Finance

Which consumer goods share is the best choice?

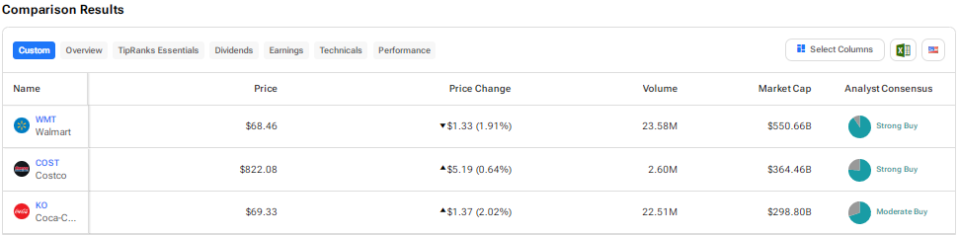

Consumer staples companies tend to be resilient in challenging macroeconomic times. This is because they sell products that are considered essential for everyday life. Using TipRanks’ stock comparison toolwe placed Walmart (WMT)Costco (COST)and Coca Cola (KO) Wall Street analysts say they’ll be competing against each other to find the best consumer staples stocks.

Walmart (NYSE:WMT)

Shares of big-box retailer Walmart are up about 30% so far this year. WMT impressed investors with its Positive results for Q1 FY25 (ending April 30, 2024). The 22% growth in adjusted earnings per share (EPS) in the first quarter of 2025 was driven by strong revenue growth, higher gross margin and membership revenue.

Walmart’s value offering continues to attract bargain-seeking customers in a difficult macroeconomic environment. The company’s grocery business is experiencing strong growth, with many customers choosing to cook at home rather than eating out at restaurants due to high inflation.

WMT is also benefiting from the strength of its e-commerce business. In the first quarter of FY25, WMT’s e-commerce sales rose 21%, fueled by in-store pickup and delivery and the company’s growing marketplace. Importantly, the company is looking to improve its profitability by focusing on high-margin businesses such as advertising, memberships, marketplace and fulfillment solutions, and data analytics and insights.

Walmart is expected to report fiscal second-quarter results on August 15. Analysts expect that from the company Earnings per share rose 6.5% to $0.65 per share and revenue will grow by more than 4% to $167.4 billion.

Is Walmart a good stock to buy now?

Last week, BMO Capital analyst Kelly Bania raised the price target on WMT stock from $75 to $80 and reaffirmed a buy rating after discussions with the company’s management. The analyst said Walmart is well positioned to grow its EBIT (earnings before interest and taxes) faster than sales, even as the company continues to make growth investments.

The analyst believes management’s expectations that the U.S. e-commerce business will become profitable in the next one to two years are feasible. His optimism is supported by a 40% reduction in delivery costs in recent quarters, the benefits of supply chain automation and an increase in the number of customers willing to pay for faster delivery options.

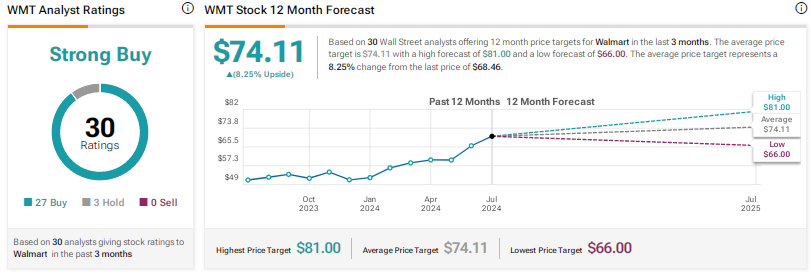

Walmart stock earns a Strong Buy consensus rating, backed by 27 Buys and three Holds. The average WMT stock price target of $74.11 implies an upside potential of 8.3%. WMT offers a dividend yield of 1.2%.

Costco Wholesale (NASDAQ:COST)

Members-only warehouse chain Costco Wholesale continues to impress investors with its consistent performance. Costco’s resilient performance is underpinned by its value offering and a loyal customer base. The company generally has membership renewal rates of around 90%.

Despite macro pressures, Costco reported better-than-expected June sales. The company’s net sales for the retail month of June (five weeks ending July 7, 2024) increased 7.4% to $24.48 billion. Comparable sales for June rose 5.3%, while e-commerce sales grew 18.4%.

The company recently made the long-awaited increase in contributions. Investors cheered the news, as Costco’s membership fee makes up a significant portion of the company’s profits.

What is the target price for Costco?

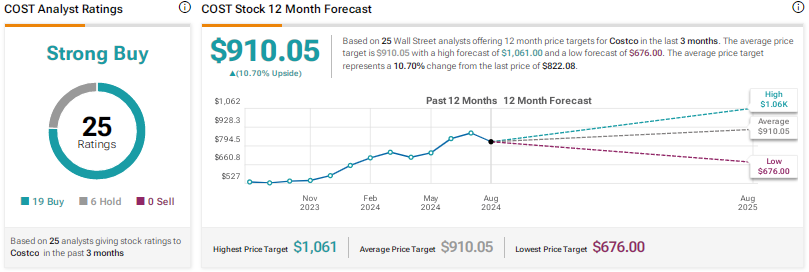

After announcing the membership fee increase, TD Cowen analyst Oliver Chen raised the price target on Costco shares from $850 to $925 and reaffirmed a buy rating.

The analyst believes the company’s digital innovation, personalization and market opportunities support its premium valuation.

With 19 Buys versus six Holds, Costco stock is assigned a Strong Buy consensus rating. The average COST stock price target of $910.05 implies an upside potential of about 11%. Shares are up 24.5% so far this year. COST shares offer a dividend yield of 0.5%.

Coca-Cola (NYSE:KO)

Shares of soft drink giant Coca-Cola are up about 18% this year. The company announced this last month better than expected results for the second quarter, with organic sales increasing 15%. The company’s performance reflected strong execution in a challenging business context.

Given the solid results in the second quarter, KO has raised its full-year organic sales growth guidance to a range of 9% to 10%, up from previous guidance of 8% to 9%. The company also raised its outlook for comparable earnings growth.

Coca-Cola was in the news last week due to an adverse development related to its legal dispute with the US Internal Revenue Service. The company must pay $6 billion in back taxes and interest to the IRS. Although Coca-Cola will pay the tax penalty, it will appeal the federal tax court’s decision.

TD Cowen analyst Robert Moskow stated that there could be negative impacts on the company’s tax rate if KO loses the appeal, although “relatively minor.” The analyst added that his earnings per share estimates would fall by almost 5% if KO’s tax rate rose from 19% to 24%.

Is KO a good stock to buy?

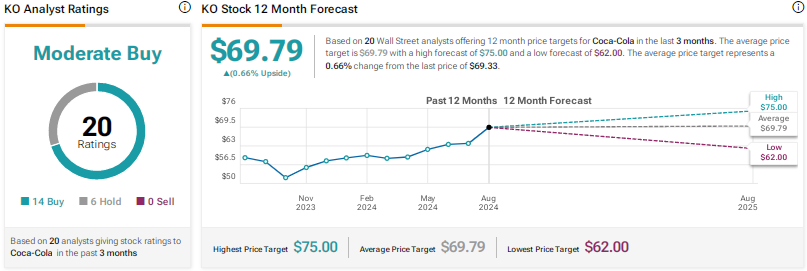

Most analysts covering KO stock remain optimistic about its prospects. In response to Coca-Cola’s second-quarter earnings, RBC Capital analyst Nik Modi reaffirmed a buy rating on KO stock and raised his price target to $68 from $65, citing strong sales growth, volume momentum and high-quality earnings in the quarter.

However, the analyst pointed to the company’s comments about a softer third quarter due to tough sequential comparisons and weakness in some developed markets.

Overall, Coca-Cola has a consensus rating of Moderate Buy, based on 14 Buys and six Holds. The average KO stock price target of $69.79 indicates that the stock is fairly valued at current levels. KO offers one dividend yield of 2.8%.

Conclusion

Wall Street is very bullish on Costco and Walmart and cautiously bullish on Coca-Cola. Currently, analysts see similar upside potential in Costco and Walmart stocks. Both stocks have proven the strength of their business models and continue to attract customers with their value proposition.

While Wall Street has a strong buy rating on both COST and WMT stocks, it’s interesting to note that hedge funds have a strong buy rating. Very positive confidence signal on WMT shares but one Negative signal on Costco. Hedge funds increased their WMT holdings by 11.5 million shares last quarter. In contrast, hedge funds reduced their COST holdings by 1.1 million shares over the same period.