Finance

The stock of energy transfer will almost double within five years

Most investors are interested Energy transfer (NYSE:ET) are attracted to its high yieldwhich is currently around 7.9%. The company currently pays a quarterly distribution of $0.32 and plans to increase this by 3% to 5% per year in the future.

That in itself is attractive, but I also think the pipeline operator’s stock could nearly double over the next five years.

This would happen through a combination of growth projects and modest multiple expansion, with investors assigning a higher valuation benchmark to a stock.

Let’s take a look at why I think Energy Transfer stock could more than double in the next five years.

Growth opportunities

Energy Transfer is one of the largest midstream companies in the US, with a comprehensive integrated system spanning the country. It is involved in almost all aspects of the midstream sector and transports, stores and processes various hydrocarbons in its systems. The size and breadth of the systems offer many possibilities for expansion projects.

This year, the company plans to spend between $3 billion and $3.2 billion on growth capital expenditure (capex) on new projects. Going forward, spending between $2.5 billion and $3.5 billion on growth investments per year would allow the country to pay its benefits while leaving money from its cash flow to pay down debt and/or buy back shares.

Given this, and the early opportunities that Energy Transfer sees in energy generation due to the increased power needs of data centers due to the rise of artificial intelligence (AI), it’s probably safe to say that the company will spend approximately $3 billion could spend on growth investments. per year for the next five years.

Most companies in the midstream space are looking for at least 8x build multiples for new projects. This means that the projects pay for themselves in approximately eight years. For example, a $100 million project with an 8x multiple would generate an average return of $12.5 million in EBITDA (earnings before interest, taxes, depreciation, and amortization) per year.

Based on that kind of return on growth projects, Energy Transfer could see its adjusted EBITDA increase roughly from $15.5 billion in 2024 to about $17.4 billion in 2029 if it continues to spend $3 billion per year on growth projects.

Multiple expansion options

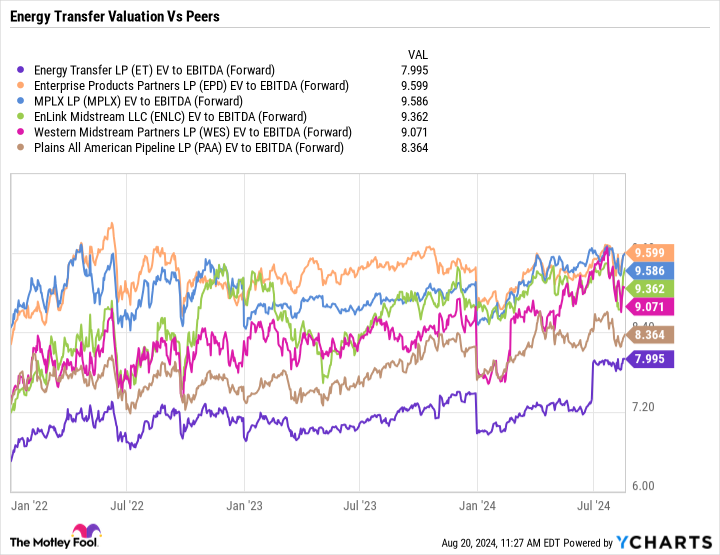

From a valuation perspective, Energy Transfer is the cheapest stock among its master limited partnership (MLP) midstream peers, trading at 8x based on forward enterprise value and adjusted EBITDA. This measure takes into account a company’s net debt when including non-cash items and is the most commonly used way to value midstream companies. At the same time, it is trading at a much lower valuation than historically.

MLP midstream stocks averaged an EV/EBITDA multiple of 13.7x between 2011 and 2016, so the sector as a whole has seen its multiple decline. However, with demand for natural gas increasing due to AI and demand for electric vehicles decreasing, it appears that the transition to renewable energy sources will take much longer than expected. If this is the case, these stocks should be able to achieve a higher multiple than they currently do, as this reduces fears that hydrocarbon demand will decline materially in the coming years.

How Energy Transfer Shares Nearly Doubled

If Energy Transfer grows its EBITDA as expected, the stock could reach $30 by 2029 if it can achieve a 10x EV/EBITDA multiple. That’s higher than the 8x forward and 8.7x trailing multiple it currently commands, but it’s still well below where the MLP midstream space has traded in the past.

|

2024 |

2025 |

2026 |

2027 |

2028 |

2029 |

|

|---|---|---|---|---|---|---|

|

Adjusted EBITDA |

$15.5 billion |

$15.88 billion |

$16.25 billion |

$16.63 billion |

$17.0 billion |

$17.38 billion |

|

Price at 8x multiple |

$17 |

$18 |

$19 |

$20 |

$21 |

|

|

Price at 9x multiple |

$21.50 |

$22.50 |

$23.50 |

$24.50 |

$25.50 |

|

|

Price at 10x multiple |

$26 |

$27 |

$28 |

$29 |

$30 |

* Enterprise value is based on 3.42 billion shares outstanding, $57.6 billion in debt, $3.9 billion in preferred stock, $3.9 billion in investments in unconsolidated subsidiaries and cash, and $11.6 billion in minority interests.

However, Energy Transfer and several other midstream companies appear very well positioned to be stealth AI winners due to increasing demand for natural gas. Energy companies and data centers have already approached Energy Transfer about natural gas transmission projects, and a boom in natural gas volumes is said to be on the way. Given this growth opportunity, along with the company’s strengthened balance sheet and consistent distribution growth, I could see Energy Transfer’s stock growing modestly over the next five years and the stock nearly doubling.

But even if the multiple doesn’t grow, investors can still get a very solid return on their investment through a combination of distributions (currently $0.32 per unit per quarter) and more modest price appreciation. Without multiple expansion and more than $7 in distributions between now and the end of 2029 (assuming a 4% annual increase), the stock would still generate a return of more than 75% over that period.

Do you now have to invest € 1,000 in energy transfer?

Consider the following before purchasing shares in Energy Transfer:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Energy Transfer wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $792,725!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns August 22, 2024

Geoffrey Seiler has positions in Energy Transfer, Enterprise Products Partners and Western Midstream Partners. The Motley Fool recommends Enterprise Products Partners. The Motley Fool has one disclosure policy.

Prediction: The stock of energy transfers will almost double in five years was originally published by The Motley Fool