 year timeline.

Still, some of the cost cutting has rankled key constituencies. Team Zaslav has scrapped projects deemed marginal — including completed films like “Batgirl” and the digital site CNN+ — and there is a sense among the operating unit staff that executives have cut into the bone. WBD’s third major layoff in as many years began last month when WBD confirmed plans for 1,000 pink slips.

Zaslav’s overarching strategy is to keep the company together through the storm of streaming disruption while building the Max platform into a global player on the scale of Netflix and Disney+. That’s why he spent so much time on the Q2 call talking about Max’s launch in markets in Latin America and Europe.

Meanwhile, Zaslav’s famously tough approach to negotiations has alienated key contributors to WBD’s cash flow: advertisers, sports leagues, Hollywood talent and even some journalists working for CNN. A cloud of ill will can be detrimental to the long-term health of a company where creativity is the key asset, not the TV networks or digital properties that showcase it.

No wonder members of WBD’s talent roster seem despondent. Yes, “Inside the NBA” host Charles Barkley recently signed a new deal to remain with TNT Sports, but his public dismay over the company’s inability to hold on to the NBA – after a partnership of more than 30 years – speaks volumes.

“The challenge organizations face is that they start to think they are managing and manipulating numbers in spreadsheets,” rather than building new business by studying the behavior and interests of customers and employees, says Scott D. Anthony, a professor at Dartmouth’s Tuck School of Business who studies the challenges of disruption. “If that happens, the game is as good as over.”

Advertisers have been grumbling about WBD’s sales tactics for years. During the most recent market, when TV networks were trying to sell off most of their ad inventory, Warner urged media agencies to commit to “growth,” or spend more dollars than they committed to in 2023 — a tall order given the shrinking economics of cable television. .

But two media buying executives familiar with the recent negotiations say Warner has been particularly unrealistic. WBD said it saw “strong” upfront commitments in sports and increases in streaming, but did not provide a dollar figure for overall commitments tied to its broader portfolio.

It’s one thing to “beat up” a cable distributor or sports league for nickels and dimes once or twice a decade, says one buyer, and it’s quite another to engage in similar behavior every twelve months. come and stand. “I don’t think he understands that it’s a different kind of negotiation,” this buyer says of Zaslav, echoing the sentiments that advertisers don’t like being told that the millions they’re spending aren’t satisfying .

Warner “makes it difficult for multiple layers of people,” this director adds. “I can’t say I enjoy dealing with Warner Bros.”