Finance

The Fed’s preferred inflation gauge will support the patience of the rate cut

(Bloomberg) — Federal Reserve officials are poised for further confirmation that progress in the fight against inflation has stalled, appearing to support a shift in tone toward keeping interest rates higher for longer than previously was expected.

Most read from Bloomberg

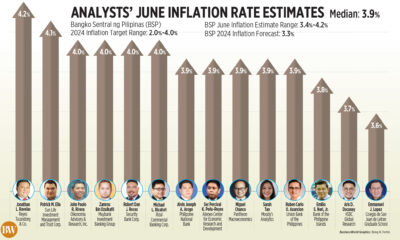

The inflation measure favored by policymakers – the price index for personal consumption expenditure – likely remained high in March, according to data available in the coming week.

The measure is expected to accelerate slightly to 2.6% annually as energy costs rise. The core metric, which excludes energy and food, is expected to rise 0.3% from the previous month, following a similar gain in February.

While the PCE’s core data may not be as strong as the consumer price index — which exceeded expectations and roiled markets earlier this month — Fed Chairman Jerome Powell and other officials have indicated it will take longer to get the necessary gain confidence in a downward trajectory of inflation before cutting rates.

Read more: Fed resets clock on cuts and questions about whether rates are high enough

Policymakers will observe the traditional blackout period for public speaking over the next week, ahead of their two-day meeting that ends on May 1.

Friday’s new inflation figures will be accompanied by March’s personal spending and income figures. Against the backdrop of healthy job growth, economists predict another strong increase in household spending on goods and services. Income growth is also expected to accelerate.

Other data for the week includes the government’s initial estimate of first-quarter growth, which likely cooled from the robust pace of the previous period but was still above what policymakers consider sustainable in the long term .

A composite gauge will also be released for activity among manufacturers and service providers, as well as new home sales. Later this week, the University of Michigan will release its final April readout of consumer confidence and inflation expectations.

What Bloomberg Economics says:

“Real GDP likely cooled to around 2.7% in the first quarter, after averaging 4.2% growth in the second half of 2023. That is still above the longer-term sustainable pace, according to FOMC projections of 1.8%, indicating persistent inflationary pressures. Looking ahead, activity will be challenged by weakness in discretionary spending, with consumers becoming increasingly sensitive to prices amid high inflation.”

— Anna Wong, Stuart Paul, Eliza Winger and Estelle Ou, economists. For a full analysis, click here

Looking north, the summary of the Bank of Canada’s deliberations will shed more light on the debate among officials about what they want to see before cutting rates. Retail sales for February and a preliminary estimate for March could confirm signs of a consumer slowdown at the start of the year.

Elsewhere, the Bank of Japan’s decision will be scrutinized for clues to future rate hikes, Turkish officials could keep borrowing costs steady, Germany’s Ifo business index could signal improvement, and countries from Australia to Mexico will announce inflation figures.

Click here for what happened last week and below is our summary of what will happen in the global economy.

Asia

The BOJ will release its latest price forecasts just over a month after the first rate hike since 2007.

With Japan’s central bank widely expected to put policy on hold after halting its massive easing program, economists and investors will scrutinize forecasts and the BOJ’s characterization of inflation risks for clues about the pace of future rate hikes .

The yen’s continued weakness will add an extra layer of tension when Governor Kazuo Ueda speaks at a briefing after Friday’s decision.

The week starts with expectations that Chinese banks will keep their key interest rates unchanged.

Preliminary export figures from South Korea will provide a snapshot of the strength of global trade. The trade-reliant country will release its gross domestic product figures on Thursday, with the economy expected to have grown at the same level as the previous four quarters.

The Indonesian central bank is likely to leave borrowing costs unchanged at 6%.

Singapore, Australia and Malaysia will release inflation figures during the week, with monthly figures from Down Under expected to show the first acceleration since September.

Australia will cut growth prospects for most major economies, including top trading partner China, when it announces its budget next month, Treasurer Jim Chalmers said on Sunday.

Europe, Middle East, Africa

Christine Lagarde, president of the European Central Bank, will deliver a speech at Yale University on Monday, marking her visit to the US after the meetings of the International Monetary Fund and the World Bank.

Back in Europe, several colleagues will speak in the coming days. Among them are Isabel Schnabel and Piero Cipollone, members of the ECB Governing Council, and presidents such as Joachim Nagel, Francois Villeroy de Galhau and Fabio Panetta.

Key releases from the eurozone include consumer confidence on Monday, the first results of monthly purchasing manager surveys on Tuesday, and the ECB’s consumer expectations survey on Friday.

Among major economies, Germany’s Ifo business confidence index will peak on Wednesday at a time when policymakers are seeing a turn for the better in Europe’s largest economy after a period of stagnation and contraction.

Tuesday will be busy in Great Britain. The PMI figures will be published together with those of the eurozone, and the latest public finance data will also be released at that time. That day, Bank of England chief economist Huw Pill and fellow policymaker Jonathan Haskell will speak.

The Swiss National Bank will hold its annual general meeting on Friday, a day after publishing earnings figures. The event has attracted climate activists in the past, and they could be motivated this time by a vote in parliament endorsing the central bank’s position not to take environmental risks into account in its monetary policy.

South Africa’s central bank will release its six-monthly review of monetary policy on Tuesday, providing guidance on the inflation and interest rate outlook.

Several monetary decisions are planned in the wider region:

-

On Tuesday, Hungary is poised to further delay cuts to the European Union’s top rate, as officials face multiple risks as they try to protect the volatile forint.

-

Two days later, Ukraine’s central bank will set policy in the wake of declining inflation.

-

Also on Thursday, Turkish officials could keep the policy rate at 50% after a surprise rate hike last month. Some analysts are not ruling out a new increase if policymakers see the inflation outlook deteriorating in the coming months from the peak they see of around 75%.

-

On Friday, the Bank of Russia will maintain its interest rate at 16% after officials flagged a “prolonged period” of tight monetary conditions this year amid persistently high inflation and deteriorating foreign trade due to sanctions.

-

The same day, Botswana is forecast to keep borrowing costs unchanged, with inflation below the target range of 3% to 6%.

Latin America

In Mexico, early April inflation data is likely to fuel speculation that the central bank will pause its May meeting, as analysts expect inflation to have risen above 4.5% again by mid-month.

Banxico Governor Victoria Rodriguez said in a Bloomberg interview this weekend that the recent volatility of the Mexican peso after rising tensions in the Middle East is not an inflation concern.

Also available are February’s GDP figures, which are highly likely to show a fifth consecutive monthly decline, and the March labor market report.

On the monetary policy front, Paraguay’s central bank is seen cutting borrowing costs for the ninth time in a row to 5.75% before taking a breather at its May meeting.

Argentina reports its monthly budget results for March, after consecutive surpluses in January and February due to President Javier Milei’s so-called shock therapy economic measures. Analysts expect the same cuts to weigh on February’s GDP figures, after January’s deeply negative figures.

In Brazil, the central bank’s analyst survey is likely to show further erosion in inflation expectations following the government’s proposal to weaken its fiscal targets.

Latin America’s largest economy will also provide its March current accounts report, foreign direct investment, tax collections and bank credit data, along with its mid-month inflation report.

The early consensus projects a result below 4%, well within the tolerance range of 1.5% to 4.5%, but still well above the 3% target.

–With assistance from Robert Jameson, Paul Jackson, Piotr Skolimowski, Monique Vanek, Beril Akman and Tony Halpin.

(Updates with Australian Treasurer in Asia section)

Most read from Bloomberg Businessweek

©2024 BloombergLP