Finance

These three overlooked parts of the stock market have seen a ‘coil spring’ uptrend, according to JPMorgan

-

Three underbought parts of the stock market are seeing unrealized upside, JPMorgan Asset Management says.

-

According to the company, these sectors include the semiconductor, rail and parcel and home improvement sectors.

-

Those could be great portfolio additions as AI stocks’ earnings growth starts to slow, strategists say.

Investors are still caught up in the frenzy over generative AI – but there are undervalued parts of the market that could offer gains like ‘coil springs’. according to JPMorgan Asset Management.

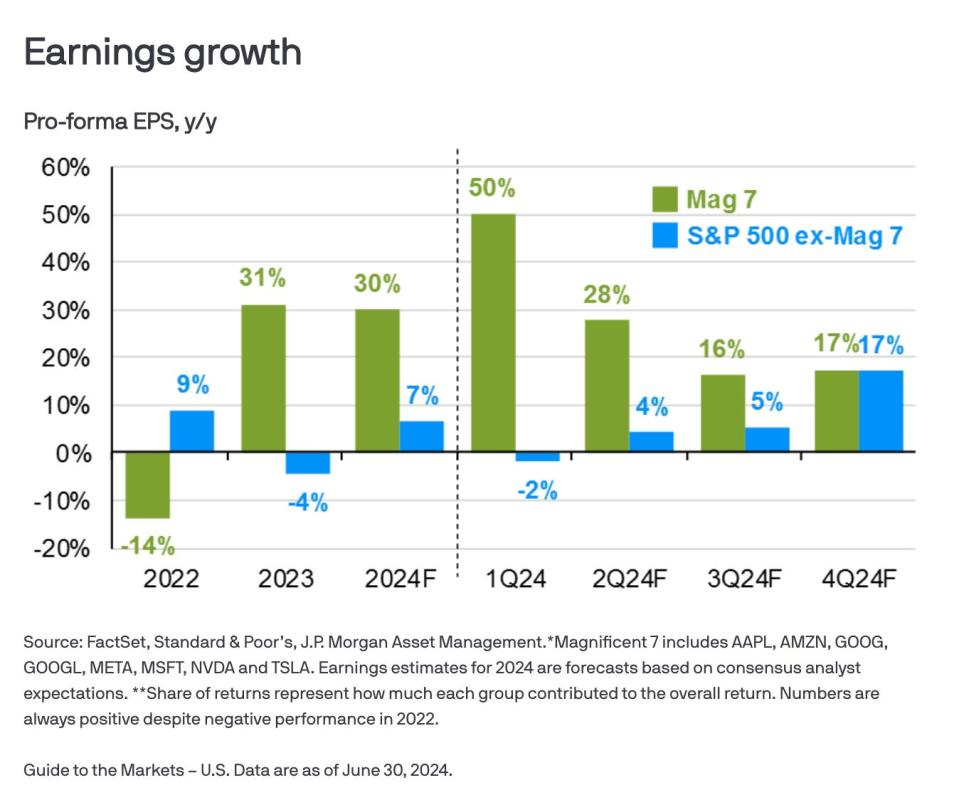

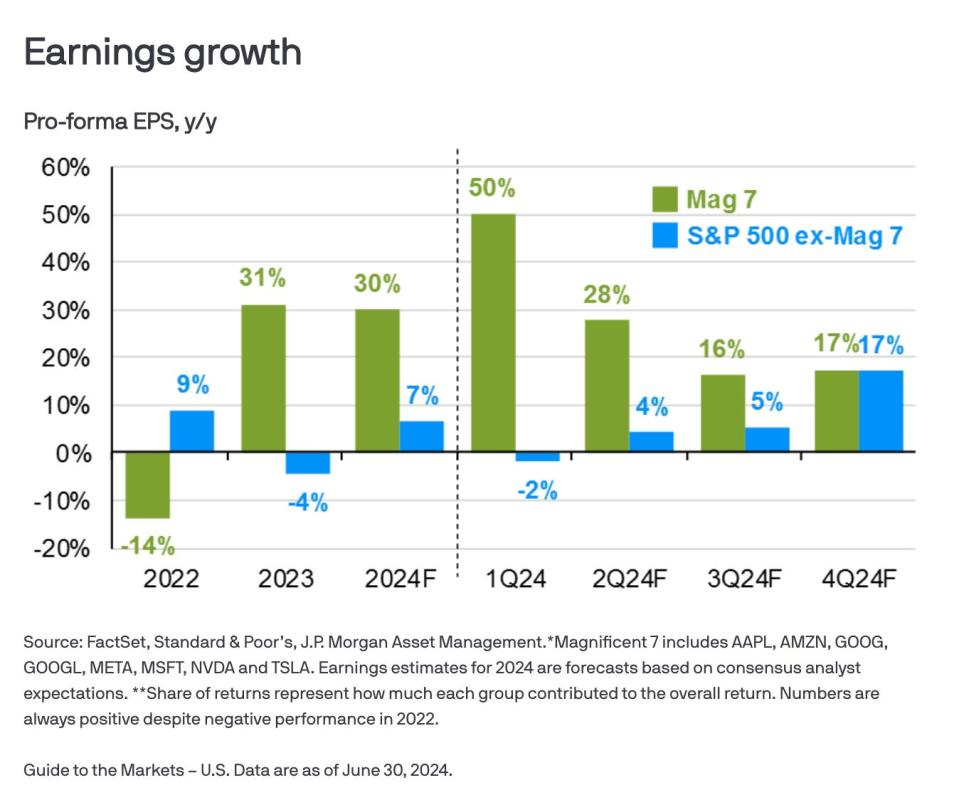

While the Beautiful seven stocks – including tech giants such as Nvidia, MetaAnd Microsoft – saw 50% annualized earnings per share growth in the first quarter; the rest of the S&P 500 will catch up.

JPMorgan expects that by the fourth quarter of 2024, earnings growth for the other 493 S&P 500 stocks will match that of the Magnificent 7, a dynamic depicted in the chart below.

“From a longer-term perspective, significant fiscal spending, particularly on infrastructure (such as the Inflation Reduction Act and the CHIPS and Science Act), coupled with growing enthusiasm around generative artificial intelligence, should provide an accommodating backdrop for stronger secular growth in the future. ,” say strategists. “It appears that markets have not fully priced in this forecast, which is reflected in the limited (and narrowing) nature of the stock market rally.”

Investors looking for unrealized upside would do well to look for non-Mag 7 stocks with ‘depressed’ valuations that have not yet taken into account earnings growth catch-up.

“These names could therefore function as ‘coil springs,’” the note added, highlighting three specific industries:

Semiconductors. JPMorgan says there are plenty of opportunities in the semifinals outside of AI trading.

“Depressed areas such as personal electronics, communications and entrepreneurship could bounce back quickly if demand is revived from the low levels left by pandemic ‘overorders,’” the company wrote.

Rail and parcel. These stocks will undoubtedly see an upward trend due to the “unexpected resilience” in the US economy and the increasing need for materials transportation. Automation in the sector is also expected to increase efficiency, which could boost upside potential.

Renovation. Americans have halted home renovations, held back by high interest rates and the fact that many have already renovated their homes during the pandemic. But that trend is likely to reverse in the future, strategists say.

“As the average American household age increases, the likelihood of significant maintenance expenditures increases. In addition, labor-related backlogs on older projects are being cleared as immigration has helped address labor shortages,” they said.

JPMorgan’s suggestions are indicative of Wall Street’s shift toward recommendations diversification, instead of continuing to chase Mag 7’s profits. This has been the case as uncertainty swirled around the world election and Fed rate cuts in the coming year. Some defensive investmentssuch as energy and utility stocks, have posted outsized gains over the past year, with returns surpassing even top AI stocks like Nvidia.

Read the original article Business insider