Health

uniQure, Amylyx, Pioneering Flagship, Abbvie

Want to stay up to date on the science and politics driving biotechnology today? Sign up to receive our biotech newsletter in your inbox.

Good morning. It has been a challenging time for workers in the biopharmaceutical industry. We’ve seen companies announce layoffs one after another, and people talking online about how it seems increasingly difficult to land a new job. Read our latest news on this subject below, with new figures on the state of the labor market.

What you need to know this morning

- Pioneering flagship has raised a new $2.6 billion investment fund, plus another $1 billion for sector-specific side funds. This brings the total capital Flagship has raised in its funds since 2021 to $6.4 billion.

- Abvie appointed new R&D chief. Roopal Thakkar will become Chief Scientific Officer and Executive Vice President for R&D, replacing the retiring Thomas Hudson. Thakkar is currently Abbvie’s chief medical officer.

Laid-off biopharmaceutical employees compete for scarce vacancies

Layoffs in the biopharmaceutical industry have been going on for several years and workers appear to have fewer and fewer prospects. As an indication of how tough the job market is, more job cuts have been made this year at large pharmaceutical companies than at small biotech companies.

About 67% of workers laid off in the first half of this year were at major pharmaceutical companies, according to data from trade group BIO. That’s a sharp jump from 2021 to 2023, when larger companies were responsible for 47% of layoffs.

Many of these cuts have been announced as part of broader reorganizations by companies with best-selling, off-patent products. One employee who was made redundant at Bristol Myers Squibb has so far unsuccessfully applied for 60 vacancies. Another employee who was laid off from BMS decided to leave the biopharmaceutical industry altogether and accepted a job at Amazon.

Read more from STAT’s Jonathan Wosen.

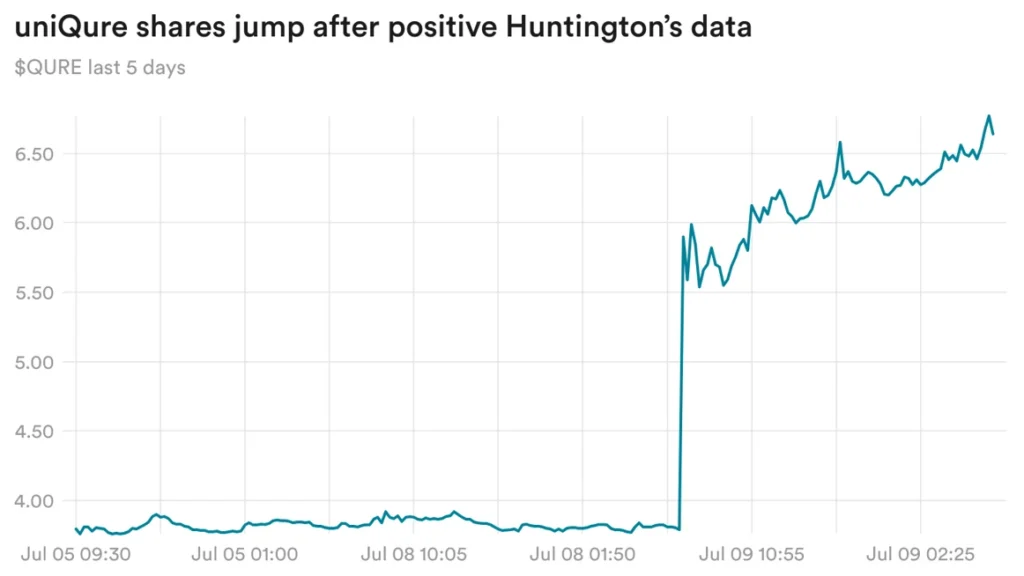

UniQure shares are rising thanks to Huntington’s data

UniQure was the best-performing biopharmaceutical stock yesterday, with shares rising 76% after the company reported positive data on its experimental gene therapy for Huntington’s disease.

Updated interim data from a phase 1/2 trial showed that after two years, nine patients who received the high dose of the drug had a decrease of 0.2 points on a measure of disease progression called cUHDRS. This is comparable to a decrease of 1 point in an external control group based on natural history research. These data suggest that there was an 80% delay in disease progression in treated patients.

However, analysts said the future of this drug will largely depend on how uniQure’s discussions with regulators go, especially whether it will be OK to use a natural history control group. The company will meet with the FDA in the second half of this year to discuss the possibility of accelerated approval.

Why Amylyx is betting on a GLP-1 antagonist

After withdrawing its ALS drug from the market after a failed trial, Amylyx has now acquired a GLP-1 receptor antagonist from Eiger BioPharmaceuticals. The company plans to start a Phase 3 program next year to test the drug in a condition called postbariatric hypoglycemia, it said in a press release today. I spoke briefly with co-CEOs Justin Klee and Joshua Cohen about this decision.

First, to be clear, this drug is not in the same class as the very popular diabetes and obesity medications – which are GLP-1 receptor drugs. agonists. The drug Amylyx acquired, called avexitide, blocks GLP-1 receptors and has been tested in rare situations: postbariatric hypoglycemia and congenital hyperinsulinism. In both cases, patients’ insulin levels are too high and they experience dangerously low blood sugar levels. The CEOs said these patients also have elevated levels of the GLP-1 hormone (which promotes insulin secretion), and avexitide is designed to help patients return to normal physiological GLP-1 levels.

I asked Klee and Cohen why they chose this drug, given Amylyx’s historical focus on neurodegenerative diseases. The CEOs noted that they have long been investigating a candidate for Wolfram syndrome, a rare genetic disorder that causes diabetes in children, and that the new drug builds on their work in endocrinology. So now they see the two main focus areas for the company as neuro and endocrine disorders, they said.

When developing endocrine drugs, there are well-established outcomes that can be measured in studies, such as glucose and insulin levels, while for neurodegenerative diseases, research continues to find better biomarkers to measure disease, Cohen said.

Pfizer’s Chief Scientific Officer is resigning

After serving as Pfizer’s Chief Scientific Officer for 15 years, during the tenures of three CEOs, Mikael Dolsten will step down once he helps find his replacement.

My colleague Matt Herper reflected on the ups and downs of Dolsten’s tenure. A key highlight was Pfizer’s performance during the Covid-19 pandemic, when the company and its partner BioNTech defeated Moderna to become the first to bring a Covid vaccine to market.

But more recently, Pfizer has failed to live up to investor expectations, with the company’s shares now trading at about half of where they were at their pandemic peak.

Read more.

FTC goes after PBMs in new report

The FTC released a lengthy report yesterday saying pharmacy benefit managers wield “tremendous power” that can influence what drugs are available, at what price, and which pharmacies patients can use to get drugs.

The three largest PBMs — Caremark Rx, Express Scripts and OptumRx — processed nearly 80% of the approximately 6.6 billion prescriptions dispensed by U.S. pharmacies in 2023, the FTC said.

In addition, PBMs, which are now part of massive conglomerates that also include large insurers and pharmacy chains, impose unfair and harmful contract terms on independent pharmacies, potentially putting them out of business, the report said.

Read more from STAT’s Ed Silverman.

Read more

- Zevra faces an FDA admonition in August over a previously rejected drug for rare diseases, Endpoints

- SciRhom raises $70 million for a new type of drug against immune diseases BioPharma Dive

- Free medical school tuition is unlikely to have a major impact on the US healthcare system, STAT

- Listen: Anthony Fauci on Presidents, Bird Flu, and Turning Down a Million-Dollar Job, STAT