Finance

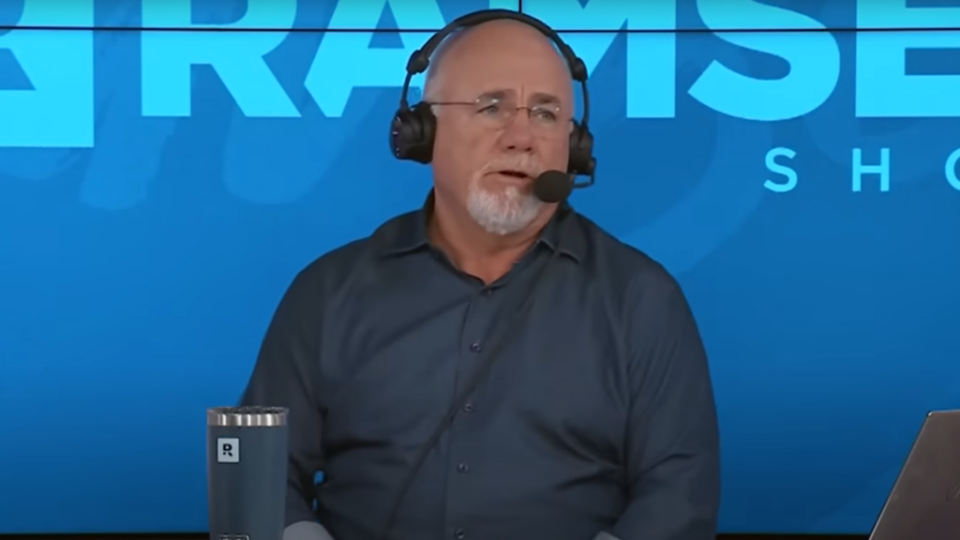

Dave Ramsey tells caller to ‘sell everything’ after purchasing $26,000 tractor, sending 61-year-old into ’emergency mode’

Financial guru Dave Ramsey recently provided critical advice to Teresa, a 61-year-old Arkansas woman facing serious economic challenges. Teresa, whose call was mentioned The Ramsey Show earns $67,000 annually and has about $69,000 in debt, including student loans and personal loans, one of which she used to buy a $26,000 tractor.

Ramsey didn’t hold back when he told her, “Poor people don’t have $26,000 tractors.” He emphasized that Teresa’s unwillingness to sell the tractor, even at a loss, is keeping her from a secure financial future.

Do not miss it:

Teresa initially inquired about her retirement options, as she plans to retire at age 67 and has no money saved. Ramsey advised her that she should pay off her debts before she even thought about it pension. He said, “If I were in your shoes, I’d say, ‘I’m so scared, I’m going crazy and I’m selling the tractor; I’m selling the car and getting a $2,000 car. I’m going to work like crazy. ”

Teresa heard about Ramsey’s celebrity Small steps towards financial peace earlier this year – after her “impulsive” $26,000 purchase – and is desperate to improve her financial stability.

“Pay off all debt (except the house)” is baby step #2, two steps before investing 15% of your household income in retirement. Ramsey repeatedly emphasized that Teresa must get out of debt before doing anything else.

Getting out of debt is not easy, especially if you are used to a specific lifestyle. Ramsey emphasizes this by saying, “You’re about to do some very difficult things. And the people in your life will think that you’ve lost your mind. But what you’re doing is trying to secure the last two decades or three decades of your life. And that is very important to fight for.’

Popular: Warren Buffett once said, “If you don’t find a way to make money while you sleep, you’ll work until you die.” This high-yield real estate bonds with a yield of 7.5% – 9% make earning passive income easier than ever.

Despite his urgent advice about Teresa’s financial emergency, Ramsey tells her there is hope financial security. “It’s not too late, but you trade in a $26,000 tractor for $150,000 when you retire. You trade in an $18,000 car for another $100,000 when you retire. You could set aside a quarter of a million dollars with match if you get your ass.” be out of debt now by the time you get to 67, 68 years old. You can get there.

Teresa is not alone in her financial problems. According to AARP, about one in four adults over age 50 have no retirement savings. Many blame inflation, including rising rent and mortgage costs, as the reason they can’t save. AARP’s research shows that the debt problem is similar to Teresa’s, stating that one-third of adults with credit card debt have a balance of more than $10,000, and 12% have a balance of more than $20,000.

Ramsey would probably tell those struggling to manage the same, “Sell everything and get out of debt now.” It’s scary to look to the future and not have a retirement account to fall back on, but it doesn’t have to stay that way. While many rely on Ramsey’s advice, consider going with one Financial Advisor to help you determine the best options to get out of debt quickly and save for retirement.

Read next:

“SECRET WEAPON OF ACTIVE INVESTORS” Boost Your Stock Game With The #1 Trading Tool For “News & Everything Else”: Benzinga Pro – Click here to start your 14-day trial now!

Want the latest stock analysis from Benzinga?

This article Dave Ramsey tells caller to ‘sell everything’ after purchasing $26,000 tractor, sending 61-year-old into ’emergency mode’ originally appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.