Business

The peso may move sideways before the inflation report comes out

The PESO may continue to move sideways against the dollar this week as the market awaits the release of June PhilippineFfacts.

The local unit closed at P58.61 per dollar on Friday, up 14 centavos from P58.75 FThis was evident from data from the Bankers Association of the Philippines on Thursday.

Week on week, the peso also rose 19 centavos from P58.80 per dollar on June 21.

The peso gained against the dollar on Friday after the Bangko Sentral ng Pilipinas (BSP) cut its rate.FMichael L. Ricafort, chief economist of Rizal Commercial Banking Corp., reiterated his dovish stance in a Viber message.

The BSP lowered its average baseline on ThursdayFForecasts for 2024 and 2025 increase to 3.3% and 3.1% respectively, compared to 3.5% and 3.3% previously.

The country also cut its risk-adjusted inflation expectations for this year and next year to 3.1% from 3.8% and 3.7% respectively.

Head inFInflation accelerated from 3.8% in April to 3.9% annualized in May, but was the sixth month in a row that inflationFThis happened within the central bank’s annual target of 2-4%.

During the first five months, the consumer price index (CPI) averaged 3.5%.

The Monetary Board kept the policy rate at a 17-year high of 6.5% for the sixth time in a row on Thursday, as expected by all fifteen analysts in a Business poll.

BSP Governor Eli M. Remolona, Jr., on a brieFAfter their policy meeting, they pointed to a “less restrictive” attitude if there is a sustainable improvement of the situationFoutlook, adding that it is “slightly more likely than before” to begin their easing cycle at their next meeting, which takes place on August 15.

Mr Remolona said they could cut rates by 25 basis points (bps) in the third quarter and another 25 basis points in the fourth quarter, for a total of 50 basis points of easing for the year, depending on data.

The Monetary Board review on August 15 is the only meeting in the third quarter. Meanwhile, the last two reviews of the year, which will take place in the fourth quarter, are scheduled for October 17 and December 19.

The peso and other Asian currencies largely consolidated against the dollar on Friday before U.S. personal consumption expenditures (PCE) data were released later that day, Security Bank Corp. Chief Economist Robert Dan J. Roces said. in a Viber message.

Monthly inflation in the US was unchanged in May, as a modest increase in the cost of services reached 0FFollowed by the biggest drop in commodity prices in six months, pushing the Federal Reserve closer to cutting interest rates later this year, Reuters reported.

Friday’s Commerce Department report also showed that consumer spending rose marginally last month. Underlying prices rose at the slowest pace in six months, boosting optimism that the US central bank could deliver a much-needed ‘soft landing’ for the economy, in whichFThe economy is cooling without causing a recession and a sharp rise in unemployment.

Traders increased their bets on a Fed rate cut in September.

The FLast month’s PCE price index bar followed an unchanged 0.3% increase in April, the Commerce Department’s Bureau of Economic Analysis said. It was the first time PCE came in in six monthsFlation was unchanged.

In the 12 months to May, the PCE price index rose 2.6%, after rising 2.7% in April. Last month is inFThe results were in line with economists’ expectations.

Inflation is easing after a peak in the first quarter as Fed rate hikes of 525 basis points since 2022 cool domestic demand. However, inflation remains above the central bank’s 2% target.

Financial markets saw a roughly 68% chance that Fed policy easing would begin in September, compared with about 64% before the data, although policymakers had recently adopted a more hawkish view. The US central bank has kept its benchmark interest rate at the current range of 5.25%-5.5% since July last year.

Economists were divided over whether the Fed would cut borrowing costs twice more this year, despite solid wage growth. The release of the US employment report next Friday in June could shed more light on the outlook for monetary policy.

Excluding volatile food and energy components, the PCE price index rose 0.1% last month, the smallest gain since November. That followed an upwardly revised 0.3% increase in April.

It was previously reported that the so-called core PCE price index rose 0.2% in April. Core in itFInflation rose 2.6% year-on-year in May, the smallest advance since March 2021, after rising 2.8% in April.

Interest rates rose 2.7% annually over the past three months, slowing from 3.5% in April.

The dollar index, which measures the greenback against a basket of currencies, fell 0.07% to 105.82 after the PCE data.

For this week, the foreign exchange market could benefit from the release of the June Philippine CPI data on Friday (July 5), Mr. Ricafort said.

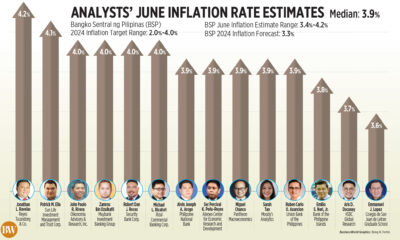

a Business a poll of 14 analysts yielded an average estimate of 3.9% for June headlinesFwithin the BSP’s 3.4-4.2% forecast for this month.

If realized, June’s CPI would be stable compared to the May release, but slower than the 5.4% pace recorded the same month a year ago.

It would be the seventh month in a row that inflation was within the BSP’s annual target of 2-4%.

Investors will also await the release of June U.S. jobs data on Friday as they could influence the Fed’s policy path, Mr. Ricafort added.

He expects the peso to move between P58.55 and P58.75 per dollar this week. — AMCS of Reuters