Business

The NG budget gap will widen in May

The budget of the national government (NG) deFAccording to the Bureau of the Treasury (BTr), interest rates widened in May as spending growth outpaced revenue growth.

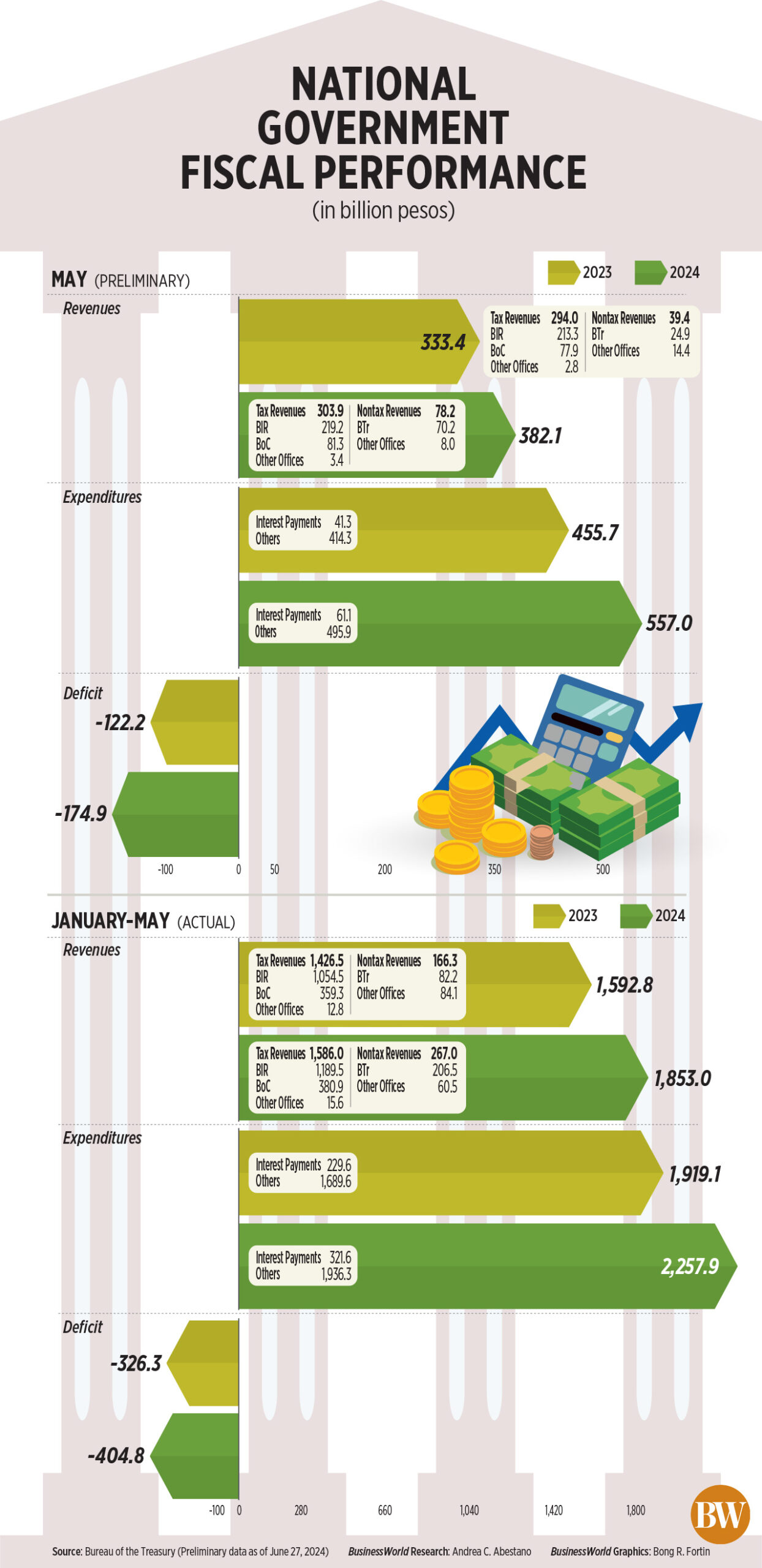

The NG’s budget deficit increased by 43.1% to 174.9 billion euros in May, compared to 122.2 billion euros in the same month a year ago.

Month-on-month, this was a reversal from April’s P42.728 billion surplus.

“The higher deficit was due to an acceleration in government spending, bringing expenditure growth for the month to 22.24%, while revenue rose 14.59%,” the BTR said.

In May, state expenditures rose 22.24% to P557 billion from P455.7 billion a year ago.

The BTR said this was due to the implementation of capital investment projects of the Departments of Public Works and Highways and National Defense and the social and health programs of the Departments of Social Welfare and Development and Health.

“Higher National Tax Allotment shares of LGUs and increased budget support to GOCCs (government-owned and controlled corporations) also contributed to the remarkable growth in disbursements in May,” it added.

Broken down, interest payments rose 47.78% year-on-year to P61.1 billion due to “additional debt incurred last year and higher interest rates on both domestic and foreign loans.”

Primary expenditure – which refers to total expenditure minus interest payments – increased by 19.69% year on year to 495.9 billion euros.

Meanwhile, revenues rose 14.59% to P382.1 billion in May from P333.4 billion in the same month in 2023.

“The robust result for the month was supported by higher non-tax collections,” the BTR said.

Non-tax revenues nearly doubled to P78.2 billion in May from P39.4 billion a year earlier.

BTR revenues rose 181% to P70.2 billion “due to higher collections from interest on advances from GOCCs, guarantee fees and NG share from Philippine Amusement and Gaming Corp. revenues.” (PAGCOR).

On the other hand, revenues from other offices fell 44.38% to P8 billion in May.

“The collections from other offices (non-taxable persons), including privatization proceeds and fees and charges, for May decreased by 44.38% due to the reclassification of the accounts of the previous months’ transactions,” it added.

Meanwhile, tax revenues rose 3.35% to P303.9 billion in May from P294 billion a year ago.

The Bureau of Internal Revenues (BIR) collections increased 2.79% to P219.2 billion “due to higher tax collections on Value Added Tax (VAT), taxes on net income and profits (deduction to the source and on wages of personal income tax), and various taxes,” according to the BTR.

Bureau of Customs (BoC) revenues rose 4.33% to P81.3 billion, amid “better performance in revenue collection (due to) the continued monitoring of the values and classifications of imported goods, as well as intensified border controls and improved trade facilitation.”

SHORTAGE OF FIVE MONTHS

Meanwhile, the budget deficit increased by 24.06% to 404.8 billion euros in the January-May period, from 326.3 billion euros a year ago.

Government spending rose 17.65% to P2.26 trillion at the end of May, compared to P1.92 trillion in the same period a year ago.

Interest payments rose 40.08% to P321.6 billion, while primary expenditures rose 14.6% to P1.94 trillion.

Meanwhile, five-month sales totaled P1.85 trillion, up 16.34% from P1.59 trillion a year earlier.

Tax revenues rose 11.18% to P1.59 trillion, while BIR revenues rose 12.81% to P1.19 trillion, while BoC collections rose 6.01% to P380.9 billion.

Non-tax revenue rose 60.58% to P267 billion, while BTR revenue rose 151.09% to P206.5 billion.

Michael L. Ricafort, chief economist of Rizal Commercial Banking Corp., said in a Viber message that the broader budget deficit may be due to higher inflation that pushed up government spending.

Inflation rose from 3.8% in April to a six-month high of 3.9% in May. This brought the average inflation in the January-May period to 3.5%.

“Larger deficits would increase the urgency of tax reforms and other fiscal reform measures, and at the very least intensify tax collections under existing tax laws, among other things,” he said.

“At some point, if inflation stabilizes further, there could be a need for higher taxes and new taxes as a last option,” he added. — Luisa Maria Jacinta C. Jocson