Business

PHL inflation accelerates to 3.8% in April

By means of Luisa Maria Jacinta C. Jocson, News reporter

HEADLINE INFLATION rose for the third month in a row in April, while inflation was higher food and transportation costs, the Philippine Statistics Authority (PSA) reported on Tuesday.

Although the annual increase was below market expectations, it supports the Bangko Sentral ng Pilipinas (BSP) decision to continue its aggressive pause, analysts said.

The pickup “also underlines the need for vigilance,” the National Economic and Development Authority said in a statement.

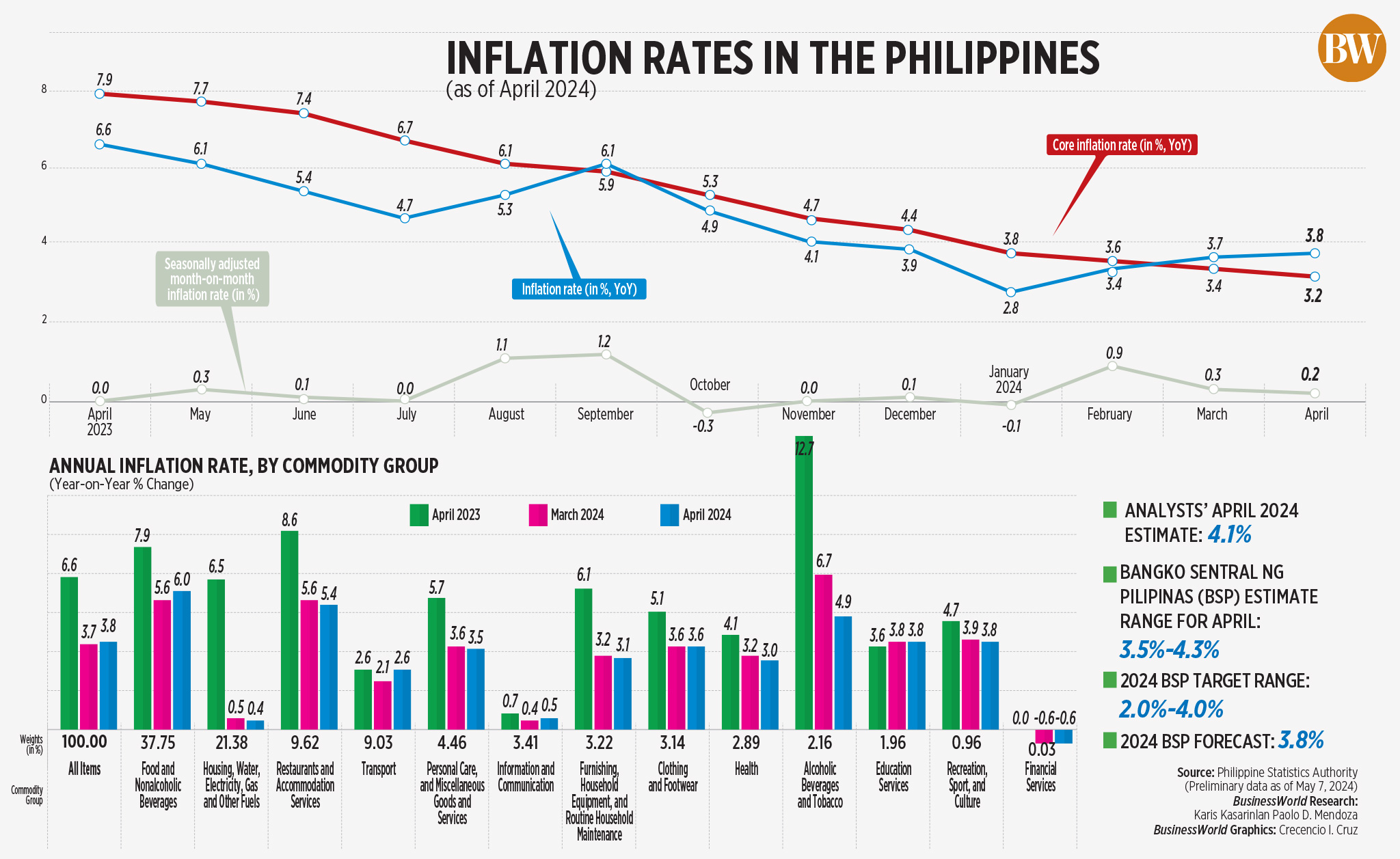

The consumer price index (CPI) accelerated to an annual rate of 3.8% in April from 3.7% in March, preliminary data from the PSA showed. Still, this was slower than the 6.6% in the same month a year ago.

This was within the BSP’s 3.5-4.3% forecast for April CPI and marked the Fwhen the following month arrivesFThis happened within the central bank’s annual target of 2-4%.

April’s print was also below the average estimate of 4.1% in a Business poll among 16 analysts conducted last week.

Month after month, insideFInterest rates fell by 0.1%. Removing seasonal factors, month-on-month inFinterest rates rose by 0.2%.

For the Ffirst four months, shut upFThe average interest rate was 3.4%, still below the BSP forecast of 3.8% for the full year.

“The inflation outcome is consistent with the BSP’s expectations that inflation could temporarily rise above the targeted range in the next two quarters of the year due to the potential negative impact of adverse weather conditions on domestic agricultural production and positive base effects,” it said. the central bank. said in a statement.

“Looking ahead, the Monetary Board will take into account the latest developmentsFlation and FThe BSP results for the first quarter of 2024 (gross domestic product) will be announced, among other things, at the upcoming monetary policy meeting on May 16. The BSP also continues to support the national government’s non-monetary measures to address supply-side price pressures and designFation process,” the central bank added.

The PSA will be released FFirst quarter GDP data on Thursday, May 9.

Core in itFInflation, which excludes volatile food and fuel prices, slowed to 3.2% in April, compared with 3.4% the previous month and 7.9% a year ago.

April’s inflation was mainly driven by the faster annual increase in the heavily weighted index for food and non-alcoholic beverages, said national statistician Claire Dennis S. Mapa.

The index rose to 6% from 5.6% the previous month, but was slower than 7.9% a year earlier.

Food inflation alone accelerated from 5.7% in March to 6.3%. However, this was slower than the 8% print in the same month in 2023.

One of the main factors contributing to faster eating in the worldFThe decline consisted of vegetables, tubers, plantains, cooking bananas and legumes, which increased to 4.3% from the previous month’s decline of 2.5%.

Mr Mapa notes an increase in onion prices. “In April we saw onion prices rise slightly. Compared to last year it is lower, but from March to April we saw an increase.”

PSA data showed that the average onion price outside the National Capital Region (NCR) in April was €126.50 per kilo. Within the region, it averaged P90.30 per kilo.

The grain and grain products index was also a major contributor to food inflation, rising 16.9% in April. This was slower than 17.3% a month ago, but faster than 5.4% a year earlier.

Rice in itFInflation rose by 23.9% in April. However, this was slower than 24.4% a month earlier.

“Rice makes a substantial contribution: it contributed about 46.2% to the total economyFlat. In the 3.8% inFthe percentage contributed about 1.75 percentage points,” Mr Mapa said.

The slight relaxation of the rice sectorFThe situation is due to the decline in rice prices in the world market, he said.

“What we saw is that world prices for rice are falling slightly. It peaked in January and then declined in February and March. That could have an impact on the decline in rice prices,” Mr Mapa added.

PSA data showed that prices of well-milled and specialty rice fell month-on-month in April, while regular milled rice showed an increase.

The average price of a kilo of well-milled rice fell to P56.42 in April from P56.44 a month ago, while specialty rice averaged P64.68 from P64.75. Meanwhile, plain white rice rose to P51.25 from P51.11 in the previous month.

April inFThe increase was also driven by faster increases in transport prices, the PSA said.

Transport inflation rose to 2.6% from 2.1% in the previous month, matching the 2.6% a year ago.

This was mainly due to the faster increase in diesel and petrol prices, Mr Mapa said.

Diesel rose to 4.2% in April from 0.1% a month ago, while gasoline accelerated to 3.3% from 0.8% in March.

In April, adjustments to pump prices amounted to a net increase of P2.25 per liter for gasoline and P0.50 per liter for diesel.

Meanwhile, the inFThe interest rate for the bottom 30% of households with income rose to 5.2% in April from 4.6% in the previous month. This was slower than the 7.4% of a year ago.

In the first two months, the inflation rate for the bottom 30% averaged 4.4%.

In the NCR, inFGrowth fell from 3.3% in March to 2.8% in April. Inflation in areas outside NCR accelerated from 3.8% to 4.1%.

INFLATION, POLICY OUTLOOK

The BSP said there are risks to the inFThe outlook remains positive.

“Possible further price pressure is mainly related to higher transport costs, higher food prices, higher electricity rates and global oil prices. Potential adjustments to the minimum wage could also give rise to a second round eFfects,” it said.

Still, the central bank said it expects the inflation average for this year and next to remain within its target.

Overall inflation averaged 6% in 2023, marking the second year in a row that the BSP’s annual target was exceeded.

“InFInflation is likely to remain on an upward trend and could potentially overshoot the target by mid-2024 due to adverse base effects, unless there are significant impacts.FThere are no obvious price reversals,” Chinabank Research said in a report.

It mentioned weather events such as the dry spell of El Niño and the emergence of the La NiñaFinfluence on local rice production.

As of April 30, agricultural damage due to El Niño amounted to P5.9 billion. Rice was the most affected crop, responsible for 53.21% of total agricultural damage, amounting to €3.14 billion.

Pantheon Chief Emerging Asia Economist Miguel Chanco said the rebound in AprilFThe increase was caused by the acceleration of food importsFsituation that will continue.

“This statistical momentum will continue into May – likely pushing headlines temporarily and marginally above the 4% upper limit of the BSP target range – before declining substantially from June to September,” he said in a note.

Following April’s CPI figures, analysts expect the central bank to keep borrowing costs stable for the fifth time in a row at its meeting this month.

“(In theFThe report reduces pressure on the BSP to resort to additional tightening to fend off price pressures,” said Nicholas Antonio T. Mapa, senior economist at ING Bank NV Manila.

“BSP Governor Eli M. Remolona Jr. believes that the monetary policy settings are appropriate and we expect the BSP to maintain all policy settings at their policy meeting on May 16,” he added.

The Monetary Board kept its benchmark interest rate at a nearly 17-year high of 6.5% in April, after cumulative hikes of 450 basis points from May 2022 to October 2023 to help lower rates.Flat.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said April inflation is within the BSP’s target for the economy. FIf the next month in a row could support interest rate cuts later this year.

Mr Chanco added that interest rate cuts could begin at the June 27 Monetary Board meeting.

“This call is also based on the assumption that Thursday’s first quarter GDP report will disappoint significantly, ultimately weighing more on the Governing Council’s thoughts next month on a likely short-lived breach of its expectations.Ftarget in the May CPI report,” he said.

a Business a poll of 20 economists and analysts last week yielded an average GDP growth estimate of 5.9% for the Ffirst quarter.

“We maintain our view that full-year inflation would remain within target this year, which would allow room for the BSP to begin its monetary easing cycle, likely at year-end. Flast quarter of the year,” Chinabank Research added.