Finance

Was high inflation inevitable? -Ecolib

In the period following the 2020 Covid pandemic, many countries experienced relatively high inflation. This reflects two factors:

1. All countries were hit by shocks, such as supply chain disruptions related to Covid-19 and the war in Ukraine.

2. Most countries introduced very extensive stimulus programs, which had similar effects in both cases.

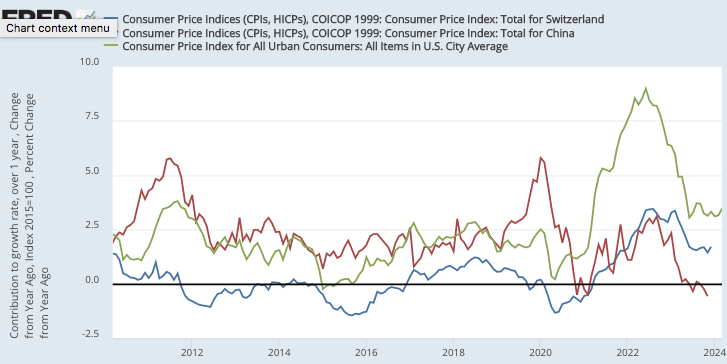

It was appropriate to allow some increase in inflation in response to negative supply shocks. That’s the whole idea behind a “flexible” average inflation target. But the actual inflation rate also reflected excessive growth in aggregate demand and was thus inappropriately high in many countries, including the US. I worry when people seem to suggest that the Fed couldn’t have done much about the rise in inflation because it was happening in many other countries as well. In fact, not all countries had extremely high inflation. Note that China (red line) and Switzerland (blue line) saw some increase in inflation, but much less than the US (green line):

In a podcast Along with David Beckworth, former Fed Vice Chairman Richard Clarida suggests that the similar pattern experienced by most countries suggests that differences in monetary policy were not crucial in this particular case:

The most important thing to remember about the lessons learned from the post-pandemic rise in inflation is that it was very similar across countries, in implementation and in all policy strategies. So inflation was too high for single-mandate inflation targets, such as the Bank of England. According to the single mandate inflation targets, inflation for the eurozone was too high.

In Switzerland inflation was too high. In Australia it was too high. In Canada it was too high. Moreover, all other advanced economy inflation targets, with the exception of the SNB and the Norwegian Central Bank, also chose to stay behind the curve, in the sense that they only started raising rates until core inflation in their country had achieved well above target. . So it was something in the initial conditions – inflation had been too low for a decade – in the size and complexity of the shocks, because they affected both supply and demand, that led central banks to do very similar things and very similar launches to achieve. , very similar inflation history, and now very similar disinflation.

So I think and I predict that as time goes on, scholars will look back on this period and not think that it revealed much about inflation targeting versus flexible average inflation targeting versus single mandate versus dual mandate. They think it will reveal something about the initial conditions and the size and complexity of the shocks.

I would argue that the cross-country pattern we see suggests that some differences in policy regimes are more important than others. Take for example the case of China, where inflation has fallen to levels even lower than those of Japan, and even to slightly below zero. Why could this have happened?

It is worth noting that the Japanese currency has recently depreciated very sharply against the US dollar, while the Chinese currency has depreciated only very modestly. Some experts have suggested that China is reluctant to allow a sharp devaluation of its currency, fearing it would provoke a protectionist response in the US. Whatever the reason, China appears to have fallen into excessively tight monetary policy as the country is reluctant to allow a dramatic decline in the exchange rate value of its currency.

This is another example of where the price-of-money approach policy can be much more powerful than the interest rate approach, a point I emphasized in my recent book. Once China decided not to allow a sharp decline in its nominal exchange rate, it could only achieve an equilibrium real exchange rate by allowing price level deflation. A similar pattern occurred in Argentina in the late 1990s, when a fixed exchange rate combined with a strong US dollar led to price deflation.

P.S. Nothing in the Clarida interview made me optimistic about the coming overhaul of the Fed’s policy regime. It seems clear to me that the average inflation target regime should at least be made symmetric, but I don’t see Fed officials advocating that kind of change. I hope I’m wrong, but I expect more of the same: a policy that allows far too much discretion.