Finance

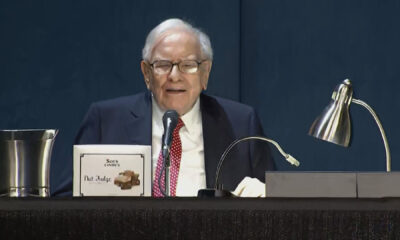

Warren Buffett gets a discount on this exceptional share. Here’s how you can do that too.

Sometimes the market offers unique opportunities to get an even bigger discount on a stock that is already trading at an attractive price. Warren Buffetts Berkshire Hathaway (NYSE: BRK.A) (NYSE: BRK.B) seems to be seizing one of those opportunities right now.

Berkshire Hathaway purchased a total of $167.5 million worth of shares Liberty SiriusXM (NASDAQ:LSXMA) (NASDAQ: LSXMK) tracking the shares in April, bringing the total position to approximately $2.6 billion. The tracking stock closely follows Liberty Media’s position Sirius XM (NASDAQ: SIRI), of which the media company owns 83%. Berkshire is also an investor in Sirius XM, although the total investment is currently only $125 million as of the most recent update.

But there’s a good reason for Buffett to choose Liberty tracking stock over Sirius XM stock. It gets a nice discount.

How Investors Can Get a Discount on Sirius XM

In December, Sirius XM and Liberty agreed to merge the two stocks. The merger is expected to close in the third quarter, when Liberty SiriusXM shareholders will receive 8.4 shares of Sirius XM stock per share of tracking stock they currently own.

At current market prices, 8.4 shares of Sirius XM are worth approximately $26.20. Meanwhile, Liberty tracking shares are trading around $25.13. As such, investors who purchase Liberty SiriusXM will receive an additional (approximately) 4% discount on shares.

In the past, that discount was much larger. When the merger was first announced in December, investors could get a huge 39% discount by buying the tracking stock instead of Sirius XM.

But there were good reasons for that discount. Strong short interest in Sirius XM last year made the shares difficult to borrow. That hampered price formation, causing shares to trade above their market value. The Liberty SiriusXM tracking stock therefore offered a better reflection of the market value of Sirius XM’s business. As short interest has fallen due to Sirius XM’s declining stock price, the discount on shares of Liberty SiriusXM tracking stock has shrunk.

But there is still a small discount. And that reflects that there is some risk versus owning shares of Sirius XM directly. The merger is still months away and it is still possible that Sirius However, as time goes by, that seems less and less likely. In all likelihood, the merger will proceed as planned.

So investors can currently get a discount on Sirius XM stock, albeit a smaller discount than before. Should they follow Buffett and Berkshire Hathaway into the stock?

Is Sirius XM worth owning?

Sirius XM is the largest satellite radio company in the United States, serving 33 million subscribers. Unlike terrestrial radio stations, which make most of their revenue from on-air advertising, Sirius makes most of its money from subscriptions.

That said, Sirius has been struggling to grow lately. First-quarter subscriber revenue fell a small amount year over year, although advertising revenue, mainly from streaming service Pandora, offset the decline. Subscriber churn also rose by a tenth of a percentage point, but that is not an unusual seasonal influence for Sirius.

However, the company may be about to turn a corner, reviving revenue growth. Sirius’ top of the subscriber funnel – free trials for new car buyers – rose to 7.5 million at the end of the first quarter. This compares with 7.2 million at the end of last year and at the end of the first quarter of 2023. As a result, management expects subscriber growth to pick up in the second half of the year.

Sirius XM’s biggest challenge is its growth streaming services. While Sirius benefits from much more favorable economic conditions than streaming, resulting in a higher profit margin and free cash flow conversion, competition is slowing subscriber growth. To that end, it acquired Pandora in 2019 and offers a streaming version of its satellite radio service. It has also invested heavily in podcasts and revamped its mobile app. Programmatic ad sales rose 29% in the first quarter across streaming and podcasting, driving total ad revenue up 7% year over year.

The revamped app and a push to purchase more exclusive podcasts could boost subscriber conversion through free trials. It’s also working with manufacturers to include its latest 360L system, which offers an improved user experience, including more personalized listening recommendations. Sirius found a higher conversion rate for trial members with 360L than without.

With a growing number of new subscribers, an upward trend in digital ad sales and increasing investments in podcasting, Sirius appears poised to return to subscriber growth. Meanwhile, the shares trade at just 10.1 times forward earnings estimates and an EV/EBITDA ratio of just 8.2. If you can get even more of a discount by buying Liberty Media’s tracking stock, things look even more attractive.

Should You Invest $1,000 in Berkshire Hathaway Right Now?

Consider the following before buying Berkshire Hathaway stock:

The Motley Fool stock advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The ten stocks that survived the cut could deliver monster returns in the coming years.

Think about when Nvidia created this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $544,015!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building guidance, regular analyst updates, and two new stock picks per month. The Stock Advisor is on duty more than quadrupled the return of the S&P 500 since 2002*.

*Stock Advisor returns April 30, 2024

Adam Levy has no position in any of the stocks mentioned. The Motley Fool holds positions in and recommends Berkshire Hathaway. The Motley Fool has one disclosure policy.

Warren Buffett gets a discount on this exceptional share. Here’s how you can do that too. was originally published by The Motley Fool