Finance

This is hands down my pick for the best artificial intelligence stocks to buy right now. (And it’s not Nvidia.)

The market is off to a thrilling start so far in 2024, with the S&P500 And Nasdaq Composite trading is near record levels, and perhaps the biggest influence right now is artificial intelligence (AI).

The technical heroes in the “Beautiful seven” are indeed making waves in the field of AI and are constantly in the spotlight. But beyond big tech, there are other disruptive forces in AI. Palantir Technologies (NYSE:PLTR) is one such player, with several AI-powered enterprise software platforms for the public and private sectors.

Last year was a milestone for Palantir and I think the best is yet to come. Here’s why it’s my top pick for investors in a highly contentious AI arena.

Customer acquisition is increasing

Several major technology companies are collaborating with leading AI startups. For example, Microsoft has invested billions in OpenAI, the developer of ChatGPT. Amazon And Alphabet are both investors in OpenAI competitor Anthropic and Nvidia is an investor in Databricks.

Palantir has figured out a way to penetrate this AI landscape. A year ago, the company released the Palantir Artificial Intelligence Platform (AIP).

To fend off competition, the company began hosting seminars called “boot camps” where potential customers could demonstrate the AIP software. The goal was to help potential customers identify a use for it.

This lead generation strategy seems to be working. In 2023, Palantir increased its customer base by 35% year over year. Additionally, the company is accelerating its expansion beyond its existing government contractor business.

Last year, the number of customers in the private sector grew by 44%. In the fourth quarter, U.S. revenue from these customers grew 70% year over year.

Turnover, margins and profits have increased

Looking at the company’s financials sheds some light on how AIP is helping Palantir. The company was founded in 2003 and took seventeen years to reach $1 billion in sales. Just three years later, it eclipsed $2 billion in sales.

In 2023, Palantir’s revenue rose 17% year over year to $2.2 billion, underscoring how quickly breakthroughs in AI are enabling new growth for software companies.

In fact, the company is also witnessing an increase in its bottom line. Last year, free cash flow grew more than threefold to $730 million, and operating margin grew 6 percentage points year over year.

The best has yet to come

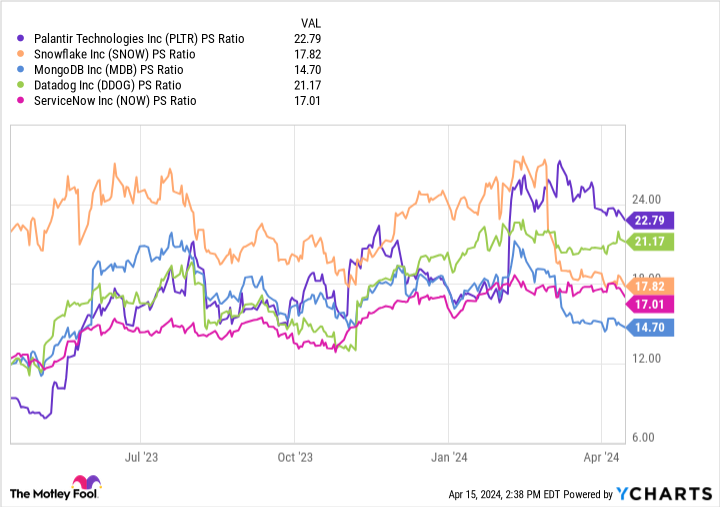

The chart below compares Palantir to similar fast-growing Software-as-a-Service (SaaS) developers in AI. The company’s price-to-sales ratio (P/S) of 23 is the highest of this cohort, narrowly exceeding Data hound.

While the stock has gotten a bit pricey, it’s important to note that Palantir’s valuation ratios really started to rise in February, following the company’s strong fourth-quarter earnings report. Since that report, the bullish buying activity has fueled new momentum in the stock price.

Despite the premium price, Palantir stock still looks attractive to me. It is trading 43% below its all-time high.

Additionally, one of Wall Street’s most highly regarded technology analysts, Dan Ives of Wedbush Securities, is calling for a huge rise in stocks. He set a price target of $35, almost 59% above current trading levels. Analysts don’t always get it right, but I agree with Ives’ optimism.

My opinion is that Palantir is well worth the premium. The combination of revenue growth and robust cash flow sets it apart from the competition, as many fast-growing SaaS companies are not yet consistently profitable. In the fourth quarter, Palantir reported its fifth consecutive quarter of GAAP (unadjusted) profitability.

Furthermore, the financial and operational results mentioned above reinforce the idea that the company’s decades-long investments in AI are providing a competitive advantage. This has led to a new wave of growth, with continued strong sales and profits.

Progress so far is encouraging, but I think Palantir’s long-term journey to disrupt big tech is just beginning. Using dollar-cost averaging to build a position or expand an existing one now appears to be a lucrative opportunity. Investors with a long time horizon don’t want to miss the company’s potential in AI.

Should You Invest $1,000 in Palantir Technologies Now?

Consider the following before purchasing shares in Palantir Technologies:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The ten stocks that made the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 15, 2024

Suzanne Frey, a director at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco has positions in Alphabet, Amazon, Microsoft, Nvidia and Palantir Technologies. The Motley Fool holds positions in and recommends Alphabet, Amazon, Datadog, Microsoft, MongoDB, Nvidia, Palantir Technologies, ServiceNow, and Snowflake. The Motley Fool recommends the following options: long January 2026 $395 calls to Microsoft and short January 2026 $405 calls to Microsoft. The Motley Fool has one disclosure policy.

This is hands down my pick for the best artificial intelligence stocks to buy right now. (And it’s not Nvidia.) was originally published by The Motley Fool