Finance

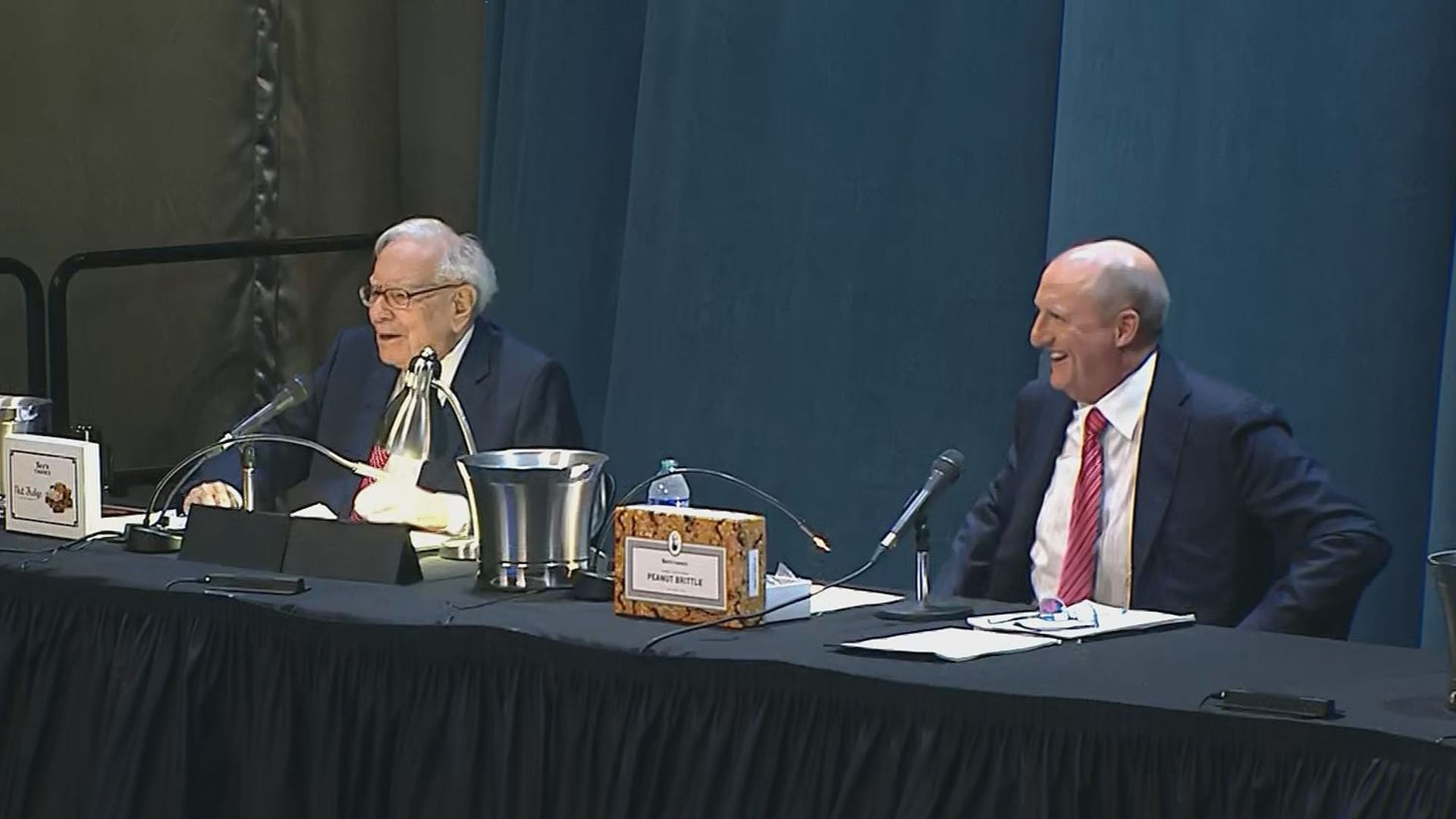

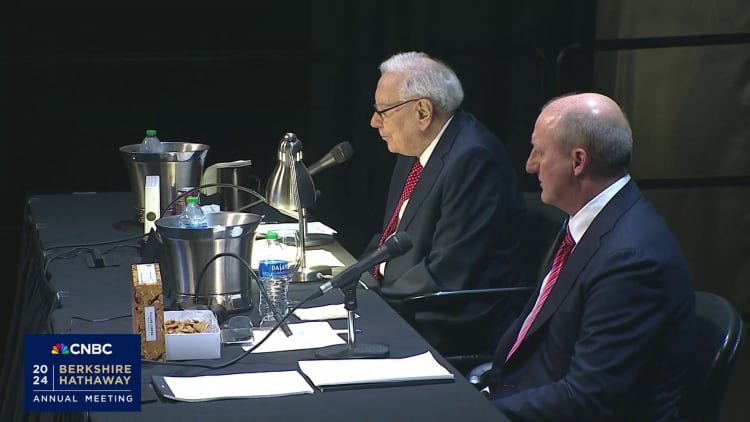

Warren Buffett says Greg Abel will make investment decisions for Berkshire Hathaway when he’s gone

OMAHA, Neb. — Warren Buffett said Saturday that his designated successor Greg Abel will have the final say on Berkshire Hathaways investment decisions when the Oracle of Omaha is no longer at the helm.

“I would leave capital allocation to Greg and he understands business extremely well,” Buffett said before an arena full of shareholders at Berkshire’s annual meeting. “If you understand companies, you understand common stocks.”

The 61-year-old Abel became known as Buffett’s heir apparent in 2021 after Charlie Munger accidentally made the revelation at the shareholders’ meeting. Abel has overseen much of Berkshire’s sprawling empire, including energy, railroads and retail.

Buffett offered the clearest insight yet into his succession plan, after years of speculation about the exact role of Berkshire’s top executives after the eventual transition. The investing icon, who turns 94 in August, said his decision will be influenced by how much Berkshire’s assets have grown.

“I used to think differently about how that would be handled, but I think the responsibility should be with the CEO and whatever that CEO decides can be helpful,” Buffett said. “The amounts have gotten so big at Berkshire, and we don’t want to try to have 200 people around us managing a billion each. It just doesn’t work.”

Berkshire’s cash pile rose to nearly $189 billion at the end of March, while Berkshire’s massive stock portfolio contains shares worth as much as $362 billion, based on current market prices.

“I think when you deal with the amounts of money that we’re going to have, you have to think very strategically about how to do very big things,” Buffett added. “I think the responsibility should be entirely on Greg.”

Although Buffett has made it clear that Abel would take over as CEO, there were still questions about who would gain control of Berkshire’s public stock portfolio, where Buffett has amassed a huge following by delivering huge returns through investments in, among other things Coca-Cola And Apple.

Berkshire investment managers Todd Combs and Ted Weschler, both former hedge fund managers, have helped Buffett manage a small portion of the stock portfolio (about 10%) over the past decade. There was speculation that they could take over that part of Berkshire’s CEO role if he is no longer able.

But based on Buffett’s latest comments, it appears Abel will make final decisions on all capital allocation – including stock selection.

“I think the CEO has to be someone who can balance buying companies versus buying stocks and doing all kinds of things that might come up at a time when no one else is willing to move,” Buffett said.

Abel is known for its strong expertise in the energy sector. Berkshire acquired MidAmerican Energy in 1999 and Abel became CEO of the company in 2008, six years before it was renamed Berkshire Hathaway Energy in 2014.

Correction: Berkshire’s stock portfolio is worth $362 billion. An earlier version displayed the figure incorrectly.