Business

Warm weather boosts UK retail sales in July, but big-ticket purchases are still lagging behind

The delayed arrival of warm summer weather led to a recovery in UK retail sales in July, according to industry data, even as consumers continued to avoid major purchases due to the ongoing cost of living crisis.

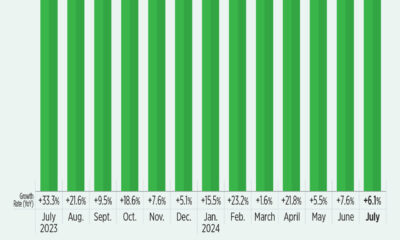

Data from the British Retail Consortium (BRC) showed a 0.5% year-on-year increase in total UK retail sales in July. This marked a recovery from the disappointing performance in June, when cooler weather had kept consumers away from spending on the high street.

In July, consumers purchased summer clothing and health and beauty products in preparation for trips and vacations. However, spending on furniture and home appliances fell as consumers with financial difficulties preferred essentials to expensive items.

The Bank of England cut interest rates last week for the first time since the COVID-19 pandemic, following a sharp fall in inflation to its 2% target in May and June. Nevertheless, prices remain significantly higher than four years ago.

Linda Ellett, UK head of Consumer, Retail and Leisure at KPMG, notes: “Spending levels continue to be driven by whether households have been able to absorb mortgage and rent increases, or as a result have had to limit their spending elsewhere . While summer staples such as health, beauty and garden products contributed to retail sales growth, both online and in-store, in July, the rebound is likely to be much smaller than retailers had hoped for in this important time of the year.”

Additional data from Barclays showed that overall consumer card spending fell 0.3% year-on-year in July as discretionary spending remained selective amid higher living costs. Barclays, which processes almost 40% of UK credit and debit card transactions, also reported higher spending on health and beauty products due to warmer weather and delayed summer sales, contributing to a modest retail recovery.

However, non-essential spending fell 1.1%, due to cuts in clothing, home improvements and sporting goods purchases. Meanwhile, pubs and bars saw a surge in spending as football fans gathered to watch England’s progress in the men’s Euro 2024 tournament. Despite the losses compared to Spain, payments in pubs and bars almost tripled on July 14, an increase of 195.6% year on year. This makes it the busiest Sunday for pubs in 2024 so far, with transaction volume up 92.9% compared to average. Sunday.

In the services sector, the S&P Global UK services purchasing managers’ index (PMI) indicated a rise in demand in July at the fastest pace since May 2023. This survey, which excludes retail, is closely watched by the Bank of England and the Ministry of Finance. early economic indicators. The PMI rose to 52.5 in July from 52.1 in June, with any reading above 50.0 indicating growth in private sector activity.

Joe Hayes, chief economist at S&P Global Market Intelligence, commented: “As the general election period drew to a close in early July, survey data over the past month showed the UK services sector making a modest recovery following a fairly muted end to the economic crisis. second quarter. The accelerated expansion of sales activity in July suggests that business and consumer confidence has improved, and although the second half of 2024 is only a month old, the latest survey results bode well for reasonable GDP growth in the third quarter.”