Finance

The stock market is approaching two catalysts that will herald the next phase of the bull run, says market doctor

-

The stock market’s record rally will get a boost from key economic data and earnings results, Ed Yardeni said.

-

The second quarter GDP figures and June PCE figures on Thursday and Friday could fuel the soft landing narrative.

-

Yardeni highlighted the strong corporate profits and profit margins that supported the market in a way that did not exist in 2000.

The The stock market rally is expected to continue this week, as investors digest two major economic data and a flurry of second-quarter earnings results.

This is evident from a Monday note from Yardeni Research, which emphasized the upcoming release of second quarter GDP and June PCE index as key to continuing the stock market rally.

“We expect a solid second-quarter real GDP print on Thursday and subdued June PCED inflation on Friday to keep the rally going,” Ed Yardeni said in the note.

Economists estimate second-quarter GDP growth will be 1.9%, and Core PCE will rise 2.5% year-over-year in June, not far from the Fed’s long-term inflation target of 2% .

If economic data comes in as expected, talk of a soft landing for the US economy could continue and the Federal Reserve even more reason to lower interest rates during the September policy meeting.

And while Bearish investors claim the market is overvalued Yardeni Research disagrees that the rally is continuing and that stocks are in bubble territory, similar to the internet age.

That’s because the stock market’s record rally is being supported by underlying corporate earnings in a way that wasn’t possible 24 years ago.

“We have recognized that the current stock market rally is reminiscent of the valuation-driven market collapse of the 1990s. But we have also noted that the current bull market is receiving more support from earnings data,” Yardeni said.

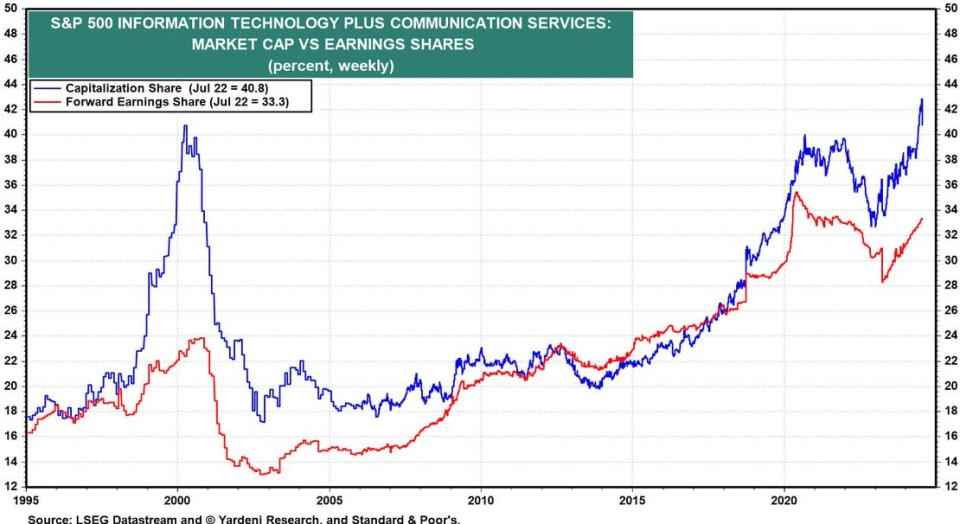

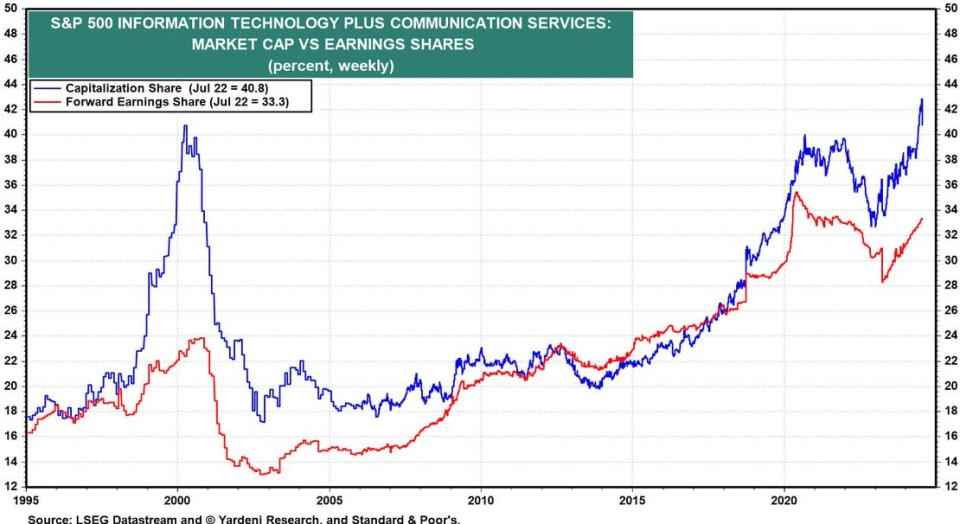

The research agency emphasized that the combination S&P500 The allocation to the information technology and communications services sectors stands at 41%, similar to the high in 2000.

But while these two sectors represented less than a quarter of the S&P 500’s earnings at the height of the dot-com bubble, today these two tech-focused sectors represent a third of the S&P 500’s future earnings per share.

What is encouraging for Yardeni is the fact that the second quarter earnings figures are already paying off.

With 16% of S&P 500 companies reporting second-quarter earnings so far, 84% are beating earnings expectations by an average of 4%, while 63% are beating revenue expectations by an average of 3%, Fundstrat data shows.

“So far, the second quarter earnings reporting season is going well. The combined reported/estimated earnings growth rate for the S&P 500 has halted the recent decline, rising to 8.2% year-over-year in the week of July 18. We expect 10% – 12 % y/y,” Yardeni said.

Looking ahead, Yardeni expects the S&P 500 will achieve significant growth in earnings per share in the coming years.

“We expect S&P 500 earnings per share of $250, $270 and $300 in 2024, 2025 and 2026. We are slightly more optimistic than industry analyst consensus this year, but less so in the next two years. We still see the S&P 500 EPS reaching $400 by the end of this decade,” Yardeni said.

Finally, Yardeni highlighted that profit margins continue to rise to near record highs, indicating that profits and economic growth will continue to impress in the second and third quarters.

Read the original article Business insider