Finance

Warren Buffett Berkshire Hathaway reduces stake in EV maker BYD to 6.9%

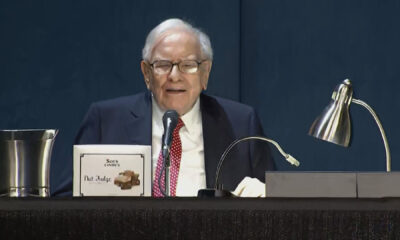

Warren Buffett speaks during Berkshire Hathaway’s annual shareholder meeting in Omaha, Nebraska, on May 4, 2024.

CNBC

Berkshire Hathaway, an early investor in BYD thanks to the late Charlie Munger, is further reducing its enormous stake in China’s largest electric vehicle manufacturer.

Warren Buffett’s conglomerate has sold another 1.3 million Hong Kong-listed BYD shares for $39.8 million. an application to the Hong Kong Stock Exchange. The sale reduced Berkshire’s stake from 7% to 6.9%.

The conglomerate first bought about 225 million shares of Shenzhen-based BYD in 2008 for about $230 million. The bet turned out to be extremely lucrative as the EV market experienced explosive growth in China and elsewhere.

Berkshire had divested half its stake through sales in 2022 and 2023, after BYD rose nearly 600% to a record high in April 2022 from early 2008.

Hong Kong rules only require a submission when a stake percentage exceeds an integer, so if Berkshire’s stake falls below 6%, a new submission will occur.

Munger’s influence

Founded by Wang Chuanfu, BYD started making cell phone batteries in the 1990s. In 2003, the company focused on cars and has since become the largest car brand in China, as well as a major producer of EV batteries.

In the fourth quarter of 2023, BYD dethroned Tesla as the world’s largest EV manufacturer, selling more battery-powered vehicles than its US rival.

Buffett said in 2010 that Munger, Berkshire’s late vice chairman, “deserves 100 percent of the credit for BYD.” Munger was introduced to BYD by his friend Li Lu, founder of Seattle-based asset manager Himalaya Capital.