Finance

Traders are now targeting just one rate cut in 2024

Markets took a sharp downturn Thursday afternoon after an initial surge to historic highs in tech-heavy stock indexes, driven by Nvidia Corp.‘s (NASDAQ:NVDA) spectacular AI-driven earnings report.

The CBOE Volatility Index (VIX), also known as the market fear index, rose more than 7% after hitting its lowest level since November 2019 earlier in the session.

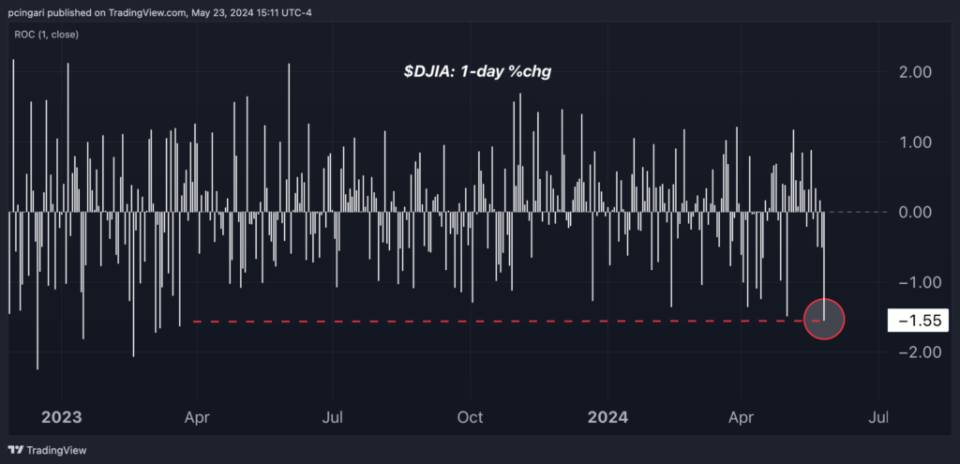

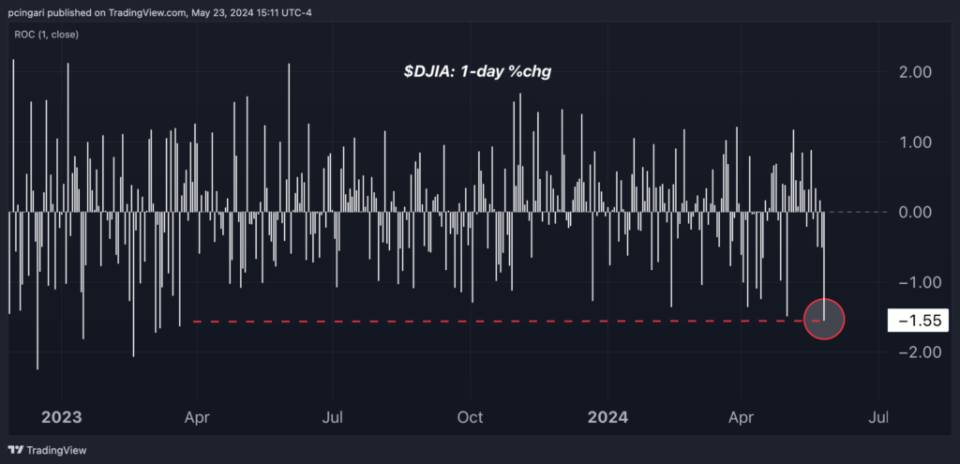

Blue chip stocks in particular were hit by a sell-off across the broader sector. The Dow Jones Industrial Average, followed by the SPDR Dow Jones Industrial Average ETF (NYSE:DIA), was down 1.5% at 3 p.m. in New York, on track for its worst performance since March 2023.

Both the S&P 500, followed by the SPDR S&P 500 ETF Trust (NYSE:SPY) and the Nasdaq 100, monitored via the Invesco QQQ Trust (NASDAQ:QQQ), fell 0.9%.

Chipmakers were the only sector in the green sector, with the VanEck Semiconductor ETF (NYSE:SMH) rose 0.8%, driven by Nvidia’s 8.7% rally.

Chart: Dow Eyes worst day in more than a year

What happened: Sentiment took a hit after S&P Global released its private sector activity surveys in May. The Composite PMI Index, a gauge of the overall health of the business community, showed the biggest increase rate over two years.

This may seem like good news, but the devil is in the details.

“Input prices continued to rise sharply in May, with the pace of inflation accelerating and recording the second-largest monthly increase in the past eight months,” S&P Global reported.

Manufacturers in particular experienced a strong increase and were confronted with the largest cost increase in a year and a half. This was attributed to higher supplier prices for a wide range of inputs, including metals, chemicals, plastics and wood-based products, as well as higher energy and labor costs.

Chris Williamson S&P Global’s chief business economist indicated that retail price inflation has risen, and continues to point to inflation modestly above target.

He emphasized that the primary inflation pressure now comes from industry and not from the services sector. This shift has resulted in higher inflation rates for both costs and retail prices compared to pre-pandemic norms, implying that achieving the Fed’s “2% target still appears elusive.”

Why it matters: Stronger-than-expected growth in business confidence and renewed concerns about inflation pushed Treasury yields higher across the board, causing investors to reassess the likelihood of Fed rate cuts.

It is striking that there has been a significant shift in expectations for interest rate cuts. Fed futures are currently pricing in just 34 basis points of rate cuts by year-end, which translates to just one rate cut.

While investors had expected a September rate cut as of Wednesday, that expectation has now been postponed until November, according to the CME Group Fed Watch Tool.

The interest-sensitive yield on two-year government bonds rose by 6 basis points to 4.93%, reaching the highest closing price since May 1.

The dollar was the only gainer among major asset classes, with the Invesco DB USD Bullish Index Fund ETF (NYSE:UUP), up 0.2%.

Read now: Boeing shares fall as CFO predicts negative cash flow and delivery delays due to regulatory scrutiny

Image: Shutterstock

“SECRET WEAPON OF ACTIVE INVESTORS” Boost Your Stock Game With The #1 Trading Tool For “News & Everything Else”: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

This article VIX Spikes, Dow Jones Falls as Inflation Jitters Price in Fed Dovish Hopes: Traders Now Price in Just One Rate Cut in 2024 originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.