Business

BSP expected interest rates to remain stable

By means of Luisa Maria Jacinta C. Jocson, News reporter

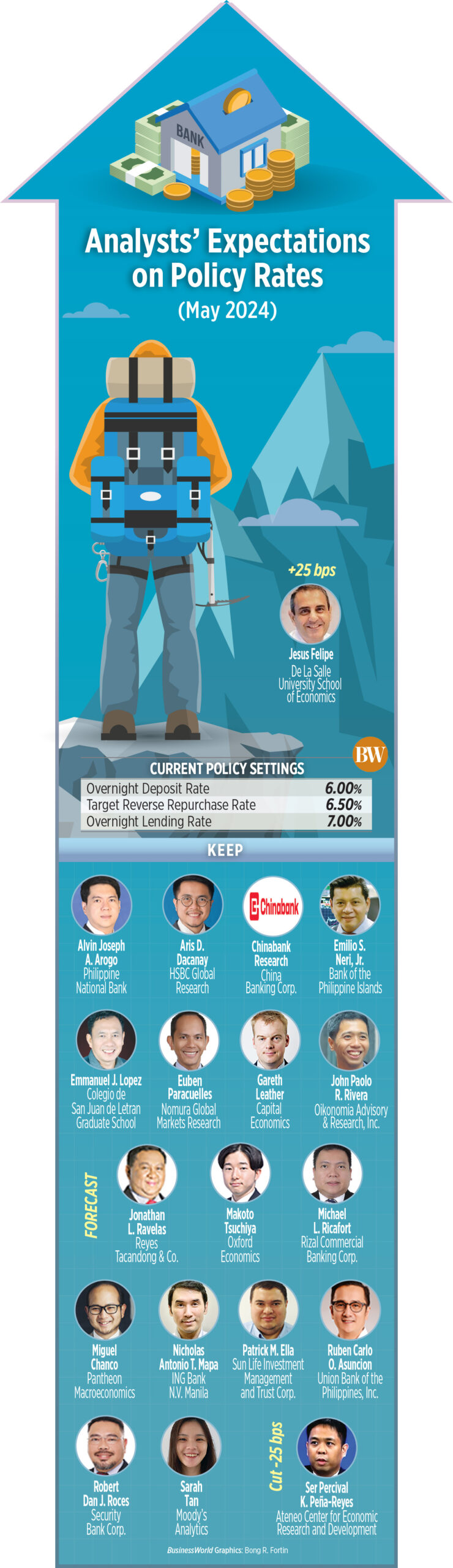

THE BANGKO SENTRAL ng PiliPinas (BSP) is expected to extend the policy pause for a period of 2.5 years Fifth straight meeting this week as inFrisks remain.

a Business A survey of 19 analysts conducted last week showed that at Thursday’s policy review, 17 expect the Monetary Board to maintain its target reverse repurchase rate at a 17-year high of 6.5%.

On the other hand, one analyst expects the BSP to cut rates by 25 basis points (bps), while another expects the central bank to raise rates amid continued interest rate swings.Flat.

The central bank has raised borrowing costs by a total of 450 basis points between May 2022 and October 2023 to keep interest rates in check.Flat.

“May 16 from the Philippine Central Banke There will likely be interest rate cuts at the meeting. This is consistent with their recent cautious approach and the need to balance inflation control with economic growth,” Robert Dan J. Roces, chief economist at Security Bank Corp., said in an email.

Headline inflation accelerated for the third month in a row from 3.7% in March to 3.8% in April. April marked the Fwhen the following month arrivesFThis was within the BSP’s target of 2-4%.

Inflation averaged 3.4% in the US Ffirst four months, still below cenTral Bank’s 3.8% full-year forecast.

Emilio S. Neri, Jr., chief economist of the Bank of the Philippine Islands, said the central bank will keep its benchmark interest rate unchanged if “inFThe situation remains uncertain, just as growth indicators continue to show overall resilience.”

In a note, Chinabank Research said the BSP is likely to maintain its hawkish stance this week given risks to inflation and weaker-than-expected gross domestic product (GDP) growth in the Ffirst quarter.

“The country’s GDP growth was weaker than expected at 5.7% Ffirst quarter, but was still a solid print and outperformed some of our regional peers.

This should give the BSP room to leave monetary settings unchanged (this) week,” Chinabank Research said.

The Philippine economy grew 5.7% in the first quarter, faster than 5.5% in the fourth quarter but slower than 6.4% in the year-ago period.

This fell short of the government target of 6-7% for the full year 2024 and was below the average forecast of 5.9% in a Business opinion poll among twenty economists.

“The BSP will be careful not to cut interest rates prematurely as it anticipates a rise in the coming monthFlation prints just as risk of inFThe reacceleration of the economy remains slightly elevated from August 2024 due to trade, climate and geopolitical uncertainties,” Mr Neri said.

That’s what the BSP saidFInflation could temporarily accelerate above the 2-4% target over the next two quarters due to base eFfects and the impact of weather conditions on agricultural production.

“Our baseline forecasts still point to a breach of the inFation target from May to August due to continued unfavorable base eFamid a challenging supply environment,” Philippine National Bank economist Alvin Joseph A. Arogo said in an email.

Sarah Tan, an economist at Moody’s Analytics, said inflation could rise “around the upper limit” in the coming months due to the El Niño dry spell.

As of April 30, agricultural damage due to El Niño amounted to P5.9 billion. Rice was the most affected crop, accounting for 53.21% or P3.14 billion of the total damage.

“We are still expecting insideFMiguel wants to exceed the upper limit of the BSP target range in the short term, but this should be temporary and we hope that the (Monetary) Council will look over this at next month’s meeting,” said Miguel, head of the emerging economy of Pantheon. Chanco said.

Ruben Carlo O. Asuncion, chief economist of Union Bank of the Philippines, Inc., also mentioned other risks to the inflation outlook, such as a possible adjustment to the daily minimum wage.

“President Ferdinand R. Marcos Jr., through the regional tripartite wage councils, has ordered a review of daily wages, which will be treated as an imminent danger. risk for the inFprospects,” he said.

In June 2023, the National Capital Region wage board approved a P40 increase, bringing the minimum wage to P610 from P570 for workers in the non-farm sector.

Senators have approved a bill on second reading that would increase the daily minimum wage in the private sector by 100 euros.

PESO WEAKNESS

Analysts said the BSP is likely to keep interest rates steady amid the peso’s recent weakness.

“We expect the BSP to remain on hold at the next meeting given the still high numbersFinflation and high pressure on the peso from the stronger US dollar,” Makoto Tsuchiya, an economist at Oxford Economics, said in an email.

The local unit closed at P57.42 against the dollar on Friday, four centavos weaker from the P57.38 Foff Thursday. The peso returned to the P57 level in April amid the escalating scamsFcrime in the Middle East.

“Moreover, the Fed is unlikely to cut rates anytime soon and a cut in Philippine-U.S.Fferential will put more pressure on the exchange rate to weaken,” Mr Arogo said.

The central bank is also unlikely to cut rates ahead of the US Federal Reserve, analysts said.

“With the Fed likely to cut rates in September or possibly even later, the BSPs will do so FThe first rate cut will likely follow the Fed’s action,” Nicholas Antonio T. Mapa, senior economist at ING Bank NV Manila, said in an email.

Mr. Asuncion said the BSP will likely wait to cut rates “until El Niño eFThe consequences have subsided, local food supplies have normalized and rice has arrivedFThe ratio has become significantly smaller.”

BSP Governor Eli M. Remolona Jr. has said that while the central bank oversees the Fed, its decisions are independent of the Fed’s own actions.

The US central bank kept the Fed funds rate stable at 5.25-5.5% at its latest meeting.

“The last one inFThe BSP data is still availableFtarget of 2-4% for the FThe next month in a row could still support possible local rate cuts later in 2024, especially if the Fed moves to cut rates,” said Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort.

Gareth Leather, senior economist at Capital Economics, expects the BSP to cut rates as early as August.

Meanwhile, Ms Tan of Moody’s Analytics said the chances of a rate hike at Thursday’s meeting are low.

“With inflation having a downside surprise, there is no pressure on the BSP to further raise the policy rate at the Monetary Board meeting (this week). There is also no need to start rising to support the peso and avoid forex inductionF“The peso strengthened against the US dollar after US jobs data came in weaker than expected,” said HSBC ASEAN (Association of Southeast Asian Nations) economist Aris D. Dacanay.

On the other hand, Professor Jesus Felipe of the De La Salle University School of Economics said the BSP could potentially raise rates by 25 basis points.

“The situation is complicated. Inside on one sideFUncertainty remains, plus the depreciation of the peso,” he said in an email.

“Our models indicate that the currency will remain at current levels and that inflation will remain in the upper part of the BSP target, between 3.5% and 4%. This leads us to think that BSP could increase its policy rate,” he added.

Meanwhile, Ser Percival Peña-Reyes, director of the Ateneo de Manila University Center for Economic Research and Development, said the central bank may consider cutting interest rates as inFThe bar is still within the target.

“The BSP could go for a rate cut this time due to weaker than expected economic growth. The decision to do so may well have been madeFblinded by the fact that inFlation came within its target,” he said.

Mr Remolona previously said they could consider cutting rates if inflation can calm down Fstable around 3% for consecutive months.