Finance

Which price indices are the most useful?

I don’t think it makes sense to talk about the actual inflation rate. After all, no one seems to know what inflation is supposed to measure. Some economists might argue that it represents the wage increase you need so that you are no worse off in terms of utility. But what does that mean?

Suppose I meet a General Zer who says he would rather make $100,000 today than $100,000 in 1955 (when I was born). After all, today he can get better medical care, better Asian cuisine, better TVs, internet, smartphones, etc., etc. Would that imply that there has been no increase in the “cost of living” since 1955, at least for that person? In my opinion, that would be a foolish way to look at inflation. But given the textbook definitions, how can I say he’s wrong?

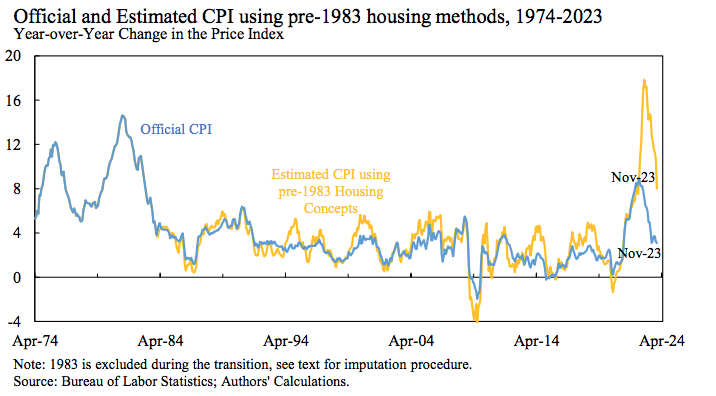

If I am correct that inflation is somewhat subjective, I would still maintain that some price indices are higher usable than others. Josh Hendrikson sent me to an article by Marijn A. Bolhuis, Judd NL Cramer, Karl Oskar Schulz and Lawrence H. Summers (BCSS), which estimates recent inflation using the techniques used before 1983. They put more weight on things like financing costs, which have risen sharply during a period of rising interest rates:

According to their revised estimates, annual CPI inflation peaked at 18% in November 2022, and remained at 9% even in November 2023. (The official figures show that CPI inflation peaked at just 9.1%.) Unless I’m mistaken, data implies a total increase of 28.6% in the CPI between November 2021 and November 2023. Let’s Compare that to some other data points:

Revised CPI: +28.6% between 11/21 and 11/23

Nominal GDP: +13.4% between 2021:Q4 and 2023:Q4

Nominal consumption: +12.9% between 21/11 and 23/11

Nominal average hourly wage: +9.6% between 21/11 and 23/11

At first glance, a 28.6% increase in the price level at a time of much slower nominal growth implies that the US has entered one of the deepest depressions in American history. Frankly, it is not entirely accurate to compare the CPI to nominal GDP, as the CPI only measures the price of consumer goods. You need the GDP deflator.

But note that nominal consumption rose even more slowly than nominal GDP (although both are actually growing rapidly by 21st century standards). So if the revised CPI figures are true, it appears that real consumption has fallen at an astonishing rate – comparable to a major economic depression like the 1930s.

I suppose you could argue that the same techniques BCSS used to adjust the CPI could also affect nominal aggregates like consumption and NGDP. Still, it is difficult to believe that a plausible adjustment to headline consumption growth could even come close to closing the gap with the revised CPI inflation estimate.

Furthermore, any issues with nominal consumption would not affect the estimate nominal average hourly wage, which only increased by 9.6% in total. I suppose it’s technically possible for nominal wages to rise 9.6% while the cost of living rises 28.6%, but what would that mean for the rest of the economy? Wouldn’t that imply a major economic crisis in which workers could afford nothing more than the most basic necessities? And yet everywhere I look I see signs of a booming economy.

To take one example, car sales tend to drop sharply during “tough times.” And yet, car sales have risen sharply during this period of rising interest rates:

And car sales tend to be much more cyclical than other forms of consumption, such as healthcare, education and haircuts. Why have they risen sharply since November 2021?

All our economic data points to strong production growth. The labor market is extremely strong, with low unemployment and very robust growth in overall employment. If you adjust the demographic data (the aging of the population), then the employment-population ratio is back near the peak levels of 1999-2000.

When you ask people why we need inflation estimates, they will typically say something to the effect that inflation adjustments allow us to figure out how the economy is actually performing, without the distortions caused by declining purchasing power of money. In other words, we use inflation to convert nominal variables into real variables. But when I try to apply the BCSS inflation estimates to any plausible nominal variable in the US economy, I end up with real variables that literally make no sense.

To be clear, this is not a criticism of the BCSS article, which focuses on one very narrow question: why is consumer confidence so poor despite a strong labor market? They may be right to say that rising borrowing costs largely explain the public’s surprisingly sour mood.

Rather, my argument here is that these inflation estimates are not usable in a conventional sense. If we try to use them to convert nominal variables into real variables, we end up with nonsense. What am I missing?