Business

The trade gap in April is the widest in five months

By means of Beatriz Marie D. Cruz, News reporter

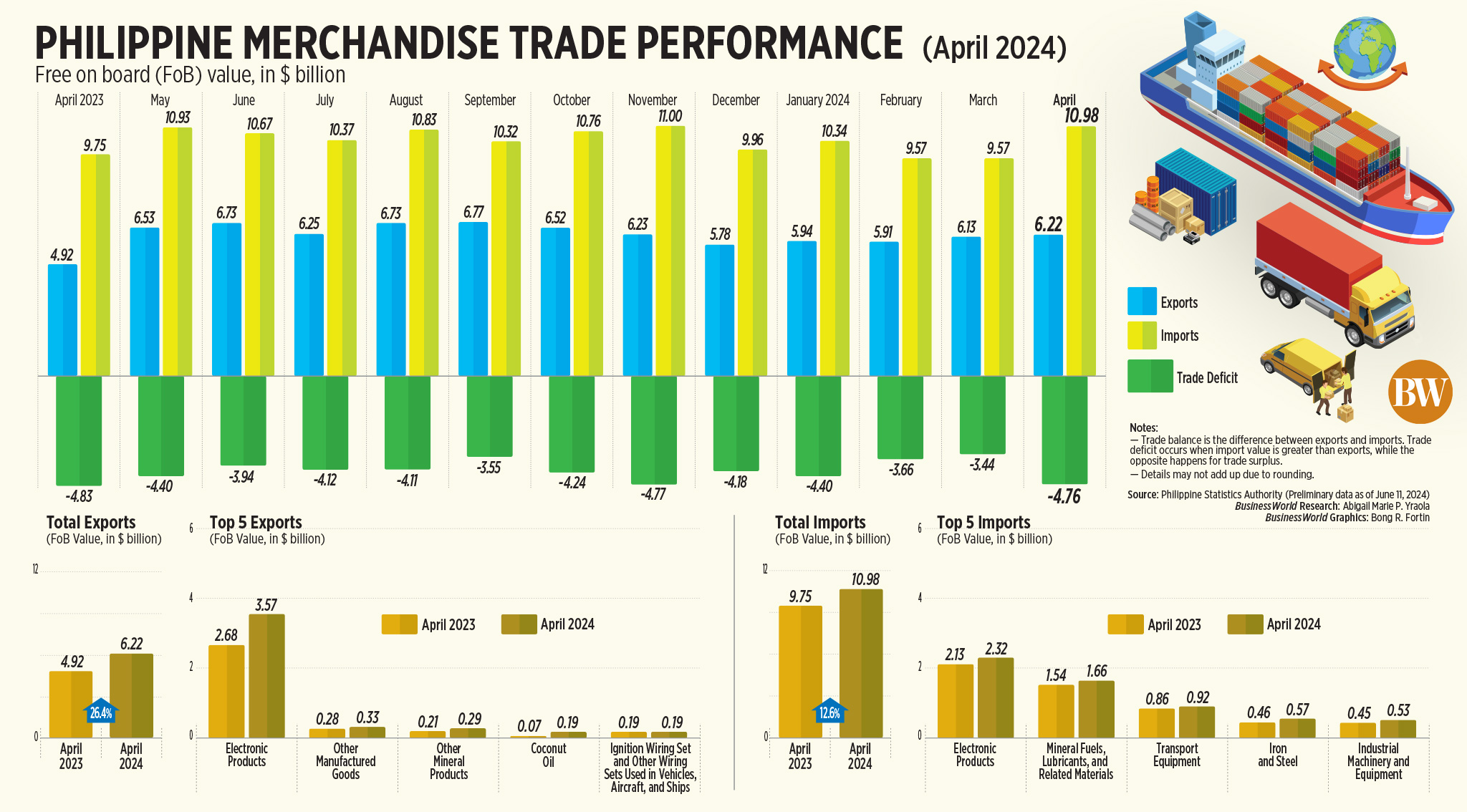

The trade of the PHILIPPINESFicit fell year over year in April, but recorded the widest level in April five months, while exports and imports recorded double digit growth growth, the statistical office said Tuesday.

Preliminary data from the Philippine Statistics Authority (PSA) showed the balance of the country’s trade in goods – the diffThe deficit between exports and imports stood at a deficit of $4.76 billion in April, 1.5% lower than the gap of $4.83 billion in the same month in 2023.

Month after month, the trade gap widened from $3.44 billionFIT in March.

April’s trade deficit was wideest in five months or since the $4.77-buttocklion gorge in November last year.

For the period January to April, the trade is theFicit shrank 15.7% to $16.27 billion, compared to the $19.29 billion gap a year ago.

In April, the value of exports rose 26.4% to $6.22 billion, compared to $4.92 billion a year ago.

This was the fastest annual export growth in 35 months or since the 30.9% increase in May 2021.

On the other hand, the value of imported goods rose 12.6% to $10.98 billion in April, up from $9.75 billion a year ago. This was the fastest increase in imports in 19 months or since the 14.4% growth in September 2022.

The Development Budget Coordination Committee (DBCC) expects growth of 3% and 4% in exports and imports respectively this year.

WEAK PESO

Import and export bills were at their highest in April Ffive months, amid the depreciation of the peso.

In mid-April, the peso fell to the level of P57 per dollar for the first time since November 2022. The peso weakened by P1.52 or 2.7% to close at P57.76 per dollar on April 30, down from P56.24. Fend on March 27.

“The weaker peso made exports cheaper on international markets… but made imports more expensive, although this was offset by the temporary spike in global crude oil prices and other global commodity prices at the height of tensions/geopolitical risks between Israel and Iran in April 2024,” says Rizal Commercial. Michael L. Ricafort, chief economist at Banking Corp., said in an emailed message.

Sunny Liu, chief economist at Oxford Economics, said the weaker peso could boost export competitiveness, but the “strong US dollar” is a key theme across the region, meaning other currencies are also weak.

“Therefore, the relative competitiveness gained could be smaller. Moreover, the benefit of a weaker peso could be offset by higher costs of imported raw materials or raw materials needed for production,” she said in an email.

Manufactured goods, which accounted for 80.2% of the country’s total export earnings, rose 27.7% to $4.99 billion in April, compared to $3.91 billion in the same month last year.

Electronic products, which make up the bulk of industrial goods, rose 33.3% to $3.57 billion in April.

Semiconductor exports rose 30.6% to $2.76 billion in April.

Exports of mineral products rose slightly by 6.7% to $546.52 million in April.

Hong Kong in April dethroned the United States as the top destination for Philippine-made goods, with exports worth $1.03 billion, accounting for 16.5% of total exports.

The United States fell to second place with $948.43 million in export value (15.3% of the total), followed by Japan ($823.27 million or 13.2%), China ($702.02 million or 11.3 %) and South Korea ($314.59 million or 5.1%).

“Demand from Hong Kong is picking up rapidly, while shipments to the US continue to steadily return to an upward trend, offsetting the sluggishness in exports to China that persisted at the start of the second quarter,” said Miguel Chanco, chief economist of emerging Asia at Pantheon. Asia economist Moorthy Krshnan said in an email.

Meanwhile, imports of raw materials and intermediate products grew 14.3% year on year to $4.09 billion in April. This accounted for over a third or 37% of total imports.

Imported capital goods rose 10.5% to $3.1 billion, while imported consumer goods rose 15.7% to $2.07 billion.

Imports of mineral fuels, lubricants and related materials rose 8.4% to $1.66 billion in April.

“The increase in imports in April was broad-based and fairly robust across the board. However, it will take more than a month of good data to prevent consumer goods imports from continuing to roll over,” said economists at Pantheon Macroeconomics.

China was the largest source of imports, worth $3.15 billion, accounting for 28.7% of the total import bill in April.

It was followed by Indonesia ($959.21 million or 8.7% of the total), Japan ($909.54 million or 8.3%), South Korea ($743.11 million or 6.8%) and the United States States ($726.20 million or 6.6%).