Finance

This market-based share is a great buy at the moment

Beauty and cosmetics retailer Ultimate beauty (NASDAQ:ULTA)The company’s price action has been anything but pretty over the past six months. Slowing growth and declining profit margins have caused stocks to falter; Shares have fallen from nearly $600 to less than $400 in the past six months.

Although stock prices had reasons to fall, the stock market often becomes overzealous. There’s a solid argument that Ulta Beauty sales are gone too farand stocks are poised to rebound strongly. This is why Ulta Beauty is a great buy for investors right now.

Why has the stock fallen so much?

Beauty and cosmetics are cultural staples, not just in America, but worldwide. Ulta Beauty is the largest cosmetics retailer in the United States, with 1,395 stores and an e-commerce store. It sells tens of thousands of products from hundreds of brands. Ulta has also become a fully-fledged brand; the company communicates with customers through social media and loyalty programs.

Ulta had only 449 stores in 2011. The steady opening of new stores has driven relatively uninterrupted sales growth for years outside of the pandemic, hurting virtually every business with brick-and-mortar stores. Consistent, profitable growth has made Ulta Beauty a market beater; the stock has outperformed the S&P500 about 3-to-1 since the company IPO in 2007.

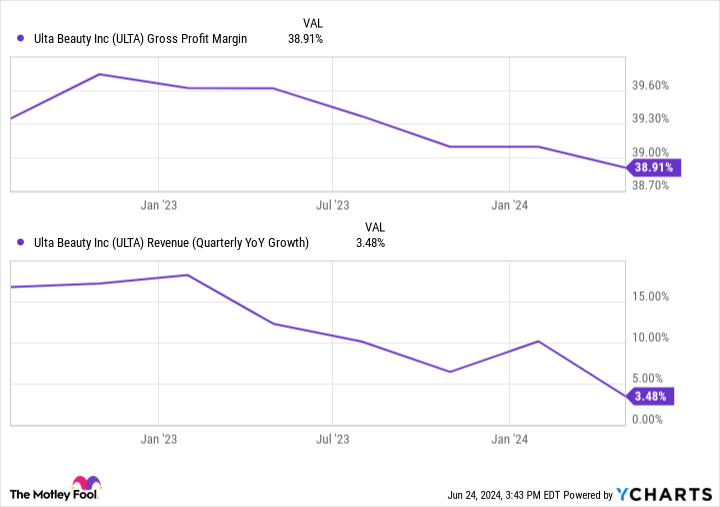

Consumers were flush with cash due to the pandemic, boosting Ulta’s business. However, that tailwind has disappeared. Revenue growth has steadily slowed since its 2021 peak gross profit margins peaked at the end of 2022:

Management has pointed to increased theft and lower-margin sales as the culprits behind the margin squeeze. That makes sense; Consumer savings rates have fallen below pre-pandemic levels. Naturally, a retailer will struggle if customers have less money and switch to cheaper brands. As much as people try to maintain their beauty regimen, cosmetics are ultimately a discretionary budget item.

It’s not all bad

The good news is that Ulta Beauty’s formula for success has been working for many years, and there’s not much reason to believe it won’t continue.

The company is still opening new stores and renovating existing locations. Management predicts 60 to 65 new store openings in 2024 and another 40 to 45 remodels. New stores will increase the total number of locations by 4% to 5%, essentially delivering low-single-digit revenue growth to the company.

Innovations and an eventual consumer recovery should boost sales in existing stores. Analysts believe that Ulta Beauty’s long-term annual sales growth will average between 5% and 6%.

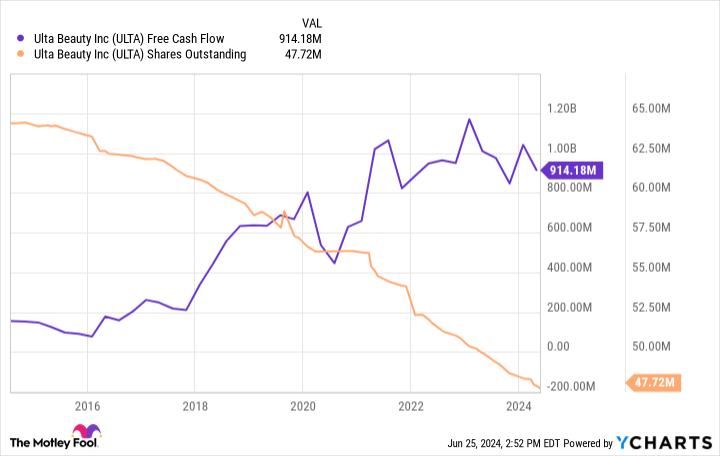

Ulta Beauty’s margin declines aren’t necessarily a reason to panic. Current gross margins of 38.9% are still significantly higher than before the pandemic, when Ulta’s margins were about 36%. The company’s free cash flow is still in a ten-year range, which should continue to drive future stock buybacks. It has reduced its share count by 26% over the past decade, which is helping to drive earnings per share growth.

Ultimately, investors must determine whether Ulta Beauty can continue to drive growth over the long term. Nothing here seems to indicate that this can’t be done.

The sale has gone far enough

The market has been aggressively selling off Ulta Beauty stock in recent months and the stock has become cheap. The company has averaged a price-to-earnings ratio of 32 over the past decade. Today, Ulta Beauty trades at just 15 times estimated 2024 earnings — less than half the long-term average valuation.

It would make sense for Ulta Beauty’s business to be seriously damaged, but as discussed, that doesn’t appear to be the case. Moreover, analysts are optimistic and expect the company to grow earnings by an average of more than 12% per year in the long term.

There is a famous saying that the stock market can be irrational at times. That saying works both ways: Stocks can become remarkably expensive or cheap depending on the whims of Wall Street. Ulta Beauty has fallen out of fashion, and the market has used some legitimate short-term speed bumps to unfairly sell the stock into the ground.

The stock is a bargain at this price, making it an attractive buy for long-term investors willing to wait for these challenges to subside.

Should You Invest $1,000 in Ulta Beauty Now?

Consider the following before buying shares in Ulta Beauty:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Ulta Beauty wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $757,001!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns June 24, 2024

Justin Pope has no position in any of the stocks mentioned. The Motley Fool holds and recommends positions in Ulta Beauty. The Motley Fool has one disclosure policy.

This market-based share is a great buy at the moment was originally published by The Motley Fool